About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 14 results tax clear search

This agent-based model (ABM), developed in NetLogo and available on the COMSES repository, simulates a stylized, competitive electricity market to explore the effects of carbon pricing policies under conditions of technological innovation. Unlike traditional models that treat innovation as exogenous, this ABM incorporates endogenous innovation dynamics, allowing clean technology costs to evolve based on cumulative deployment (Wright’s Law) or time (Moore’s Law). Electricity generation companies act as agents, making investment decisions across coal, gas, wind, and solar PV technologies based on expected returns and market conditions. The model evaluates three policy scenarios—No Policy, Emissions Trading System (ETS), and Carbon Tax—within a merit-order market framework. It is partially empirically grounded, using real-world data for technology costs and emissions caps. By capturing emergent system behavior, this model offers a flexible and transparent tool for analyzing the transition to low-carbon electricity systems.

Protein 2.0: An Agent-Based Model for Simulating Norway’s Protein Sector Under Carbon Pricing and the Emergence of Cultivated Proteins

Gary Polhill Nick Roxburgh Rob J.F. Burton Klaus Mittenzwei | Published Thursday, May 08, 2025Protein 2.0 is a systems model of the Norwegian protein sector designed to explore the potential impacts of carbon taxation and the emergence of cultivated meat and dairy technologies. The model simulates production, pricing, and consumption dynamics across conventional and cultivated protein sources, accounting for emissions intensity, technological learning, economies of scale, and agent behaviour. It assesses how carbon pricing could alter the competitiveness of conventional beef, lamb, pork, chicken, milk, and egg production relative to emerging cultivated alternatives, and evaluates the implications for domestic production, emissions, and food system resilience. The model provides a flexible platform for exploring policy scenarios and transition pathways in protein supply. Further details can be found in the associated publication.

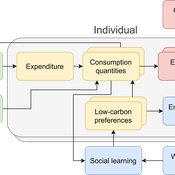

The cultural multiplier of climate policy

Daniel Torren-Peraire | Published Thursday, October 31, 2024For deep decarbonisation, the design of climate policy needs to account for consumption choices being influenced not only by pricing but also by social learning. This involves changes that pertain to the whole spectrum of consumption, possibly involving shifts in lifestyles. In this regard, it is crucial to consider not just short-term social learning processes but also slower, longer-term, cultural change. Against this background, we analyse the interaction between climate policy and cultural change, focusing on carbon taxation. We extend the notion of “social multiplier” of environmental policy derived in an earlier study to the context of multiple consumer needs while allowing for behavioural spillovers between these, giving rise to a “cultural multiplier”. We develop a model to assess how this cultural multiplier contributes to the effectiveness of carbon taxation. Our results show that the cultural multiplier stimulates greater low-carbon consumption compared to fixed preferences. The model results are of particular relevance for policy acceptance due to the cultural multiplier being most effective at low-carbon tax values, relative to a counter-case of short-term social interactions. Notably, at high carbon tax levels, the distinction between social and cultural multiplier effects diminishes, as the strong price signal drives even resistant individuals toward low-carbon consumption. By varying socio-economic conditions, such as substitutability between low- and high-carbon goods, social network structure, proximity of like-minded individuals and the richness of consumption lifestyles, the model provides insight into how cultural change can be leveraged to induce maximum effectiveness of climate policy.

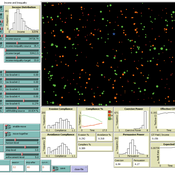

Agent-based tax evasion model for investigating impacts of public disclosure

Hiroyuki Sano | Published Thursday, March 14, 2024The model explores the impact of public disclosure on tax compliance among diverse agents, including individual taxpayers and a tax authority. It incorporates heterogeneous preferences and income endowments among taxpayers, captured through a utility function that considers psychic costs subtracted from expected pecuniary utility. These costs include moral, reciprocity, and stigma costs associated with norm violations, leading to variations in taxpayers’ risk attitudes and related parameters. The tax authority’s attributes, such as the frequency of random audits, penalty rate, and the choice between partial or full disclosure, remain fixed throughout the simulation. Income endowments and preference parameters are randomly assigned to taxpayers at the outset.

Taxpayers maximize their expected utility by reporting income, taking into account tax, penalty, and audit rates. They make annual decisions based on their own and their peers’ behaviors from the previous year. Taxpayers indirectly interact at the societal level through public disclosure conducted by the tax authority, exchanging tax information among peers. Each period in the simulation collects data on total reported income, average compliance rates per income group, distribution of compliance rates, counts of compliers, full evaders, partial evaders, and the numbers of taxpayers experiencing guilt and anger. The model evaluates whether public disclosure positively or negatively impacts compliance rates and quantifies this impact based on aggregated individual reporting behaviors.

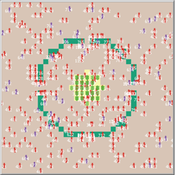

Design principles for a redistributive collective action institution in times of crisis

Aashis Joshi | Published Friday, September 15, 2023What policy measures are effective in redistributing essential resources during crisis situations such as climate change impacts? We model a collective action institution with different rules for designing and organizing it, and make our analysis specific to various societal contexts.

Our model captures a generic societal context of unequal vulnerability and climate change impact in a stylized form. We represent a community of people who harvest and consume an essential resource to maintain their well-being. However, their ability to harvest the resource is not equal; people are characterized by a ‘resource access’ attribute whose values are uniformly distributed from 0 to 1 in the population. A person’s resource access value determines the amount of resource units they are able to harvest, and therefore the welfare levels they are able to attain. People travel to the centralized resource region and derive well-being or welfare, represented as an energy gain, by harvesting and consuming resource units.

The community is subject to a climate change impact event that occurs with a certain periodicity and over a certain duration. The capacity of resource units to regenerate diminishes during the impact events. Unequal capacities to access the essential resource results in unequal vulnerability among people with regards to their ability to maintain a sufficient welfare level, especially during impact events.

…

Agent-Based Simulation for International Tax Compliance

Peter Gerbrands | Published Tuesday, July 18, 2023Country-by-Country Reporting and Automatic Exchange of Information have recently been implemented in European Union (EU) countries. These international tax reforms increase tax compliance in the short term. In the long run, however, taxpayers will continue looking abroad to avoid taxation and, countries, looking for additional revenues, will provide opportunities. As a result, tax competition intensifies and the initial increase in compliance could reverse. To avoid international tax reforms being counteracted by tax competition, this paper suggests bilateral responsive regulation to maximize compliance. This implies that countries would use different tax policy instruments toward other countries, including tax and secrecy havens.

To assess the effectiveness of fully or partially enforce tax policies, this agent based model has been ran many times under different enforcement rules, which influence the perceived enforced- and voluntary compliance, as the slippery-slope model prescribes. Based on the dynamics of this perception and the extent to which agents influence each other, the annual amounts of tax evasion, tax avoidance and taxes paid are calculated over longer periods of time.

The agent-based simulation finds that a differentiated policy response could increase tax compliance by 6.54 percent, which translates into an annual increase of €105 billion in EU tax revenues on income, profits, and capital gains. Corporate income tax revenues in France, Spain, and the UK alone would already account for €35 billion.

Peer reviewed A Simple Agent-Based Spatial Model of the Economy: Tools for Policy

Bernardo Furtado Isaque Daniel Rocha Eberhardt | Published Tuesday, July 05, 2022This study simulates the evolution of artificial economies in order to understand the tax relevance of administrative boundaries in the quality of life of its citizens. The modeling involves the construction of a computational algorithm, which includes citizens, bounded into families; firms and governments; all of them interacting in markets for goods, labor and real estate. The real estate market allows families to move to dwellings with higher quality or lower price when the families capitalize property values. The goods market allows consumers to search on a flexible number of firms choosing by price and proximity. The labor market entails a matching process between firms (given its location) and candidates, according to their qualification. The government may be configured into one, four or seven distinct sub-national governments, which are all economically conurbated. The role of government is to collect taxes on the value added of firms in its territory and invest the taxes into higher levels of quality of life for residents. The results suggest that the configuration of administrative boundaries is relevant to the levels of quality of life arising from the reversal of taxes. The model with seven regions is more dynamic, but more unequal and heterogeneous across regions. The simulation with only one region is more homogeneously poor. The study seeks to contribute to a theoretical and methodological framework as well as to describe, operationalize and test computer models of public finance analysis, with explicitly spatial and dynamic emphasis. Several alternatives of expansion of the model for future research are described. Moreover, this study adds to the existing literature in the realm of simple microeconomic computational models, specifying structural relationships between local governments and firms, consumers and dwellings mediated by distance.

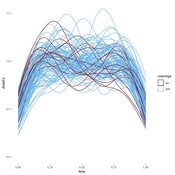

Peer reviewed Modern Wage Dynamics

J M Applegate | Published Sunday, June 05, 2022The Modern Wage Dynamics Model is a generative model of coupled economic production and allocation systems. Each simulation describes a series of interactions between a single aggregate firm and a set of households through both labour and goods markets. The firm produces a representative consumption good using labour provided by the households, who in turn purchase these goods as desired using wages earned, thus the coupling.

Each model iteration the firm decides wage, price and labour hours requested. Given price and wage, households decide hours worked based on their utility function for leisure and consumption. A labour market construct chooses the minimum of hours required and aggregate hours supplied. The firm then uses these inputs to produce goods. Given the hours actually worked, the households decide actual consumption and a market chooses the minimum of goods supplied and aggregate demand. The firm uses information gained through observing market transactions about consumption demand to refine their conceptions of the population’s demand.

The purpose of this model is to explore the general behaviour of an economy with coupled production and allocation systems, as well as to explore the effects of various policies on wage and production, such as minimum wage, tax credits, unemployment benefits, and universal income.

…

An Agent-Based Simple Economy Model With Taxation And Almsgiving For Social Justice

Erşan Taşan | Published Monday, December 17, 2018An agent based simple economy model that examines the effect of taxation and almsgiving (particularly Islamic almsgiving - zakat) for ameliorating wealth inequality.

PolicySpace: agent-based modeling

Francisco Miguel Quesada Bernardo Furtado Isaque Daniel Rocha Eberhardt | Published Tuesday, March 06, 2018PolicySpace models public policies within an empirical, spatial environment using data from 46 metropolitan regions in Brazil. The model contains citizens, markets, residences, municipalities, commuting and a the tax scheme. In the associated publications (book in press and https://arxiv.org/abs/1801.00259) we validate the model and demonstrate an application of the fiscal analysis. Besides providing the basics of the platform, our results indicate the relevance of the rules of taxes transfer for cities’ quality of life.

Displaying 10 of 14 results tax clear search