About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 933 results for "Jan Buurma" clear search

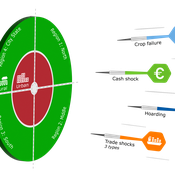

DARTS: modelling effects of shocks on global, regional, urban and rural food security

Geerten Hengeveld Hubert Fonteijn Pepijn van Oort | Published Tuesday, June 18, 2024Food trade networks represent a complex system where food is periodically produced in different regions of the world. Food is continuously stocked and traded. Food security in a globalised world is vulnerable to shocks. We present DARTS, a new agent based model that models monthly dynamics of food production, trade, stocking, consumption and food security for different interconnected world regions and a city state. Agents in different regions differ in their harvest seasons, wealth (rich and poor), degree of urbanisation and connection to domestic and global markets. DARTS was specifically designed to model direct and indirect effects of shocks in the food system. We introduce a new typology of 6 distinct shock types and analyse their impact on food security, modelling local and global effects and short term and longer term effects. An second important scientific novelty of the model is that DARTS can also model indirect effects of shocks (cascading in space and in time, lag effects due to trade and food stock buffering). A third important scientific novelty of the model is its’ capability of modelling food security at different scales, in which the rural/urban divide and differences in (intra-annually varying) production and trade connections play a key role. At the time of writing DARTS is yet insufficiently parameterised for accurate prediction for real world regions and cities. Simulations for a hypothetical in silico world with 3 regions and a city state show that DARTS can reproduce rich and complex dynamics with analogues in the real world. The scientific interest is more on deepening insight in process dynamics and chains of events that lead to ultimate shock effects on food security.

Industrial Cooperation and the Hydrogen Transition

Amineh Ghorbani Renske van 't Veer Emre Ates Zofia Lukszo | Published Tuesday, September 23, 2025An Agent Based Model that explores the deployment of hydrogen among a regional industrial cluster in the Netherlands, consisting of 15 companies. The companies seek to decarbonize by replacing their natural gas by hydrogen.

The model integrates technical characteristics as well as company motivations to transition to hydrogen. The baseline model only considers individual investments where company can locally produce hydrogen. If they reach the backbone threshold, companies can also consider buying hydrogen through a connection to the national hydrogen network. The second scenario considers that companies can participate in a joint investment to get an electrolyzer to locally produce the hydrogen.

Two experiments look at the impact of the sectoral configuration and at the impact of subsidy conditions on the region’s hydrogen transition

FoxNet is an individual-based modelling framework that can be customised to generate high-resolution red fox Vulpes vulpes population models for both northern and southern hemispheres. FoxNet predicts red fox population dynamics, including responses to control and landscape productivity. Model landscapes (up to ~15,000 km^2 and bait layouts can be generated within FoxNet or imported as GIS layers.

If you use FoxNet, please cite:

Hradsky BA, Kelly L, Robley A, Wintle BA (in review). FoxNet: an individual-based modelling framework to support red fox management. Journal of Applied Ecology.

Modelling Electricity Consumption in Office Buildings: An Agent Based Approach

Tao Zhang | Published Thursday, May 19, 2011 | Last modified Saturday, April 27, 2013This is the electronic companion to the paper “Modelling Electricity Consumption in Office Buildings: An Agent Based Approach”

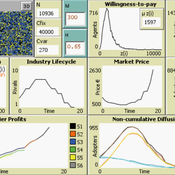

9 Maturity levels in Empirical Validation - An innovation diffusion example

Martin Rixin | Published Wednesday, October 19, 2011 | Last modified Saturday, April 27, 2013Several taxonomies for empirical validation have been published. Our model integrates different methods to calibrate an innovation diffusion model, ranging from simple randomized input validation to complex calibration with the use of microdata.

Thoughtless conformity and spread of norms in an artificial society

Muhammad Azfar Nisar | Published Tuesday, May 27, 2014This model is based on Joshua Epstein’s (2001) model on development of thoughtless conformity in an artificial society of agents.

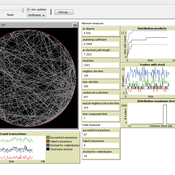

MERCURY: an ABM of tableware trade in the Roman East

Tom Brughmans Jeroen Poblome | Published Thursday, September 25, 2014 | Last modified Friday, May 01, 2015MERCURY aims to represent and explore two descriptive models of the functioning of the Roman trade system that aim to explain the observed strong differences in the wideness of distributions of Roman tableware.

Exploring organizational learning in innovation networks. An agent-based model

Sandra Schmid | Published Saturday, March 07, 2015This agent-based model represents a stylized inter-organizational innovation network where firms collaborate with each other in order to generate novel organizational knowledge.

An Agent-based model of the economy with consumer credit

Paola D'Orazio Gianfranco Giulioni | Published Friday, April 15, 2016 | Last modified Thursday, March 07, 2019The model was built to study the links between consumer credit, wealth distribution and aggregate demand in a complex macroeconomics system.

An adaptive model of homing pigeons: A genetic algorithm approach

Gudrun Wallentin Francis Oloo | Published Friday, January 27, 2017In this model, we simulate the navigation behavior of homing pigeons. Specifically we use genetic algorithms to optimize the navigation and flocking parameters of pigeon agents.

Displaying 10 of 933 results for "Jan Buurma" clear search