About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 2 of 2 results referendum clear search

A basic macroeconomic agent-based model for analyzing monetary regime shifts

Oliver Reinhardt Florian Peters Doris Neuberger Adelinde Uhrmacher | Published Tuesday, May 03, 2022In macroeconomics, an emerging discussion of alternative monetary systems addresses the dimensions of systemic risk in advanced financial systems. Monetary regime changes with the aim of achieving a more sustainable financial system have already been discussed in several European parliaments and were the subject of a referendum in Switzerland. However, their effectiveness and efficacy concerning macro-financial stability are not well-known. This paper introduces a macroeconomic agent-based model (MABM) in a novel simulation environment to simulate the current monetary system, which may serve as a basis to implement and analyze monetary regime shifts. In this context, the monetary system affects the lending potential of banks and might impact the dynamics of financial crises. MABMs are predestined to replicate emergent financial crisis dynamics, analyze institutional changes within a financial system, and thus measure macro-financial stability. The used simulation environment makes the model more accessible and facilitates exploring the impact of different hypotheses and mechanisms in a less complex way. The model replicates a wide range of stylized economic facts, including simplifying assumptions to reduce model complexity.

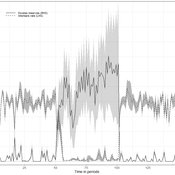

Peer reviewed An extended replication of Abelson's and Bernstein's community referendum simulation

Klaus G. Troitzsch | Published Friday, October 25, 2019 | Last modified Friday, August 25, 2023This is an extended replication of Abelson’s and Bernstein’s early computer simulation model of community referendum controversies which was originally published in 1963 and often cited, but seldom analysed in detail. This replication is in NetLogo 6.3.0, accompanied with an ODD+D protocol and class and sequence diagrams.

This replication replaces the original scales for attitude position and interest in the referendum issue which were distributed between 0 and 1 with values that are initialised according to a normal distribution with mean 0 and variance 1 to make simulation results easier compatible with scales derived from empirical data collected in surveys such as the European Value Study which often are derived via factor analysis or principal component analysis from the answers to sets of questions.

Another difference is that this model is not only run for Abelson’s and Bernstein’s ten week referendum campaign but for an arbitrary time in order that one can find out whether the distributions of attitude position and interest in the (still one-dimensional) issue stabilise in the long run.