About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 67 results Agent-based modelling clear search

Agent-based Modelling of Unsustainable and Sustainable Norms Under Resource Constraints

Fachrizal Sinaga Adrian Thomas Sufyan Fawwad | Published Monday, November 24, 2025This model explores the coupled dynamics of social norm diffusion and finite resource depletion. Extending the “Affordance Landscape” framework by Kaaronen & Strelkovskii (2020), this simulation investigates how resource scarcity and regeneration rates influence the adoption of pro-environmental behaviours.

The model addresses the gap by linking behavioural norms to a depleting common-pool resource. It tests whether sustainable norms can diffuse rapidly enough to prevent ecological collapse and identifies “tipping points” where resource scarcity acts as a driver for behavioural change.

Peer reviewed E³-MAN. An Institutionally-guided multi-agent. Model for fair and efficient negotiation.

José luis bustelo | Published Monday, September 01, 2025Negotiation plays a fundamental role in shaping human societies, underpinning conflict resolution, institutional design, and economic coordination. This article introduces E³-MAN, a novel multi-agent model for negotiation that integrates individual utility maximization with fairness and institutional legitimacy. Unlike classical approaches grounded solely in game theory, our model incorporates Bayesian opponent modeling, transfer learning from past negotiation domains, and fallback institutional rules to resolve deadlocks. Agents interact in dynamic environments characterized by strategic heterogeneity and asymmetric information, negotiating over multidimensional issues under time constraints. Through extensive simulation experiments, we compare E³-MAN against the Nash bargaining solution and equal-split baselines using key performance metrics: utilitarian efficiency, Nash social welfare, Jain fairness index, Gini coefficient, and institutional compliance. Results show that E³-MAN achieves near-optimal efficiency while significantly improving distributive equity and agreement stability. A legal application simulating multilateral labor arbitration demonstrates that institutional default rules foster more balanced outcomes and increase negotiation success rates from 58% to 98%. By combining computational intelligence with normative constraints, this work contributes to the growing field of socially aware autonomous agents. It offers a virtual laboratory for exploring how simple institutional interventions can enhance justice, cooperation, and robustness in complex socio-legal systems.

An agent-based model of the journey of victim/survivors through local authority domestic abuse support services in the UK

Bruce Edmonds | Published Monday, July 28, 2025This model played a small part in the UK government’s review of the working of local authority implementation of the Domestic Abuse legislation. The model explicitly represents victim-survivor families as they: (a) try to contact the local DA support system, (b) are triaged by the system and (if there is space) allocated to safe temporary accomodation (c) recieve support services from this position and (d) eventually move on to more permenant accomodation. The purpose of the model was to understand some possible ways in which the implementation of DA Duty, might be frustrated in practice, the identification of gaps in the evidence base and to inform the developing Theory of Change. The key measures used for assessing outcomes in the model were the number of families helped and the services that were delivered to them. The exploration was grounded for in two archetypal cases: that of a relatively immature system for the delivery of DA services and a more mature one (based on actual local authority cases, but not based on any single one). See the official report under associated publications for a summary of results.

BESTMAP-ABM-DE is an agent-based model to determine the adoption and spatial allocation of selected agri-environmental schemes (AES) by individual farmers in the Mulde River Basin located in Western Saxony, Germany. The selected AES are buffer areas, cover crops, maintaining permanent grassland and conversion of arable land to permanent grassland. While the first three schemes have already been offered in the case study area, the latter scheme is a hypothetical scheme designed to test the impact of potential policy changes. For the first model analyses, only the currently offered schemes are considered. With the model, the effect of different scenarios of policy design on patterns of adoption can be investigated. In particular, the model can be used to study the social-ecological consequences of agricultural policies at different spatial and temporal scales and, in combination with biophysical models, test the ecological implications of different designs of the EU’s Common Agricultural Policy. The model was developed in the BESTMAP project.

FilterBubbles_in_Carley1991

Benoît Desmarchelier | Published Wednesday, May 21, 2025The model is an extension of: Carley K. (1991) “A theory of group stability”, American Sociological Review, vol. 56, pp. 331-354.

The original model from Carley (1991) works as follows:

- Agents know or ignore a series of knowledge facts;

- At each time step, each agent i choose a partner j to interact with at random, with a probability of choice proportional to the degree of knowledge facts they have in common.

- Agents interact synchronously. As such, interaction happens only if the partnert j is not already busy interacting with someone else.

…

We provide a theory-grounded, socio-geographic agent-based model to present a possible explanation for human movement in the Adriatic region within the Cetina phenomenon.

Focusing on ideas of social capital theory from Piere Bordieu (1986), we implement agent mobility in an abstract geography based on cultural capital (prestige) and social capital (social position). Agents hold myopic representations of social (Schaff, 2016) and geographical networks and decide in a heuristic way on moving (and where) or staying.

The model is implemented in a fork of the Laboratory for Simulation Development (LSD), appended with GIS capabilities (Pereira et. al. 2020).

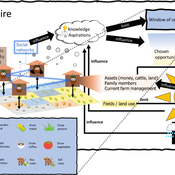

3spire: an agent-based model for exploring aspiration adaptation theory and its implications on smallholder farmers in Ethiopia

ateeuw Yue Dou Markus A Meyer Andrew Nelson | Published Sunday, February 16, 20253spire is an ABM where farming households make management decisions aimed at satisficing along the aspirational dimensions: food self-sufficiency, income, and leisure. Households decision outcomes depend on their social networks, knowledge, assets, household needs, past management, and climate/market trends

Using Agent-Based Modelling and Reinforcement Learning to Study Hybrid Threats

kpadur | Published Friday, September 20, 2024Hybrid attacks coordinate the exploitation of vulnerabilities across domains to undermine trust in authorities and cause social unrest. Whilst such attacks have primarily been seen in active conflict zones, there is growing concern about the potential harm that can be caused by hybrid attacks more generally and a desire to discover how better to identify and react to them. In addressing such threats, it is important to be able to identify and understand an adversary’s behaviour. Game theory is the approach predominantly used in security and defence literature for this purpose. However, the underlying rationality assumption, the equilibrium concept of game theory, as well as the need to make simplifying assumptions can limit its use in the study of emerging threats. To study hybrid threats, we present a novel agent-based model in which, for the first time, agents use reinforcement learning to inform their decisions. This model allows us to investigate the behavioural strategies of threat agents with hybrid attack capabilities as well as their broader impact on the behaviours and opinions of other agents.

epiworldR Type: Fast Agent-Based Epi Models

George G. Vega Yon Derek Meyer | Published Monday, August 26, 2024A flexible framework for Agent-Based Models (ABM), the ‘epiworldR’ package provides methods for prototyping disease outbreaks and transmission models using a ‘C++’ backend, making it very fast. It supports multiple epidemiological models, including the Susceptible-Infected-Susceptible (SIS), Susceptible-Infected-Removed (SIR), Susceptible-Exposed-Infected-Removed (SEIR), and others, involving arbitrary mitigation policies and multiple-disease models. Users can specify infectiousness/susceptibility rates as a function of agents’ features, providing great complexity for the model dynamics. Furthermore, ‘epiworldR’ is ideal for simulation studies featuring large populations.

Team Structure and Task Performance

Davide Secchi Martin Neumann | Published Monday, August 05, 2024This model was designed to study resilience in organizations. Inspired by ethnographic work, it follows the simple goal to understand whether team structure affects the way in which tasks are performed. In so doing, it compares the ‘hybrid’ data-inspired structure with three more traditional structures (i.e. hierarchy, flexible/relaxed hierarchy, and anarchy/disorganization).

Displaying 10 of 67 results Agent-based modelling clear search