About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 1107 results for "Joan A Barceló" clear search

Urban Dynamics

Hideyuki Nagai | Published Monday, November 11, 2019This is an urban dynamics ABM of abstraction of a city and residents’ activities there.

It allows you to evaluate the effects of urban policies, such as an introduction of an open facility for residents with pedestrian-friendly accommodations, promotion of bicycle use, and control of private automobile use in an urban central area, in controlling urban sprawl.

Peer reviewed Street Dog Sim - An agent based model for investigating strategies of free roaming dog control.

Andrew Calinger-yoak | Published Wednesday, July 19, 2023This is an agent-based model constructed in Netlogo v6.2.2 which seeks to provide a simple but flexible tool for researchers and dog-population managers to help inform management decisions.

It replicates the basic demographic processes including:

* reproduction

* natural death

* dispersal

…

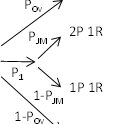

Will it spread or not? The effects of social influences and network topology on innovation diffusion

Sebastiano Delre | Published Monday, October 24, 2011 | Last modified Saturday, April 27, 2013This models simulates innovation diffusion curves and it tests the effects of the degree and the direction of social influences. This model replicates, extends and departs from classical percolation models.

MayaSim: An agent-based model of the ancient Maya social-ecological system

Scott Heckbert | Published Wednesday, July 11, 2012 | Last modified Tuesday, July 02, 2013MayaSim is an agent-based, cellular automata and network model of the ancient Maya. Biophysical and anthropogenic processes interact to grow a complex social ecological system.

Peer reviewed Garbage can model Excel reconstruction

Smarzhevskiy Ivan | Published Tuesday, August 19, 2014 | Last modified Tuesday, July 30, 2019Reconstruction of the original code M. Cohen, J. March, and J. Olsen garbage can model, realized by means of Microsoft Office Excel 2010

Spatial model of the noisy Prisoner's Dilemma with reward shift

Matus Halas | Published Thursday, March 05, 2015 | Last modified Tuesday, May 29, 2018Interactions of players embedded in a closed square lattice are determined by distance and overall gains and they lead to shifts of reward payoff between temptation and punishment. A new winner balancing against threats is ultimately discovered.

Climate Change Adaptation in Coastal Regions

Emma Cutler | Published Thursday, June 01, 2017This generic model simulates climate change adaptation in the form of resistance, accommodation, and retreat in coastal regions vulnerable to sea level rise and flooding. It tracks how population changes as households retreat to higher ground.

Models for assessing empowerment through public policies in rural areas in Brazil

Marcos Aurélio Santos da Silva | Published Monday, April 08, 2019Brazil has initiated two territorial public policies for a rural sustainable development, the National Program for Sustainable Development of the Rural Territories (PRONAT) and Citizenship Territory Program (PTC). These public policies aims, as a condition for its effectiveness, the equilibrium of the power relations between actors which participate in the Collegiate for Territorial Development (CODETER) of each Rural Territory. Our research studies the hypotheses that, in the Rural Territories submitted to the PRONAT and PTC public policies, the power and reciprocity relations between actors engaged in the CODETER effectively have evolved in favor of the civil society representatives to the detriment of the public powers, notably the mayors.

The SocLab approach has been applied in two case studies and four models representing the Southern Rural Territory of Sergipe (TRSS) and the São Francisco Rural Territory (TRBSF) were designed for two referential periods, 2008-2012 and 2013-2017. These models were developed to evaluate the empowerment of the civil society in these rural territories due to thes two public policies, PRONAT and PTC.

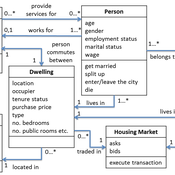

Demography, Industry and Residential Choice (DIReC) model

Jiaqi Ge | Published Wednesday, September 04, 2019The integrated and spatially-explicit ABM, called DIReC (Demography, Industry and Residential Choice), has been developed for Aberdeen City and the surrounding Aberdeenshire (Ge, Polhill, Craig, & Liu, 2018). The model includes demographic (individual and household) models, housing infrastructure and occupancy, neighbourhood quality and evolution, employment and labour market, business relocation, industrial structure, income distribution and macroeconomic indicators. DIReC includes a detailed spatial housing model, basing preference models on house attributes and multi-dimensional neighbourhood qualities (education, crime, employment etc.).

The dynamic ABM simulates the interactions between individuals, households, the labour market, businesses and services, neighbourhoods and economic structures. It is empirically grounded using multiple data sources, such as income and gender-age distribution across industries, neighbourhood attributes, business locations, and housing transactions. It has been used to study the impact of economic shocks and structural changes, such as the crash of oil price in 2014 (the Aberdeen economy heavily relies on the gas and oil sector) and the city’s transition from resource-based to a green economy (Ge, Polhill, Craig, & Liu, 2018).

Peer reviewed FishMob: Interactions between fisher mobility and spatial resource heterogeneity

Emilie Lindkvist | Published Wednesday, October 16, 2019 | Last modified Tuesday, June 23, 2020Migration or other long-distance movement into other regions is a common strategy of fishers and fishworkers living and working on the coast to adapt to environmental change. This model attempts to understand the general dynamics of fisher mobility for over larger spatial scales. The model can be used for investigating the complex interplay that exists between mobility and fish stock heterogeneity across regions, and the associated outcomes of mobility at the system level.

The model design informed by the example of small-scale fisheries in the Gulf of California, Mexico but implements theoretical and stylized facts and can as such be used for different archetypical cases. Our methodological approach for designing the model aims to account for the complex causation, emergence and interdependencies in small-scale fisheries to explain the phenomenon of sequential overexploitation, i.e., overexploiting one resource after another. The model is intended to be used as a virtual laboratory to investigate when and how different levels of mobile fishers affect exploitation patterns of fisheries resources.

Displaying 10 of 1107 results for "Joan A Barceló" clear search