About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 933 results for "Jan Buurma" clear search

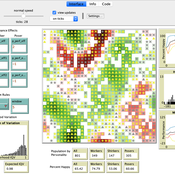

SLUCEII LUXE (Land Use in an eXurban Environment)

Qingxu Huang Rick L Riolo Shipeng Sun Derek Robinson Dawn Parker Tatiana Filatova Meghan Hutchins Dan Brown | Published Tuesday, September 10, 2013 | Last modified Saturday, October 22, 2022LUXE is a land-use change model featuring different levels of land market implementation. It integrates utility measures, budget constraints, competitive bidding, and market interactions to model land-use change in exurban environment.

An Agent-Based Model of Corruption: Micro Approach

Valery Dzutsati | Published Friday, January 30, 2015 | Last modified Sunday, September 27, 2015Endogenous social transition from a high-corruption state to a low-corruption state, replication of Hammond 2009

Product Diffusion Model in an Advance Selling Strategy

Peng Shao | Published Tuesday, March 15, 2016 | Last modified Tuesday, March 15, 2016the model can be used to describe the product diffusion in an Advance Selling Strategy. this model takes into account the consumers product adoption, and describe consumer’s online behavior based on four states.

An Agent Based Model of International Capital Flows

Harvey Baldovino | Published Thursday, April 06, 2023This is a preliminary attempt in creating an Agent-Based Model of capital flows. This is based on the theory of capital flows based on interest-rate differentials. Foreign capital flows to a country with higher interest rates relative to another. The model shows how capital volatilty and wealth concentration are affected by the speed of capital flow, number of investors, magnitude of changes in interest rate due to capital flows and the interest differential threshold that investors set in deciding whether to move capital or not. Investors in the model are either “regional” investors (only investing in neighboring countries) and “global” investors (those who invest anywhere in the world).

In the future, the author hopes to extend this model to incorporate capital flow based on changes in macroeconomic fundamentals, exchange rate volatility, behavioral finance (for instance, herding behavior) and the presence of capital controls.

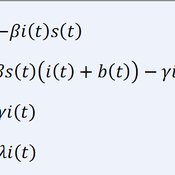

An Agent-Based Model for Skilled Workers Migration

Hassan Bashiri | Published Thursday, September 21, 2023This documentation provides an overview and explanation of the NetLogo simulation code for modeling skilled workers’ migration in Iran. The simulation aims to explore the dynamics of skilled workers’ migration and their transition through various states, including training, employment, and immigration.

The flow of elite and talent migration, or “brain drain,” is a complex issue with far-reaching implications for developing countries. The decision to migrate is made due to various factors including economic opportunities, political stability, social factors and personal circumstances.

Measuring individual interests in the field of immigration is a complex task that requires careful consideration of various factors. The agent-based model is a useful tool for understanding the complex factors that are involved in talent migration. By considering the various social, economic, and personal factors that influence migration decisions, policymakers can provide more effective strategies to retain skilled and talented labor and promote sustainable growth in developing countries. One of the main challenges in studying the flow of elite migration is the complexity of the decision-making process and a set of factors that lead to migration decisions. Agent-based modeling is a useful tool for understanding how individual decisions can lead to large-scale migration patterns.

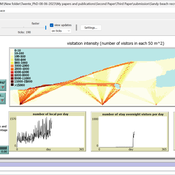

Sandy Beach Visitor Flow: An Agent-Based Model

Elham Bakhshianlamouki | Published Thursday, March 14, 2024The model is intended to simulate visitor spatial and temporal dynamics, encompassing their numbers, activities, and distribution along a coastline influenced by beach landscape design. Our primary focus is understanding how the spatial distribution of services and recreational facilities (e.g., beach width, entrance location, recreational facilities, parking availability) impacts visitation density. Our focus is not on tracking the precise visitation density but rather on estimating the areas most affected by visitor activity. This comprehension allows for assessing the diverse influences of beach layouts on spatial visitor density and, consequently, on the landscape’s biophysical characteristics (e.g., vegetation, fauna, and sediment features).

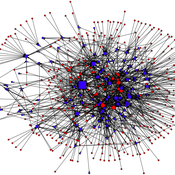

Institutions and Cooperation in an Ecology of Games

Paul Smaldino | Published Wednesday, November 29, 2017Dynamic bipartite network model of agents and games in which agents can participate in multiple public goods games.

HMODEL: an exploratory simulation of surface archaeological formation

Benjamin Davies Simon Holdaway Patricia Fanning | Published Thursday, November 30, 2017This model is used to simulate the influence of spatially and temporally variable sedimentary processes on the distribution of dated archaeological features in a surface context.

Peer reviewed OfficeMoves: Personalities and Performance in an Interdependent Environment

Alan Dugger | Published Thursday, June 11, 2020After a little work experience, we realize that different kinds of people prefer different work environments: some enjoy a fast-paced challenge; some want to get by; and, others want to show off.

From that experience, we also realize that different kinds of people affect their work environments differently: some increase the pace; some slow it down; and, others make it about themselves.

This model concerns how three different kinds of people affect their work environment and how that work environment affects them in return. The model explores how this circular relation between people’s preferences and their environment creates patterns of association and performance over time.

…

Modelling an intersection with traffic signal countdown timer

Eduard | Published Thursday, May 19, 2022Developed as a part of a project in the University of Augsburg, Institute of Geography, it simulates the traffic in an intersection or junction which uses either regular traffic lights or traffic lights with a countdown timer. The model tracks the average speed of cars before and after traffic lights as well as the throughput.

Displaying 10 of 933 results for "Jan Buurma" clear search