About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 1111 results for "Clint A Penick" clear search

Adaptive model of a consumer advice network

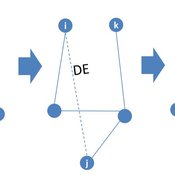

Peng Shao | Published Monday, May 14, 2018In the consumer advice network, users with connections can interact with each other, and the network topology will change during the opinion interaction. When the opinion distance from i to j is greater than the confidence threshold, the two consumers cannot exchange opinions, and the link between them will disconnect with probability DE. Then, a link from node i to node k is established with probability CE and node i learning opinion from node k.

A Toy Model for the Abilene Paradox

Victor Sahin | Published Monday, June 17, 2019 | Last modified Sunday, July 14, 2019This version adds a Maslowian entropy to each agent decision based on Kendrick et. al. Rudimentary implementation assumes agents with lower scores are more likely to make decisions autonomously rather than sociotropically.

A Simulation Model of the Radicalisation Process

Rosemary Pepys | Published Saturday, November 16, 2019This is the code for a simulation model of the radicalisation process based on the IVEE theoretical framework.

Reflexivity in a diffusion of innovations model

César García-Díaz Carlos Cordoba | Published Thursday, May 07, 2020In this agent-based model, agents decide to adopt a new product according to a utility function that depends on two kinds of social influences. First, there is a local influence exerted on an agent by her closest neighbors that have already adopted, and also by herself if she feels the product suits her personal needs. Second, there is a global influence which leads agents to adopt when they become aware of emerging trends happening in the system. For this, we endow agents with a reflexive capacity that allows them to recognize a trend, even if they can not perceive a significant change in their neighborhood.

Results reveal the appearance of slowdown periods along the adoption rate curve, in contrast with the classic stylized bell-shaped behavior. Results also show that network structure plays an important role in the effect of reflexivity: while some structures (e.g., scale-free networks) may amplify it, others (e.g., small-world structure) weaken such an effect.

Peer reviewed Vigilant sharing in a small-scale society

Marcos Pinheiro | Published Wednesday, July 22, 2020 | Last modified Wednesday, July 29, 2020The model explores food distribution patterns that emerge in a small-scale non-agricultural group when sharing individuals engage in intentional consumption leveling with a given probability.

Venues and Segregation: A Revised Schelling Model

Ultan Byrne | Published Thursday, August 06, 2020This model examines an important but underappreciated mechanism affecting urban segregation and integration: urban venues. The venue- an area where urbanites interact- is an essential aspect of city life that tends to influence how satisfactory any location is. We study the venue/segregation relationship by installing venues into Schelling’s classic agent-based segregation model.

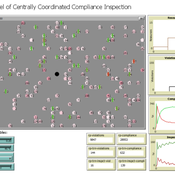

ICARUS - a multi-agent compliance inspection model

Slaven Smojver | Published Monday, May 09, 2022ICARUS is a multi-agent compliance inspection model (ICARUS - Inspecting Compliance to mAny RUleS). The model is applicable to environments where an inspection agency, via centrally coordinated inspections, examines compliance in organizations which must comply with multiple provisions (rules). The model (ICARUS) contains 3 types of agents: entities, inspection agency and inspectors / inspections. ICARUS describes a repeated, simultaneous, non-cooperative game of pure competition. Agents have imperfect, incomplete, asymmetric information. Entities in each move (tick) choose a pure strategy (comply/violate) for each rule, depending on their own subjective assessment of the probability of the inspection. The Inspection Agency carries out the given inspection strategy.

A more detailed description of the model is available in the .nlogo file.

Full description of the model (in line with the ODD+D protocol) and the analysis of the model (including verification, validation and sensitivity analysis) can be found in the attached documentation.

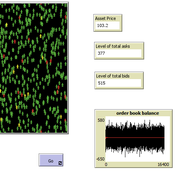

Peer reviewed A financial market with zero intelligence agents

edgarkp | Published Wednesday, March 27, 2024The model’s aim is to represent the price dynamics under very simple market conditions, given the values adopted by the user for the model parameters. We suppose the market of a financial asset contains agents on the hypothesis they have zero-intelligence. In each period, a certain amount of agents are randomly selected to participate to the market. Each of these agents decides, in a equiprobable way, between proposing to make a transaction (talk = 1) or not (talk = 0). Again in an equiprobable way, each participating agent decides to speak on the supply (ask) or the demand side (bid) of the market, and proposes a volume of assets, where this number is drawn randomly from a uniform distribution. The granularity depends on various factors, including market conventions, the type of assets or goods being traded, and regulatory requirements. In some markets, high granularity is essential to capture small price movements accurately, while in others, coarser granularity is sufficient due to the nature of the assets or goods being traded

Comparing agent-based models on experimental data of irrigation games

Marco Janssen Jacopo A. Baggio | Published Tuesday, July 02, 2013 | Last modified Wednesday, July 03, 2013Comparing 7 alternative models of human behavior and assess their performance on a high resolution dataset based on individual behavior performance in laboratory experiments.

Effect of communication in irrigation games

Jacopo A. Baggio Marco Janssen | Published Wednesday, January 14, 2015 | Last modified Wednesday, August 09, 2017The model includes different formulations how agents make decisions in irrigation games and this is compared with empirical data. The aim is to test different theoretical models, especially explaining effect of communication.

Displaying 10 of 1111 results for "Clint A Penick" clear search