About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 194 results for "Carsten M Buchmann" clear search

STECCAR: a simulation of the diffusion of electric cars

A Kangur Lc Verbrugge W Jager M Bockarjova | Published Sunday, November 29, 2015In this Repast model the ‘Consumat’ cognitive framework is applied to an ABM of the Dutch car market. Different policy scenarios can be selected or created to examine their effect on the diffusion of EVs.

Model of Rental Evictions in Phoenix During the Covid-19 Pandemic

Sean Bergin J M Applegate | Published Saturday, July 31, 2021 | Last modified Friday, October 15, 2021The purpose of this model is to explore the dynamics of residency and eviction for households renting in the greater Phoenix (Arizona) metropolitan area. The model uses a representative population of renters modified from American Community Survey (ACS) data that includes demographic, housing and economic information. Each month, households pay their subsistence, rental and utility bills. If a household is unable to pay their monthly rent or utility bill they apply for financial assistance. This model provides a platform to understand the impact of various economic shock upon households. Also, the model includes conditions that occurred as a result of the Covid-19 pandemic which allows for the study of eviction mitigation strategies that were employed, such as the eviction moratorium and stimulus payments. The model allows us to make preliminary predictions concerning the number of households that may be evicted once the moratorium on evictions ends and the long-term effects on the number of evicted households in the greater Phoenix area going forward.

WeDiG Sim

Reza Shamsaee | Published Monday, May 14, 2012 | Last modified Saturday, April 27, 2013WeDiG Sim- Weighted Directed Graph Simulator - is an open source application that serves to simulate complex systems. WeDiG Sim reflects the behaviors of those complex systems that put stress on scale-free, weightedness, and directedness. It has been implemented based on “WeDiG model” that is newly presented in this domain. The WeDiG model can be seen as a generalized version of “Barabási-Albert (BA) model”. WeDiG not only deals with weighed directed systems, but also it can handle the […]

Animal territory formation (Reusable Building Block RBB)

Volker Grimm Stephanie Kramer-Schadt Robert Zakrzewski | Published Sunday, November 12, 2023This is a generic sub-model of animal territory formation. It is meant to be a reusable building block, but not in the plug-and-play sense, as amendments are likely to be needed depending on the species and region. The sub-model comprises a grid of cells, reprenting the landscape. Each cell has a “quality” value, which quantifies the amount of resources provided for a territory owner, for example a tiger. “Quality” could be prey density, shelter, or just space. Animals are located randomly in the landscape and add grid cells to their intial cell until the sum of the quality of all their cells meets their needs. If a potential new cell to be added is owned by another animal, competition takes place. The quality values are static, and the model does not include demography, i.e. mortality, mating, reproduction. Also, movement within a territory is not represented.

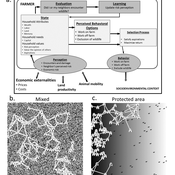

Wildlife-Human Interactions in Shared Landscapes (WHISL)

Nicholas Magliocca Neil Carter Andres Baeza-Castro | Published Friday, May 22, 2020This model simulates a group of farmers that have encounters with individuals of a wildlife population. Each farmer owns a set of cells that represent their farm. Each farmer must decide what cells inside their farm will be used to produce an agricultural good that is self in an external market at a given price. The farmer must decide to protect the farm from potential encounters with individuals of the wildlife population. This decision in the model is called “fencing”. Each time that a cell is fenced, the chances of a wildlife individual to move to that cell is reduced. Each encounter reduces the productive outcome obtained of the affected cell. Farmers, therefore, can reduce the risk of encounters by exclusion. The decision of excluding wildlife is made considering the perception of risk of encounters. In the model, the perception of risk is subjective, as it depends on past encounters and on the perception of risk from other farmers in the community. The community of farmers passes information about this risk perception through a social network. The user (observer) of the model can control the importance of the social network on the individual perception of risk.

Agent-based simulation of discussion processes in risk workshops with quantitative skepticism

Matthias Meyer Clemens Harten Lucia Bellora-Bienengräber | Published Sunday, August 14, 2022The model measures drivers of effectiveness of risk assessments in risk workshops where a calculative culture of quantitative skepticism is present. We model the limits to information transfer, incomplete discussions, group characteristics, and interaction patterns and investigate their effect on risk assessment in risk workshops, in order to contrast results to a previous model focused on a calculative culture of quantitative enthusiasm.

The model simulates a discussion in the context of a risk workshop with 9 participants. The participants use constraint satisfaction networks to assess a given risk individually and as a group.

Evolution of Conditional Cooperation

M Manning Marco Janssen Oyita Udiani | Published Thursday, August 01, 2013 | Last modified Friday, May 13, 2022Cultural group selection model used to evaluate the conditions for agents to evolve who have other-regarding preferences in making decisions in public good games.

Imperfect knowledge and stable governance in democracies

Carlos M Fernández-Márquez Francisco Jose Vazquez Luis Fernando Medina | Published Tuesday, February 05, 2019In this paper we introduce an agent-based model of elections and government formation where voters do not have perfect knowledge about the parties’ ideological position. Although voters are boundedly rational, they are forward-looking in that they try to assess the likely impact of the different parties over the resulting government. Thus, their decision rules combine sincere and strategic voting: they form preferences about the different parties but deem some of them as inadmissible and try to block them from office. We find that the most stable and durable coalition governments emerge at intermediate levels of informational ambiguity. When voters have very poor information about the parties, their votes are scattered too widely, preventing the emergence of robust majorities. But also, voters with highly precise perceptions about the parties will cluster around tiny electoral niches with a similar aggregate effect.

Learning Extension - RAGE RAngeland Grazing Model

Nikita Strelkovskii Cristina I. Apetrei Nikolay Khabarov Valeria Javalera Rincón | Published Saturday, July 22, 2023This is an extension of the original RAGE model (Dressler et al. 2018), where we add learning capabilities to agents, specifically learning-by-doing and social learning (two processes central to adaptive (co-)management).

The extension module is applied to smallholder farmers’ decision-making - here, a pasture (patch) is the private property of the household (agent) placed on it and there is no movement of the households. Households observe the state of the pasture and their neighrbours to make decisions on how many livestock to place on their pasture every year. Three new behavioural types are created (which cannot be combined with the original ones): E-RO (baseline behaviour), E-LBD (learning-by-doing) and E-RO-SL1 (social learning). Similarly to the original model, these three types can be compared regarding long-term social-ecological performance. In addition, a global strategy switching option (corresponding to double-loop learning) allows users to study how behavioural strategies diffuse in a heterogeneous population of learning and non-learning agents.

An important modification of the original model is that extension agents are heterogeneous in how they deal with uncertainty. This is represented by an agent property, called the r-parameter (household-risk-att in the code). The r-parameter is catch-all for various factors that form an agent’s disposition to act in a certain way, such as: uncertainty in the sensing (partial observability of the resource system), noise in the information received, or an inherent characteristic of the agent, for instance, their risk attitude.

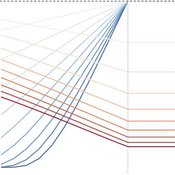

Peer reviewed Price Evolution with Expectations

J M Applegate Gesine Steudel Armin Haas Carlo Jaeger | Published Friday, September 10, 2021The Price Evolution with Expectations model provides the opportunity to explore the question of non-equilibrium market dynamics, and how and under which conditions an economic system converges to the classically defined economic equilibrium. To accomplish this, we bring together two points of view of the economy; the classical perspective of general equilibrium theory and an evolutionary perspective, in which the current development of the economic system determines the possibilities for further evolution.

The Price Evolution with Expectations model consists of a representative firm producing no profit but producing a single good, which we call sugar, and a representative household which provides labour to the firm and purchases sugar.The model explores the evolutionary dynamics whereby the firm does not initially know the household demand but eventually this demand and thus the correct price for sugar given the household’s optimal labour.

The model can be run in one of two ways; the first does not include money and the second uses money such that the firm and/or the household have an endowment that can be spent or saved. In either case, the household has preferences for leisure and consumption and a demand function relating sugar and price, and the firm has a production function and learns the household demand over a set number of time steps using either an endogenous or exogenous learning algorithm. The resulting equilibria, or fixed points of the system, may or may not match the classical economic equilibrium.

Displaying 10 of 194 results for "Carsten M Buchmann" clear search