About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 88 results for "Claude Garcia" clear search

05 CmLab V1.17 – Conservation of Money Laboratory

Garvin Boyle | Published Saturday, April 15, 2017In CmLab we explore the implications of the phenomenon of Conservation of Money in a modern economy. This is one of a series of models exploring the dynamics of sustainable economics – PSoup, ModEco, EiLab, OamLab, MppLab, TpLab, CmLab.

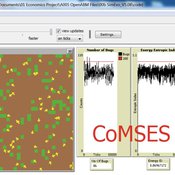

06 EiLab V1.40 – Entropic Index Laboratory

Garvin Boyle | Published Monday, March 19, 2018There is a new type of economic model called a capital exchange model, in which the biophysical economy is abstracted away, and the interaction of units of money is studied. Benatti, Drăgulescu and Yakovenko described at least eight capital exchange models – now referred to collectively as the BDY models – which are replicated as models A through H in EiLab. In recent writings, Yakovenko goes on to show that the entropy of these monetarily isolated systems rises to a maximal possible value as the model approaches steady state, and remains there, in analogy of the 2nd law of thermodynamics. EiLab demonstrates this behaviour. However, it must be noted that we are NOT talking about thermodynamic entropy. Heat is not being modeled – only simple exchanges of cash. But the same statistical formulae apply.

In three unpublished papers and a collection of diary notes and conference presentations (all available with this model), the concept of “entropic index” is defined for use in agent-based models (ABMs), with a particular interest in sustainable economics. Models I and J of EiLab are variations of the BDY model especially designed to study the Maximum Entropy Principle (MEP – model I) and the Maximum Entropy Production Principle (MEPP – model J) in ABMs. Both the MEPP and H.T. Odum’s Maximum Power Principle (MPP) have been proposed as organizing principles for complex adaptive systems. The MEPP and the MPP are two sides of the same coin, and an understanding of their implications is key, I believe, to understanding economic sustainability. Both of these proposed (and not widely accepted) principles describe the role of entropy in non-isolated systems in which complexity is generated and flourishes, such as ecosystems, and economies.

EiLab is one of several models exploring the dynamics of sustainable economics – PSoup, ModEco, EiLab, OamLab, MppLab, TpLab, and CmLab.

Agent Based Integrated Assessment Model

Marcin Czupryna | Published Saturday, June 27, 2020Agent based approach to the class of the Integrated Assessment Models. An agent-based model (ABM) that focuses on the energy sector and climate relevant facts in a detailed way while being complemented with consumer goods, labour and capital markets to a minimal necessary extent.

Parallel trading systems

Marcin Czupryna | Published Friday, June 26, 2020The model simulates agents behaviour in wine market parallel trading systems: auctions, OTC and Liv-ex. Models are written in JAVA and use MASON framework. To run a simulation download source files with additional src folder with sobol.csv file. In WineSimulation.java set RESULTS_FOLDER parameter. Uses following external libraries mason19..jar, opencsv.jar, commons-lang3-3.5.jar and commons-math3-3.6.1.jar.

Behavioural parallel trading systems

Marcin Czupryna | Published Friday, June 26, 2020This model simulates the behaviour of the agents in 3 wine markets parallel trading systems: Liv-ex, Auctions and additionally OTC market (finally not used). Behavioural aspects (impatience) is additionally modeled. This is an extention of parallel trading systems model with technical trading (momentum and contrarian) and noise trading.

00b SimEvo_V5.08 NetLogo

Garvin Boyle | Published Saturday, October 05, 2019In 1985 Dr Michael Palmiter, a high school teacher, first built a very innovative agent-based model called “Simulated Evolution” which he used for teaching the dynamics of evolution. In his model, students can see the visual effects of evolution as it proceeds right in front of their eyes. Using his schema, small linear changes in the agent’s genotype have an exponential effect on the agent’s phenotype. Natural selection therefore happens quickly and effectively. I have used his approach to managing the evolution of competing agents in a variety of models that I have used to study the fundamental dynamics of sustainable economic systems. For example, here is a brief list of some of my models that use “Palmiter Genes”:

- ModEco - Palmiter genes are used to encode negotiation strategies for setting prices;

- PSoup - Palmiter genes are used to control both motion and metabolic evolution;

- TpLab - Palmiter genes are used to study the evolution of belief systems;

- EffLab - Palmiter genes are used to study Jevon’s Paradox, EROI and other things.

…

06b EiLab_Model_I_V5.00 NL

Garvin Boyle | Published Saturday, October 05, 2019EiLab - Model I - is a capital exchange model. That is a type of economic model used to study the dynamics of modern money which, strangely, is very similar to the dynamics of energetic systems. It is a variation on the BDY models first described in the paper by Dragulescu and Yakovenko, published in 2000, entitled “Statistical Mechanics of Money”. This model demonstrates the ability of capital exchange models to produce a distribution of wealth that does not have a preponderance of poor agents and a small number of exceedingly wealthy agents.

This is a re-implementation of a model first built in the C++ application called Entropic Index Laboratory, or EiLab. The first eight models in that application were labeled A through H, and are the BDY models. The BDY models all have a single constraint - a limit on how poor agents can be. That is to say that the wealth distribution is bounded on the left. This ninth model is a variation on the BDY models that has an added constraint that limits how wealthy an agent can be? It is bounded on both the left and right.

EiLab demonstrates the inevitable role of entropy in such capital exchange models, and can be used to examine the connections between changing entropy and changes in wealth distributions at a very minute level.

…

07 EffLab_V5.07 NL

Garvin Boyle | Published Monday, October 07, 2019EffLab was built to support the study of the efficiency of agents in an evolving complex adaptive system. In particular:

- There is a definition of efficiency used in ecology, and an analogous definition widely used in business. In ecological studies it is called EROEI (energy returned on energy invested), or, more briefly, EROI (pronounced E-Roy). In business it is called ROI (dollars returned on dollars invested).

- In addition, there is the more well-known definition of efficiency first described by Sadi Carnot, and widely used by engineers. It is usually represented by the Greek letter ‘h’ (pronounced as ETA). These two measures of efficiency bear a peculiar relationship to each other: EROI = 1 / ( 1 - ETA )

In EffLab, blind seekers wander through a forest looking for energy-rich food. In this multi-generational world, they live and reproduce, or die, depending on whether they can find food more effectively than their contemporaries. Data is collected to measure their efficiency as they evolve more effective search patterns.

…

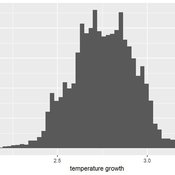

A Matter of Values: On The Link between Economic Performance and Schwartz Human Values

Marcin Czupryna | Published Sunday, June 23, 2024The goal of the paper is to propose an abstract but formalised model of how Schwartz higher order values may influence individual decisions on sharing an individual effort among alternative economic activities. Subsequently, individual decisions are aggregated into the total (collective) economic output, taking into account interactions between the agents. In particular, we explore the relationship between individual higher order values: Self–Enhancement, Self–Transcendence, Openness to Change, and Conservation – measured according to Schwartz’s universal human values theory – and individual and collective economic performance, by means of a theoretical agent based model. Furthermore, based on empirical observations, Openness to Change (measured by the population average in the case of collective output) is positively associated with individual and collective output. These relations are negative for Conservation. Self-Enhancement is positively associated with individual output but negatively with collective output. In case of Self–Transcendence, this effect is opposite. The model provides the potential explanations, in terms of individual and population differences in: propensity for management, willingness to change, and skills (measured by an educational level) for the empirically observed relations between Schwartz higher order values and individual and collective output. We directly calibrate the micro–level of the model using data from the ninth round of the European Social Survey (ESS9) and present the results of numerical simulations.

On the liquidity of the illiquid (hard-to-trade) assets

Marcin Czupryna | Published Monday, January 13, 2025This paper investigates the impact of agents' trading decisions on market liquidity and transactional efficiency in markets for illiquid (hard-to-trade) assets. Drawing on a unique order book dataset from the fine wine exchange Liv-ex, we offer novel insights into liquidity dynamics in illiquid markets. Using an agent-based framework, we assess the adequacy of conventional liquidity measures in capturing market liquidity and transactional efficiency. Our main findings reveal that conventional liquidity measures, such as the number of bids, asks, new bids and new asks, may not accurately represent overall transactional efficiency. Instead, volume (measured by the number of trades) and relative spread measures may be more appropriate indicators of liquidity within the context of illiquid markets. Furthermore, our simulations demonstrate that a greater number of traders participating in the market correlates with an increased efficiency in trade execution, while wider trader-set margins may decrease the transactional efficiency. Interestingly, the trading period of the agents appears to have a significant impact on trade execution. This suggests that granting market participants additional time for trading (for example, through the support of automated trading systems) can enhance transactional efficiency within illiquid markets. These insights offer practical implications for market participants and policymakers aiming to optimise market functioning and liquidity.

Displaying 10 of 88 results for "Claude Garcia" clear search