About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 50 results price clear search

Wildlife-Human Interactions in Shared Landscapes (WHISL)

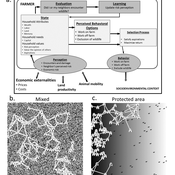

Nicholas Magliocca Neil Carter Andres Baeza-Castro | Published Friday, May 22, 2020This model simulates a group of farmers that have encounters with individuals of a wildlife population. Each farmer owns a set of cells that represent their farm. Each farmer must decide what cells inside their farm will be used to produce an agricultural good that is self in an external market at a given price. The farmer must decide to protect the farm from potential encounters with individuals of the wildlife population. This decision in the model is called “fencing”. Each time that a cell is fenced, the chances of a wildlife individual to move to that cell is reduced. Each encounter reduces the productive outcome obtained of the affected cell. Farmers, therefore, can reduce the risk of encounters by exclusion. The decision of excluding wildlife is made considering the perception of risk of encounters. In the model, the perception of risk is subjective, as it depends on past encounters and on the perception of risk from other farmers in the community. The community of farmers passes information about this risk perception through a social network. The user (observer) of the model can control the importance of the social network on the individual perception of risk.

Peer reviewed BAM: The Bottom-up Adaptive Macroeconomics Model

Alejandro Platas López Alejandro Guerra-Hernández | Published Tuesday, January 14, 2020 | Last modified Sunday, July 26, 2020Overview

Purpose

Modeling an economy with stable macro signals, that works as a benchmark for studying the effects of the agent activities, e.g. extortion, at the service of the elaboration of public policies..

…

An Agent-based Model of Firm Size Distribution and Collaborative Innovation

Inyoung Hwang | Published Monday, December 09, 2019I added a discounting rate to the equation for expected values of defective / collaborative strategies.

The discounting rate was set to 0.956, the annual average from 1980 to 2015, using the Consumer Price Index (CPI) of Statistics Korea.

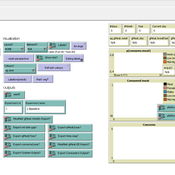

An agent-based model to simulate meat consumption behaviour of consumers in Britain

Andrea Scalco | Published Friday, October 18, 2019The current rate of production and consumption of meat poses a problem both to peoples’ health and to the environment. This work aims to develop a simulation of peoples’ meat consumption behaviour in Britain using agent-based modelling. The agents represent individual consumers. The key variables that characterise agents include sex, age, monthly income, perception of the living cost, and concerns about the impact of meat on the environment, health, and animal welfare. A process of peer influence is modelled with respect to the agents’ concerns. Influence spreads across two eating networks (i.e. co-workers and household members) depending on the time of day, day of the week, and agents’ employment status. Data from a representative sample of British consumers is used to empirically ground the model. Different experiments are run simulating interventions of application of social marketing campaigns and a rise in price of meat. The main outcome is the average weekly consumption of meat per consumer. A secondary outcome is the likelihood of eating meat.

Demography, Industry and Residential Choice (DIReC) model

Jiaqi Ge | Published Wednesday, September 04, 2019The integrated and spatially-explicit ABM, called DIReC (Demography, Industry and Residential Choice), has been developed for Aberdeen City and the surrounding Aberdeenshire (Ge, Polhill, Craig, & Liu, 2018). The model includes demographic (individual and household) models, housing infrastructure and occupancy, neighbourhood quality and evolution, employment and labour market, business relocation, industrial structure, income distribution and macroeconomic indicators. DIReC includes a detailed spatial housing model, basing preference models on house attributes and multi-dimensional neighbourhood qualities (education, crime, employment etc.).

The dynamic ABM simulates the interactions between individuals, households, the labour market, businesses and services, neighbourhoods and economic structures. It is empirically grounded using multiple data sources, such as income and gender-age distribution across industries, neighbourhood attributes, business locations, and housing transactions. It has been used to study the impact of economic shocks and structural changes, such as the crash of oil price in 2014 (the Aberdeen economy heavily relies on the gas and oil sector) and the city’s transition from resource-based to a green economy (Ge, Polhill, Craig, & Liu, 2018).

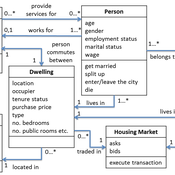

Risks and Hedonics in Empirical Agent-based land market (RHEA) model

Tatiana Filatova Koen de Koning | Published Monday, April 01, 2019RHEA aims to provide a methodological platform to simulate the aggregated impact of households’ residential location choice and dynamic risk perceptions in response to flooding on urban land markets. It integrates adaptive behaviour into the spatial landscape using behavioural theories and empirical data sources. The platform can be used to assess: how changes in households’ preferences or risk perceptions capitalize in property values, how price dynamics in the housing market affect spatial demographics in hazard-prone urban areas, how structural non-marginal shifts in land markets emerge from the bottom up, and how economic land use systems react to climate change. RHEA allows direct modelling of interactions of many heterogeneous agents in a land market over a heterogeneous spatial landscape. As other ABMs of markets it helps to understand how aggregated patterns and economic indices result from many individual interactions of economic agents.

The model could be used by scientists to explore the impact of climate change and increased flood risk on urban resilience, and the effect of various behavioural assumptions on the choices that people make in response to flood risk. It can be used by policy-makers to explore the aggregated impact of climate adaptation policies aimed at minimizing flood damages and the social costs of flood risk.

Modeling Personal Carbon Trading with ABM

Roman Seidl | Published Friday, December 07, 2018 | Last modified Thursday, July 29, 2021A simulated approach for Personal Carbon Trading, for figuring out what effects it might have if it will be implemented in the real world. We use an artificial population with some empirical data from international literature and basic assumptions about heterogeneous energy demand. The model is not to be used as simulating the actual behavior of real populations, but a toy model to test the effects of differences in various factors such as number of agents, energy price, price of allowances, etc. It is important to adapt the model for specific countries as carbon footprint and energy demand determines the relative success of PCT.

External shocks, agent interactions, and endogenous feedbacks--investigating system resilience with a stylized land use model

Yang Chen | Published Tuesday, March 06, 2018The purpose of the presented ABM is to explore how system resilience is affected by external disturbances and internal dynamics by using the stylized model of an agricultural land use system.

We explore land system resilience with a stylized land use model in which agents’ land use activities are affected by external shocks, agent interactions, and endogenous feedbacks. External shocks are designed as yield loss in crops, which is ubiquitous in almost every land use system where perturbations can occur due to e.g. extreme weather conditions or diseases. Agent interactions are designed as the transfer of buffer capacity from farmers who can and are willing to provide help to other farmers within their social network. For endogenous feedbacks, we consider land use as an economic activity which is regulated by markets — an increase in crop production results in lower price (a negative feedback) and an agglomeration of a land use results in lower production costs for the land use type (a positive feedback).

PercolationPrice

Koen Frenken Luis Izquierdo Paolo Zeppini | Published Thursday, December 21, 2017 | Last modified Thursday, May 03, 2018This model simulate product diffusion on different social network structures.

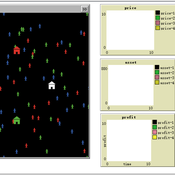

Dynamic pricing strategies for perishable products in a competitive multi-agent retailer market

Wenchong Chen Hongwei Liu | Published Monday, November 27, 2017 | Last modified Thursday, March 01, 2018This model explores a price Q-learning mechanism for perishable products that considers uncertain demand and customer preferences in a competitive multi-agent retailer market (a model-free environment).

Displaying 10 of 50 results price clear search