About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 1115 results for "Sjoukje A Osinga" clear search

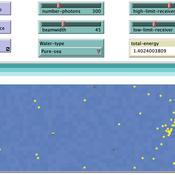

ABM for Underwater optical wireless communication in a water tank

Mohamed ABID | Published Sunday, May 29, 2022This model simulates the propagation of photons in a water tank. A source of light emits an impulse of photons with equal energy represented by yellow dots. These photons are then scattered by water particles before possibly reaching the photo-detector represented by a gray line. Different types of water are considered. For each one of them we calculate the total received energy.

The water tank is represented by a blue rectangle with fixed dimensions. It’s exposed to the air interface and has totally absorbent barriers. Four types of water are supported. Each one is characterized by its absorption and scattering coefficients.

At the source, the photons are generated uniformly with a random direction within the beamwidth. Each photon travels a random distance drawn from a distribution depending on the water characteristics before encountering a water particle.

Based on the updated position of the photon, three situations may occur:

-The photon hits the barrier of the tank on its trajectory. In this case it’s considered as lost since the barriers are assumed totally absorbent.

…

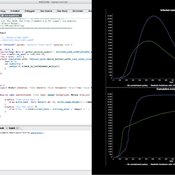

Peer reviewed NoD-Neg: A Non-Deterministic model of affordable housing Negotiations

Aya Badawy Nuno Pinto Richard Kingston | Published Sunday, September 08, 2024The Non-Deterministic model of affordable housing Negotiations (NoD-Neg) is designed for generating hypotheses about the possible outcomes of negotiating affordable housing obligations in new developments in England. By outcomes we mean, the probabilities of failing the negotiation and/or the different possibilities of agreement.

The model focuses on two negotiations which are key in the provision of affordable housing. The first is between a developer (DEV) who is submitting a planning application for approval and the relevant Local Planning Authority (LPA) who is responsible for reviewing the application and enforcing the affordable housing obligations. The second negotiation is between the developer and a Registered Social Landlord (RSL) who buys the affordable units from the developer and rents them out. They can negotiate the price of selling the affordable units to the RSL.

The model runs the two negotiations on the same development project several times to enable agents representing stakeholders to apply different negotiation tactics (different agendas and concession-making tactics), hence, explore the different possibilities of outcomes.

The model produces three types of outputs: (i) histograms showing the distribution of the negotiation outcomes in all the simulation runs and the probability of each outcome; (ii) a data file with the exact values shown in the histograms; and (iii) a conversation log detailing the exchange of messages between agents in each simulation run.

Peer reviewed Evolution of Conditional Cooperation in a Spatial Public Goods Game

Marco Janssen Francesca Federico Raksha Balakrishna | Published Saturday, March 15, 2025A model to investigate the Evolution of Conditional Cooperation in a Spatial Public Goods Game. We consider two conditional cooperation strategies: one based on thresholds (Battu & Srinivasan, 2020) and another based on independent decisions for each number of cooperating neighbors. We examine the effects of productivity and conditional cooperation criteria on the trajectory of cooperation. Cooperation is evolving with no need for additional mechanisms apart from spatial structure when agents follow conditional strategies. We confirm the positive influence of productivity and cluster formation on the evolution of cooperation in spatial models. Results are robust for the two types of conditional cooperation strategies.

Peer reviewed Casting: A Bio-Inspired Method for Restructuring Machine Learning Ensembles

Colin Lynch Bryan Daniels | Published Thursday, September 18, 2025The wisdom of the crowd refers to the phenomenon in which a group of individuals, each making independent decisions, can collectively arrive at highly accurate solutions—often more accurate than any individual within the group. This principle relies heavily on independence: if individual opinions are unbiased and uncorrelated, their errors tend to cancel out when averaged, reducing overall bias. However, in real-world social networks, individuals are often influenced by their neighbors, introducing correlations between decisions. Such social influence can amplify biases, disrupting the benefits of independent voting. This trade-off between independence and interdependence has striking parallels to ensemble learning methods in machine learning. Bagging (bootstrap aggregating) improves classification performance by combining independently trained weak learners, reducing bias. Boosting, on the other hand, explicitly introduces sequential dependence among learners, where each learner focuses on correcting the errors of its predecessors. This process can reinforce biases present in the data even if it reduces variance. Here, we introduce a new meta-algorithm, casting, which captures this biological and computational trade-off. Casting forms partially connected groups (“castes”) of weak learners that are internally linked through boosting, while the castes themselves remain independent and are aggregated using bagging. This creates a continuum between full independence (i.e., bagging) and full dependence (i.e., boosting). This method allows for the testing of model capabilities across values of the hyperparameter which controls connectedness. We specifically investigate classification tasks, but the method can be used for regression tasks as well. Ultimately, casting can provide insights for how real systems contend with classification problems.

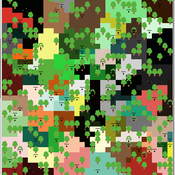

Large-scale land acqusitions and smallholder food security

Tim Williams | Published Thursday, September 16, 2021Large-scale land acquisitions (LSLAs) threaten smallholder livelihoods globally. Despite more than a decade of research on the LSLA phenomenon, it remains a challenge to identify governance conditions that may foster beneficial outcomes for both smallholders and investors. One potentially promising strategy toward this end is contract farming (CF), which more directly involves smallholder households in commodity production than conditions of acquisition and displacement.

To improve understanding of how CF may mediate the outcomes of LSLAs, we developed an agent-based model of smallholder livelihoods, which we used as a virtual laboratory to experiment on a range of hypothetical LSLA and CF implementation scenarios.

The model represents a community of smallholder households in a mixed crop-livestock system. Each agent farms their own land and manages a herd of livestock. Agents can also engage in off-farm employment, for which they earn a fixed wage and compete for a limited number of jobs. The principal model outputs include measures of household food security (representing access to a single, staple food crop) and agricultural production (of a single, staple food crop).

…

Simulation model replicating the five different games that were run during a workshop of the TISSS Lab

tissslab | Published Friday, April 30, 2021The three-day participatory workshop organized by the TISSS Lab had 20 participants who were academics in different career stages ranging from university student to professor. For each of the five games, the participants had to move between tables according to some pre-specified rules. After the workshop both the participant’s perception of the games’ complexities and the participants’ satisfaction with the games were recorded.

In order to obtain additional objective measures for the games’ complexities, these games were also simulated using this simulation model here. Therefore, the simulation model is an as-accurate-as-possible reproduction of the workshop games: it has 20 participants moving between 5 different tables. The rules that specify who moves when vary from game to game. Just to get an idea, Game 3 has the rule: “move if you’re sitting next to someone who is waring white or no socks”.

An exact description of the workshop games and the associated simulation models can be found in the paper “The relation between perceived complexity and happiness with decision situations: searching for objective measures in social simulation games”.

Peer reviewed Reduced Mobility Transition Model (R-MoTMo)

Gesine A. Steudle Sarah Wolf Steffen Fürst | Published Tuesday, December 06, 2022The Mobility Transition Model (MoTMo) is a large scale agent-based model to simulate the private mobility demand in Germany until 2035. Here, we publish a very much reduced version of this model (R-MoTMo) which is designed to demonstrate the basic modelling ideas; the aim is by abstracting from the (empirical, technological, geographical, etc.) details to examine the feed-backs of individual decisions on the socio-technical system.

Interactions between organizations and social networks in common-pool resource governance

Phesi Project | Published Monday, October 29, 2012 | Last modified Saturday, April 27, 2013Explores how social networks affect implementation of institutional rules in a common pool resource.

Peer reviewed COMOKIT

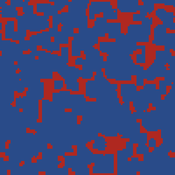

Patrick Taillandier Alexis Drogoul Benoit Gaudou Kevin Chapuis Nghi Huyng Quang Doanh Nguyen Ngoc Arthur Brugière Pierre Larmande Marc Choisy Damien Philippon | Published Tuesday, May 26, 2020 | Last modified Wednesday, July 01, 2020In the face of the COVID-19 pandemic, public health authorities around the world have experimented, in a short period of time, with various combinations of interventions at different scales. However, as the pandemic continues to progress, there is a growing need for tools and methodologies to quickly analyze the impact of these interventions and answer concrete questions regarding their effectiveness, range and temporality.

COMOKIT, the COVID-19 modeling kit, is such a tool. It is a computer model that allows intervention strategies to be explored in silico before their possible implementation phase. It can take into account important dimensions of policy actions, such as the heterogeneity of individual responses or the spatial aspect of containment strategies.

In COMOKIT, built using the agent-based modeling and simulation platform GAMA, the profiles, activities and interactions of people, person-to-person and environmental transmissions, individual clinical statuses, public health policies and interventions are explicitly represented and they all serve as a basis for describing the dynamics of the epidemic in a detailed and realistic representation of space.

…

WEEM (Woodlot Establishment and Expansion Model)

Jürgen Groeneveld Vianny Ahimbisibwe Uta Berger Melvin Lippe Susan Balaba Tumwebaze Eckhard Auch | Published Monday, September 27, 2021The agent-based model WEEM (Woodlot Establishment and Expansion Model) as described in the journal article, has been designed to make use of household socio-demographics (household status, birth, and death events of households), to better understand the temporal dynamics of woodlot in the buffer zones of Budongo protected forest reserve, Masindi district, Uganda. The results contribute to a mechanistic understanding of what determines the current gap between intention and actual behavior in forest land restoration at farm level.

Displaying 10 of 1115 results for "Sjoukje A Osinga" clear search