About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 365 results for "Noé Guiraud" clear search

Peer reviewed Are Countertrade credits as flexible and efficient as cash? A novel approach to reducing income inequality using countertrade methodology.

Peter Malliaros | Published Monday, May 03, 2021 | Last modified Tuesday, May 11, 2021The impacts of income inequality can be seen everywhere, regardless of the country or the level of economic development. According to the literature review, income inequality has negative impacts in economic, social, and political variables. Notwithstanding of how well or not countries have done in reducing income inequality, none have been able to reduce it to a Gini Coefficient level of 0.2 or less.

This is the promise that a novel approach called Counterbalance Economics (CBE) provides without the need of increased taxes.

Based on the simulation, introducing the CBE into the Australian, UK, US, Swiss or German economies would result in an overall GDP increase of under 1% however, the level of inequality would be reduced from an average of 0.33 down to an average of 0.08. A detailed explanation of how to use the model, software, and data dependencies along with all other requirements have been included as part of the info tab in the model.

Narragansett Bay (RI) Recreational Fishery ABM

Tyler Pavlowich Anne Innes-Gold Margaret Heinichen M. Conor McManus Jason McNamee Jeremy Collie Austin Humphries | Published Monday, June 21, 2021This model is based on the Narragansett Bay, RI recreational fishery. The two types of agents are piscivorous fish and fishers (shore and boat fishers are separate “breeds”). Each time step represents one week. Open season is weeks 1-26, assuming fishing occurs during half the year. At each weekly time step, fish agents grow, reproduce, and die. Fisher agents decide whether or not to fish based on their current satisfaction level, and those that do go fishing attempt to catch a fish. If they are successful, they decide whether to keep or release the fish. In our publication, this model was linked to an Ecopath with Ecosim food web model where the commercial harvest of forage fish affected the biomass of piscivorous fish - which then became the starting number of piscivorous fish for this ABM. The number of fish caught in a season of this ABM was converted to a fishing pressure and input back into the food web model.

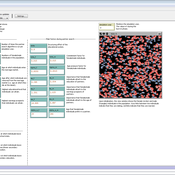

Cultural Dissemination: An Agent-Based Model with Social Influence

nhnguyen98 | Published Monday, July 26, 2021We study cultural dissemination in the context of an Axelrod-like agent-based model describing the spread of cultural traits across a society, with an added element of social influence. This modification produces absorbing states exhibiting greater variation in number and size of distinct cultural regions compared to the original Axelrod model, and we identify the mechanism responsible for this amplification in heterogeneity. We develop several new metrics to quantitatively characterize the heterogeneity and geometric qualities of these absorbing states. Additionally, we examine the dynamical approach to absorbing states in both our Social Influence Model as well as the Axelrod Model, which not only yields interesting insights into the differences in behavior of the two models over time, but also provides a more comprehensive view into the behavior of Axelrod’s original model. The quantitative metrics introduced in this paper have broad potential applicability across a large variety of agent-based cultural dissemination models.

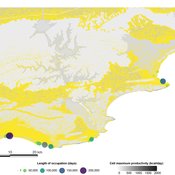

PaleoscapeABM: coastal occupation and shellfish discard

Claudine Gravel-Miguel | Published Tuesday, February 08, 2022This model builds on the Armature distribution within the PaleoscapeABM model, which is itself a variant of the PaleoscapeABM available here written by Wren and Janssen, and.

This model aims to explore where and how much shellfish is discarded at coastal and non-coastal locations by daily coastal foraging. We use this model’s output to test the idea that we can confidently use the archaeological record to evaluate the importance of shellfish in prehistoric people’s diets.

The recognition that aquatic adaptations likely had significant impacts on human evolution triggered an explosion of research on that topic. Recognizing coastal foraging in the past relies on the archaeological signature of that behavior. We use this model to explore why some coastal sites are very intensely occupied and see if it is due to the shellfish productivity of the coast.

Mobility USA (MUSA)

Giangiacomo Bravo Davide Natalini | Published Sunday, December 08, 2013 | Last modified Monday, December 30, 2013MUSA is an ABM that simulates the commuting sector in USA. A multilevel validation was implemented. Social network with a social-circle structure included. Two types of policies have been tested: market-based and preference-change.

Model of communication between two groups of managers in the course of project implementation

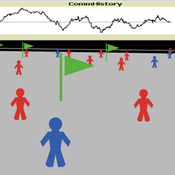

Smarzhevskiy Ivan | Published Monday, December 07, 2020This is a simulation model of communication between two groups of managers in the course of project implementation. The “world” of the model is a space of interaction between project participants, each of which belongs either to a group of work performers or to a group of customers. Information about the progress of the project is publicly available and represents the deviation Earned value (EV) from the planned project value (cost baseline).

The key elements of the model are 1) persons belonging to a group of customers or performers, 2) agents that are communication acts. The life cycle of persons is equal to the time of the simulation experiment, the life cycle of the communication act is 3 periods of model time (for the convenience of visualizing behavior during the experiment). The communication act occurs at a specific point in the model space, the coordinates of which are realized as random variables. During the experiment, persons randomly move in the model space. The communication act involves persons belonging to a group of customers and a group of performers, remote from the place of the communication act at a distance not exceeding the value of the communication radius (MaxCommRadius), while at least one representative from each of the groups must participate in the communication act. If none are found, the communication act is not carried out. The number of potential communication acts per unit of model time is a parameter of the model (CommPerTick).

The managerial sense of the feedback is the stimulating effect of the positive value of the accumulated communication complexity (positive background of the project implementation) on the productivity of the performers. Provided there is favorable communication (“trust”, “mutual understanding”) between the customer and the contractor, it is more likely that project operations will be performed with less lag behind the plan or ahead of it.

The behavior of agents in the world of the model (change of coordinates, visualization of agents’ belonging to a specific communicative act at a given time, etc.) is not informative. Content data are obtained in the form of time series of accumulated communicative complexity, the deviation of the earned value from the planned value, average indicators characterizing communication - the total number of communicative acts and the average number of their participants, etc. These data are displayed on graphs during the simulation experiment.

The control elements of the model allow seven independent values to be varied, which, even with a minimum number of varied values (three: minimum, maximum, optimum), gives 3^7 = 2187 different variants of initial conditions. In this case, the statistical processing of the results requires repeated calculation of the model indicators for each grid node. Thus, the set of varied parameters and the range of their variation is determined by the logic of a particular study and represents a significant narrowing of the full set of initial conditions for which the model allows simulation experiments.

…

Exploring organizational learning in innovation networks. An agent-based model

Sandra Schmid | Published Saturday, March 07, 2015This agent-based model represents a stylized inter-organizational innovation network where firms collaborate with each other in order to generate novel organizational knowledge.

Transitions between homophilic and heterophilic modes of cooperation

Genki Ichinose | Published Sunday, June 14, 2015 | Last modified Sunday, November 14, 2021In our model, individual agents are distributed over a two-dimensional square lattice. The agents play the prisoner’s dilemma game with their neighbors, imitate the highest strategy, and then migrate to empty sites based on their tag preference.

Peter Diamond's Coconut Model (Heterogeneity and Learning)

Sven Banisch Eckehard Olbrich | Published Monday, May 30, 2016Agent-based version of the simple search and barter economy conceived by Peter Diamond in 1982. The model is also known as Coconut Model.

A model to explore the link between the gender-gap reversal in education and relative divorce risks

Jan Van Bavel Christine Schnor André Grow | Published Thursday, June 30, 2016 | Last modified Wednesday, September 13, 2017This model explores a social mechanism that links the reversal of the gender gap in education with changing patterns in relative divorce risks in 12 European countries.

Displaying 10 of 365 results for "Noé Guiraud" clear search