About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 986 results for "J Van Der Beek" clear search

From Cyber Space Opinion Leaders and the Spread of Anti-Vaccine Extremism to Physical Space Disease Outbreaks

Xiaoyi Yuan | Published Wednesday, March 08, 2017 | Last modified Friday, March 31, 2017This model simulates the spread of anti-vaccine sentiments in cyber and physical space and how it creates emergence of clusters of anti-vacciners, which eventually lead to higher probablity of disease outbreaks.

Peer reviewed Social Consequences of Past Compound Events - Laacher See Eruption

Kevin Su Brennen Bouwmeester | Published Monday, May 17, 2021Resilience of humans in the Upper Paleolithic could provide insights in how to defend against today’s environmental threats. Approximately 13,000 years ago, the Laacher See volcano located in present-day western Germany erupted cataclysmically. Archaeological evidence suggests that this is eruption – potentially against the background of a prolonged cold spell – led to considerable culture change, especially at some distance from the eruption (Riede, 2017). Spatially differentiated and ecologically mediated effects on contemporary social networks as well as social transmission effects mediated by demographic changes in the eruption’s wake have been proposed as factors that together may have led to, in particular, the loss of complex technologies such as the bow-and-arrow (Riede, 2014; Riede, 2009).

This model looks at the impact of the interaction between climate change trajectory and an extreme event, such as the Laacher See eruption, on the generational development of hunter-gatherer bands. Historic data is used to model the distribution and population dynamics of hunter-gatherer bands during these circumstances.

Narragansett Bay (RI) Recreational Fishery ABM

Tyler Pavlowich Anne Innes-Gold Margaret Heinichen M. Conor McManus Jason McNamee Jeremy Collie Austin Humphries | Published Monday, June 21, 2021This model is based on the Narragansett Bay, RI recreational fishery. The two types of agents are piscivorous fish and fishers (shore and boat fishers are separate “breeds”). Each time step represents one week. Open season is weeks 1-26, assuming fishing occurs during half the year. At each weekly time step, fish agents grow, reproduce, and die. Fisher agents decide whether or not to fish based on their current satisfaction level, and those that do go fishing attempt to catch a fish. If they are successful, they decide whether to keep or release the fish. In our publication, this model was linked to an Ecopath with Ecosim food web model where the commercial harvest of forage fish affected the biomass of piscivorous fish - which then became the starting number of piscivorous fish for this ABM. The number of fish caught in a season of this ABM was converted to a fishing pressure and input back into the food web model.

John Q. Public (JQP): A Model of Political Judgment and Behavior

Sung-Youn Kim | Published Monday, March 14, 2011 | Last modified Saturday, April 27, 2013The model integrates major theories of political judgment and behavior within the classical cognitive paradigm embedded in the ACT-R cognitive architecture. It models preferences and beliefs of political candidates, parties, and groups.

Feedback Loop Example: Wildland Fire Spread

James Millington | Published Friday, December 21, 2012 | Last modified Saturday, April 27, 2013This model is a replication of that described by Peterson (2002) and illustrates the ‘spread’ feedback loop type described in Millington (2013).

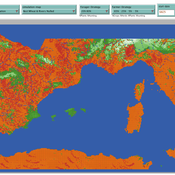

The Cardial Spread Model

Sean Bergin | Published Friday, September 29, 2017 | Last modified Monday, February 04, 2019The purpose of this model is to provide a platform to test and compare four conceptual models have been proposed to explain the spread of the Impresso-Cardial Neolithic in the west Mediterranean.

Peer reviewed MIOvPOPsurveillance

Aniruddha Belsare | Published Monday, April 13, 2020MIOvPOPsurveillance is set up to simulate harvest-based chronic wasting disease (CWD) surveillance of white-tailed deer (Odocoileus virginianus) populations in select Michigan Counties. New regions can be readily added, also the model can be readily adapted for other disease systems and used for informed-decision making during planning and implementation stages of disease surveillance in wildlife and free-ranging species.

An Agent-Based Model of an Insurance Market driven by Supply and Demand with Imperfectly Estimated Strategies in C#

Rei England | Published Sunday, September 24, 2023This is a simulation of an insurance market where the premium moves according to the balance between supply and demand. In this model, insurers set their supply with the aim of maximising their expected utility gain while operating under imperfect information about both customer demand and underlying risk distributions.

There are seven types of insurer strategies. One type follows a rational strategy within the bounds of imperfect information. The other six types also seek to maximise their utility gain, but base their market expectations on a chartist strategy. Under this strategy, market premium is extrapolated from trends based on past insurance prices. This is subdivided according to whether the insurer is trend following or a contrarian (counter-trend), and further depending on whether the trend is estimated from short-term, medium-term, or long-term data.

Customers are modelled as a whole and allocated between insurers according to available supply. Customer demand is calculated according to a logit choice model based on the expected utility gain of purchasing insurance for an average customer versus the expected utility gain of non-purchase.

ABM Simulation of Transition from Late Longshan Cultures to Early Erlitou Culture

Carmen Iasiello | Published Sunday, November 26, 2023Within the archeological record for Bronze Age Chinese culture, there continues to be a gap in our understanding of the sudden rise of the Erlitou State from the previous late Longshan chiefdoms. In order to examine this period, I developed and used an agent-based model (ABM) to explore possible socio-politically relevant hypotheses for the gap between the demise of the late Longshan cultures and rise of the first state level society in East Asia. I tested land use strategy making and collective action in response to drought and flooding scenarios, the two plausible environmental hazards at that time. The model results show cases of emergent behavior where an increase in social complexity could have been experienced if a catastrophic event occurred while the population was sufficiently prepared for a different catastrophe, suggesting a plausible lead for future research into determining the life of the time period.

The ABM published here was originally developed in 2016 and its results published in the Proceedings of the 2017 Winter Simulation Conference.

Tail biting behaviour in pigs

Iris J.M.M. Boumans Iris Jmm Boumans | Published Friday, April 22, 2016 | Last modified Wednesday, September 14, 2016The model simulates tail biting behaviour in pigs and how they can turn into a biter and/or victim. The effect of a redirected motivation, behavioural changes in victims and preference to bite a lying pig on tail biting can be tested in the model

Displaying 10 of 986 results for "J Van Der Beek" clear search