About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 942 results for "Bert Van Meeuwen" clear search

Pollution-development Tradeoffs in Nigeria--an Agent-based Model

Christopher Thron | Published Thursday, June 03, 2021Like many developing countries, Nigeria is faced with a number of tradeoffs that pit rapid economic development against environmental preservation. Environmentally sustainable, “green” economic development is slower, more costly, and more difficult than unrestricted, unregulated economic growth. The mathematical model that we develop in this code suggests that widespread public awareness of environmental issues is insufficient to prevent the tendency towards sacrificing the environment for the sake of growth. Even if people have an understanding of negative impacts and always choose to act in their own self-interest, they may still act collectively in such a way as to bring down the quality of life for the entire society. We conclude that additional actions must be taken besides raising public awareness of the environmental problem.

Cultural Dissemination: An Agent-Based Model with Social Influence

nhnguyen98 | Published Monday, July 26, 2021We study cultural dissemination in the context of an Axelrod-like agent-based model describing the spread of cultural traits across a society, with an added element of social influence. This modification produces absorbing states exhibiting greater variation in number and size of distinct cultural regions compared to the original Axelrod model, and we identify the mechanism responsible for this amplification in heterogeneity. We develop several new metrics to quantitatively characterize the heterogeneity and geometric qualities of these absorbing states. Additionally, we examine the dynamical approach to absorbing states in both our Social Influence Model as well as the Axelrod Model, which not only yields interesting insights into the differences in behavior of the two models over time, but also provides a more comprehensive view into the behavior of Axelrod’s original model. The quantitative metrics introduced in this paper have broad potential applicability across a large variety of agent-based cultural dissemination models.

An Agent-based Model of Farmland Transfer (Version 1.0.0)

Hang Xiong Peng Jiang | Published Wednesday, August 11, 2021This is model that explores how a few farmers in a Chinese village, where all farmers are smallholders originally, reach optimal farming scale by transferring in farmland from other farmers in the context of urbanization and aging.

An Agent-Based Model of Farmland Trading Partners Selection

Hang Xiong Chen Yuxin Xinfan Wang | Published Tuesday, August 19, 2025This base model uses an agent-based approach to represent heterogeneous farmers’ trading partners selection among multiple recipients (other farmers, village collectives, and firms). Each period, a potential transfer-out farmer decides whether to transfer based on a net-return versus transaction-cost trade-off; if transferring, the farmer selects the counterparty with the highest expected profit. Meanwhile, social learning—operationalized as logistic accumulation of neighborhood experience—continuously updates uncertainty, which in turn shapes transaction costs and subsequent decisions.

Classrooms; teachers, students and learning

petertymms | Published Wednesday, October 07, 2020This a phenomenon-based model plan. Classroom in school are places when students are supposed to learn and the most often do. But things can go awry, the students can play up and that can result in an unruly class and learning can suffer. This model aims to look at how much students learn according to how good the teacher is a classroom control and how good he or she is at teaching per se.

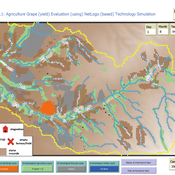

Peer reviewed Agriculture.Grape.yield.Evaluation.using.NetLogo.based.Technology.Simulation (AGENTS): A NetLogo agent-based model developed to assess viticulture efficiency in Byzantine Shivta.

Barak Garty Gil Gambash Guy BarOz Sharona T Levy | Published Friday, December 06, 2024AGENTS model is an agent-based computational framework designed to explore the socio-ecological and economic dynamics of agricultural production in the Byzantine Negev Highlands, with a focus on viticulture. It integrates historical, environmental, and social factors to simulate settlement sustainability, crop yields, and the impacts of varying climate conditions. The model is built in NetLogo and incorporates GIS-based topographical and hydrological data. Key features include the ability to assess climate impacts on crop profitability and settlement strategies, evaluate economic outputs of ancient vineyards, and simulate agent decision-making processes under diverse scenarios.

The AGENTS model is highly flexible, enabling users to simulate agricultural regimes with any two crops: one cash crop (a crop grown for profit, e.g., grapevines) and one staple crop (a crop grown for subsistence, e.g., wheat). While the default setup models viticulture and wheat cultivation in the Byzantine Negev Highlands, users can adapt the model to different environmental and socio-ecological contexts worldwide—both past and present.

Users can load external files to customize precipitation, evaporation, topography, and labor costs (measured as man-days per 0.1ha, converted to kg of wheat per model patch size area), and can also edit key parameters related to yield calculations. This includes modifying crop-specific yield formulas, soil and runoff indices, and any factors influencing crop performance. The model inherently simulates cash crops grown in floodplain regions and staple crops cultivated along riverbanks, providing a powerful tool to investigate societal resilience and responses to climate stressors across diverse environments.

…

Obligation norm identification in multi-agent societies

Tony Savarimuthu | Published Tuesday, June 29, 2010 | Last modified Saturday, April 27, 2013This model describes a mechanism by which software agents can identify norms in an artificial agent society. In particular, this model uses a sequence mining approach to identify norms in an agent soc

Risk perception of individuals and the transmission dynamics of COVID-19

Sara Shahin Moghadam Franziska klügel | Published Tuesday, June 27, 2023The purpose of this model is to explore the influence of integrating individuals’ behavioral dynamics in an agent-based model of COVID-19, on the dynamics of disease transmission. The model is an agent-based extention of an established large-scale Individual-based model called STRIDE. Four risk factors determine the individual’s perception of the risk and how they behave accordingly. It is assumed that individuals with higher levels of risk perception adopt higher levels of contact reduction in their daily routines. Individuals can assign different weights to any of the four different risk factors, i.e., the modeler can model different populations and explore how the transmission dynamics vary among them.

Modelling Electricity Consumption in Office Buildings: An Agent Based Approach

Tao Zhang | Published Thursday, May 19, 2011 | Last modified Saturday, April 27, 2013This is the electronic companion to the paper “Modelling Electricity Consumption in Office Buildings: An Agent Based Approach”

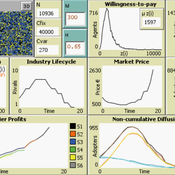

9 Maturity levels in Empirical Validation - An innovation diffusion example

Martin Rixin | Published Wednesday, October 19, 2011 | Last modified Saturday, April 27, 2013Several taxonomies for empirical validation have been published. Our model integrates different methods to calibrate an innovation diffusion model, ranging from simple randomized input validation to complex calibration with the use of microdata.

Displaying 10 of 942 results for "Bert Van Meeuwen" clear search