About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 199 results for "M Vavier" clear search

Mitigating bioenergy-driven biodiversity decline: a modelling approach with the European brown hare

Volker Grimm Maria Langhammer | Published Wednesday, November 13, 2019 | Last modified Tuesday, November 24, 2020The model is designed to analyse the effects of mitigation measures on the European brown hare (Lepus europaeus), which is directly affected by ongoing land use change and has experienced widespread decline throughout Europe since the 1960s. As an input, we use two 4×4 km large model landscapes, which were generated by a landscape generator based on real field sizes and crop proportions and differed in average field size and crop composition. The crops grown annually are evaluated in terms of forage suitability, breeding suitability and crop richness for the hare. Six mitigation scenarios are implemented, defined by a 10 % increase in: (1) mixed silphie, (2) miscanthus, (3) grass-clover ley, (4) alfalfa, (5) set-aside, and (6) general crop richness. The model shows that that both landscape configuration and composition have a significant effect on hare population development, which responds particularly strongly to compositional changes.

Exploring Creativity and Urban Development with Agent-Based Modeling

Ammar Malik Andrew Crooks Hilton Root Melanie Swartz | Published Thursday, October 30, 2014An agent-based model which explores Creativity and Urban Development

A simplified Arthur & Polak logic circuit model of combinatory technology build-out via incremental development. Only some inventions trigger radical effects, suggesting they depend on whole interdependent systems rather than specific innovations.

Implementation of 'satisficing’ as a model for farmers’ decision-making in an agent-based model of groundwater over-exploitation

Marvin Nebel | Published Monday, May 20, 2013This model uses ’satisficing’ as a model for farmers’ decision making to learn about influences of alternative decision-making models on simulation results and to exemplify a way to transform a rather theoretical concept into a feasible decision-making model for agent-based farming models.

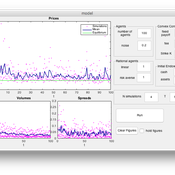

An Agent Based Model for implementing a double auction financial market

Annalisa Fabretti | Published Thursday, April 14, 2016The model implements a double auction financial markets with two types of agents: rational and noise. The model aims to study the impact of different compensation structure on the market stability and market quantities as prices, volumes, spreads.

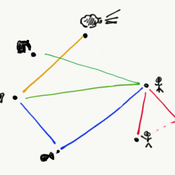

Managing networked landscapes: conservation in fragmented, regionally connected world

Jacopo A. Baggio Michael Schoon Sechindra Vallury | Published Monday, December 09, 2019Exploring how learning and social-ecological networks influence management choice set and their ability to increase the likelihood of species coexistence (i.e. biodiversity) on a fragmented landscape controlled by different managers.

A network agent-based model of ethnocentrism and intergroup cooperation

Ross Gore | Published Sunday, October 27, 2019We present a network agent-based model of ethnocentrism and intergroup cooperation in which agents from two groups (majority and minority) change their communality (feeling of group solidarity), cooperation strategy and social ties, depending on a barrier of “likeness” (affinity). Our purpose was to study the model’s capability for describing how the mechanisms of preexisting markers (or “tags”) that can work as cues for inducing in-group bias, imitation, and reaction to non-cooperating agents, lead to ethnocentrism or intergroup cooperation and influence the formation of the network of mixed ties between agents of different groups. We explored the model’s behavior via four experiments in which we studied the combined effects of “likeness,” relative size of the minority group, degree of connectivity of the social network, game difficulty (strength) and relative frequencies of strategy revision and structural adaptation. The parameters that have a stronger influence on the emerging dominant strategies and the formation of mixed ties in the social network are the group-tag barrier, the frequency with which agents react to adverse partners, and the game difficulty. The relative size of the minority group also plays a role in increasing the percentage of mixed ties in the social network. This is consistent with the intergroup ties being dependent on the “arena” of contact (with progressively stronger barriers from e.g. workmates to close relatives), and with measures that hinder intergroup contact also hindering mutual cooperation.

RBM - A Relation-based model - a fishery implementation

Nanda Wijermans Maja Schlüter Anja Klein Tilman Hertz | Published Monday, March 17, 2025The Relation-Based Model (RBM) purpose is to operationalise (a form of) process-relational (PR) thinking to serve as a thinking tool for process-relational thinking among social-ecological system (SES) researchers. The development of this model itself has been a ‘Proof of concept’- exercise to see whether we actually represent process-relational thinking in a methodology that is entity-based (ABM).

The target of the agent-based model is to show the emergence, change and disappearance of fishing assemblages (focusing on processes of self-organisation) in a Mexican fishery using a process-relational view. From this view, a fishery is regarded as an assemblage in which fishing can be enabled, fishing can occur, and fish can be bought/sold. These core doings - or sub-assemblages or capacities - maintain the assemblage. Each (sub)assemblage reflects different actualisations of constellations of relations and elements (buyers, fishers, fuel, permits, vessels and wind). The RBM thereby reflects an artificial fishery in which agents (elements) and their links (relations) engage in (enabling) fishing and buying/selling.

A Mathematical Model of The Beer Game

Hakan Yasarcan Mert Edali | Published Wednesday, November 05, 2014This is the R code of the mathematical model that includes the decision making formulations for artificial agents. This code corresponds to equations 1-70 given in the paper “A Mathematical Model of The Beer Game”.

A Mathematical Model of The Beer Game Coded in R for Verification

Hakan Yasarcan Mert Edali | Published Wednesday, November 05, 2014This is the R code of the mathematical model used for verification. This code corresponds to equations 1-9, 15-53, 58-62, 69-70, and 72-75 given in the paper “A Mathematical Model of The Beer Game”.

Displaying 10 of 199 results for "M Vavier" clear search