About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 1170 results for "Aad Kessler" clear search

Risk-Sharing under Heterogeneity: NetLogo simulation

Eva Vriens | Published Monday, February 28, 2022Motivated by the emergence of new Peer-to-Peer insurance organizations that rethink how insurance is organized, we propose a theoretical model of decision-making in risk-sharing arrangements with risk heterogeneity and incomplete information about the risk distribution as core features. For these new, informal organisations, the available institutional solutions to heterogeneity (e.g., mandatory participation or price differentiation) are either impossible or undesirable. Hence, we need to understand the scope conditions under which individuals are motivated to participate in a bottom-up risk-sharing setting. The model puts forward participation as a utility maximizing alternative for agents with higher risk levels, who are more risk averse, are driven more by solidarity motives, and less susceptible to cost fluctuations. This basic micro-level model is used to simulate decision-making for agent populations in a dynamic, interdependent setting. Simulation results show that successful risk-sharing arrangements may work if participants are driven by motivations of solidarity or risk aversion, but this is less likely in populations more heterogeneous in risk, as the individual motivations can less often make up for the larger cost deficiencies. At the same time, more heterogeneous groups deal better with uncertainty and temporary cost fluctuations than more homogeneous populations do. In the latter, cascades following temporary peaks in support requests more often result in complete failure, while under full information about the risk distribution this would not have happened.

Urban waterlogging disaster evaluation based on complex network a case study of Zhengzhou, China

Chao Ding Jia Xu | Published Monday, April 17, 2023The model constructs a complex network of traffic based on the main urban area of Zhengzhou, China, and simulates the urban rainfall process using the ABM model to analyse the real-time risk of flooding hazards in the nodes of the complex network.

Peer reviewed General Housing Model

J M Applegate | Published Thursday, May 07, 2020The General Housing Model demonstrates a basic housing market with bank lending, renters, owners and landlords. This model was developed as a base to which students contributed additional functions during Arizona State University’s 2020 Winter School: Agent-Based Modeling of Social-Ecological Systems.

Alternative Fuel Design/Consumer Choice Model

Rosanna Garcia | Published Wednesday, September 22, 2010 | Last modified Saturday, April 27, 2013This is a model of the diffusion of alternative fuel vehicles based on manufacturer designs and consumer choices of those designs. It is written in Netlogo 4.0.3. Because it requires data to upload

Wave When the Hale Wale (WWHW)

María Pereda José Manuel Galán Iván Briz I Godino Jorge Caro Débora Zurro Myriam Álvarez José Santos | Published Friday, October 10, 2014 | Last modified Wednesday, April 25, 2018WWHW is an agent-based model designed to allow the exploration of the emergence, resilience and evolution of cooperative behaviours in hunter-fisher-gatherer societies.

Cluster Analysis

Lars Spång | Published Sunday, January 14, 2018This model illustrates how to apply a simple cluster-analysis on points distributed around 5 centers. The result can be displayed in shades of a color or a spectacular colored pattern.

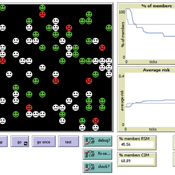

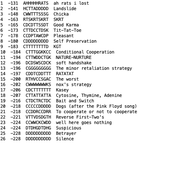

Prisoner's Tournament

Kristin Crouse | Published Wednesday, November 06, 2019 | Last modified Wednesday, December 15, 2021This model replicates the Axelrod prisoner’s dilemma tournaments. The model takes as input a file of strategies and pits them against each other to see who achieves the best payoff in the end. Change the payoff structure to see how it changes the tournament outcome!

Peer reviewed A financial market with zero intelligence agents

edgarkp | Published Wednesday, March 27, 2024The model’s aim is to represent the price dynamics under very simple market conditions, given the values adopted by the user for the model parameters. We suppose the market of a financial asset contains agents on the hypothesis they have zero-intelligence. In each period, a certain amount of agents are randomly selected to participate to the market. Each of these agents decides, in a equiprobable way, between proposing to make a transaction (talk = 1) or not (talk = 0). Again in an equiprobable way, each participating agent decides to speak on the supply (ask) or the demand side (bid) of the market, and proposes a volume of assets, where this number is drawn randomly from a uniform distribution. The granularity depends on various factors, including market conventions, the type of assets or goods being traded, and regulatory requirements. In some markets, high granularity is essential to capture small price movements accurately, while in others, coarser granularity is sufficient due to the nature of the assets or goods being traded

Memetic Exploration of Demand

rolanmd | Published Monday, August 09, 2010 | Last modified Saturday, April 27, 2013In this presentation, we use the concept of meme to explore evolution of demand.

Peer reviewed ana-wag

Géraldine Abrami Mamadou Diallo Stefano Farolfi Bruno Bonté Nils Ferrand Wanda Aquae Gaudi | Published Monday, February 13, 2017 | Last modified Friday, May 10, 2019The ana-wag model, for Analyse Wat-A-Game (WAG), is a NetLogo version of the WAG role playing game. It enables to model a river catchment with the graphical modelling language WAG and to play it as a network-game (each player is a water user).

Displaying 10 of 1170 results for "Aad Kessler" clear search