About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 1170 results for "Aad Kessler" clear search

Peer reviewed collective action in urban community gardens

Arthur Feinberg Paulien Herder Amineh Ghorbani Elena Hooijschuur Nicole Rogge | Published Saturday, May 15, 2021this agent-based model explores the dynamics of volunteer participation in urban community gardens, by combining behavioral theory and institutional theory

Primate Group Decision Making

j.zappala | Published Wednesday, August 11, 2010 | Last modified Saturday, April 27, 2013This model contains source code and a technical appendix for the paper “Effects of Resource Availability on Consensus Decision Making in Primates”.

HeatSupply

Jonathan Busch | Published Tuesday, May 17, 2016 | Last modified Tuesday, March 15, 2022HeatSupply models the development of district heat networks in cities by three types of instigators: Local Authorities, Commercial developers and Community organisations.

Mikania micrantha control in western Chitwan community forests

Jie Dai | Published Thursday, August 20, 2020This model simulates the household participation in large-scale M. micrantha intervention campaigns and the response of M. micrantha to the intervention.

Shellmound Trade

Henrique de Sena Kozlowski | Published Saturday, June 15, 2024This model simulates different trade dynamics in shellmound (sambaqui) builder communities in coastal Southern Brazil. It features two simulation scenarios, one in which every site is the same and another one testing different rates of cooperation. The purpose of the model is to analyze the networks created by the trade dynamics and explore the different ways in which sambaqui communities were articulated in the past.

How it Works?

There are a few rules operating in this model. In either mode of simulation, each tick the agents will produce an amount of resources based on the suitability of the patches inside their occupation-radius, after that the procedures depend on the trade dynamic selected. For BRN? the agents will then repay their owed resources, update their reputation value and then trade again if they need to. For GRN? the agents will just trade with a connected agent if they need to. After that the agents will then consume a random amount of resources that they own and based on that they will grow (split) into a new site or be removed from the simulation. The simulation runs for 1000 ticks. Each patch correspond to a 300x300m square of land in the southern coast of Santa Catarina State in Brazil. Each agent represents a shellmound (sambaqui) builder community. The data for the world were made from a SRTM raster image (1 arc-second) in ArcMap. The sites can be exported into a shapefile (.shp) vector to display in ArcMap. It uses a UTM Sirgas 2000 22S projection system.

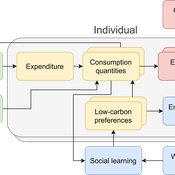

The cultural multiplier of climate policy

Daniel Torren-Peraire | Published Thursday, October 31, 2024For deep decarbonisation, the design of climate policy needs to account for consumption choices being influenced not only by pricing but also by social learning. This involves changes that pertain to the whole spectrum of consumption, possibly involving shifts in lifestyles. In this regard, it is crucial to consider not just short-term social learning processes but also slower, longer-term, cultural change. Against this background, we analyse the interaction between climate policy and cultural change, focusing on carbon taxation. We extend the notion of “social multiplier” of environmental policy derived in an earlier study to the context of multiple consumer needs while allowing for behavioural spillovers between these, giving rise to a “cultural multiplier”. We develop a model to assess how this cultural multiplier contributes to the effectiveness of carbon taxation. Our results show that the cultural multiplier stimulates greater low-carbon consumption compared to fixed preferences. The model results are of particular relevance for policy acceptance due to the cultural multiplier being most effective at low-carbon tax values, relative to a counter-case of short-term social interactions. Notably, at high carbon tax levels, the distinction between social and cultural multiplier effects diminishes, as the strong price signal drives even resistant individuals toward low-carbon consumption. By varying socio-economic conditions, such as substitutability between low- and high-carbon goods, social network structure, proximity of like-minded individuals and the richness of consumption lifestyles, the model provides insight into how cultural change can be leveraged to induce maximum effectiveness of climate policy.

The impact of potential crowd behaviours on emergency evacuation: an evolutionary game theoretic approach

Azhar Mohd Ibrahim | Published Monday, July 30, 2018Crowd dynamics have important applications in evacuation management systems relevant to organizing safer large scale gatherings. For crowd safety, it is very important to study the evolution of potential crowd behaviours by simulating the crowd evacuation process. Planning crowd control tasks by studying the impact of crowd behaviour evolution towards evacuation could mitigate the possibility of crowd disasters. During a typical emergency evacuation scenario, conflict among agents occurs when agents intend to move to the same location as a result of the interaction with their nearest neighbours. The effect of the agent response towards their neighbourhood is vital in order to understand the effect of variation of crowd behaviour on the whole environment. In this work, we model crowd motion subject to exit congestion under uncertainty conditions in a continuous space via computer simulations. We model best-response, risk-seeking, risk-averse and risk-neutral behaviours of agents via certain game theoretic notions. We perform computer simulations with heterogeneous populations in order to study the effect of the evolution of agent behaviours towards egress flow under threat conditions. Our simulation results show the relation between the local crowd pressure and the number of injured agents. We observe that when the proportion of agents in a population of risk-seeking agents is increased, the average crowd pressure, average local density and the number of injured agents increases. Besides that, based on our simulation results, we can infer that crowd disasters could be prevented if the agent population consists entirely of risk-averse and risk-neutral agents despite circumstances that lead to threats.

Prisoner's Dilemma Game on Complex Networks with Agents' Adaptive Expectations

Bo Xianyu | Published Wednesday, November 16, 2011 | Last modified Saturday, April 27, 2013This model studies the effect of the agents’ adaptive expectation on cooperation frequency in the prisoner’s dilemma game in complex networks from an agent based approach. The model is implemented in Repast simphony 1.2.

Peer reviewed Simple Coastal Exploitation in the American Samoa

Chloe Atwater | Published Wednesday, November 05, 2014This model employs optimal foraging theory principles to generate predictions of which coastal habitats are exploited in climatically stable versus variable environments, using the American Samoa as a study area.

Dental Routine Check-Up

Peyman Shariatpanahi Afshin Jafari | Published Thursday, March 10, 2016 | Last modified Monday, April 08, 2019We develop an agent-based model for collective behavior of routine medical check-ups, and specifically dental visits, in a social network.

Displaying 10 of 1170 results for "Aad Kessler" clear search