About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 65 results economics clear search

E³-MAN. An Institutionally-guided multi-agent. Model for fair and efficient negotiation.

José luis bustelo | Published Monday, September 01, 2025Negotiation plays a fundamental role in shaping human societies, underpinning conflict resolution, institutional design, and economic coordination. This article introduces E³-MAN, a novel multi-agent model for negotiation that integrates individual utility maximization with fairness and institutional legitimacy. Unlike classical approaches grounded solely in game theory, our model incorporates Bayesian opponent modeling, transfer learning from past negotiation domains, and fallback institutional rules to resolve deadlocks. Agents interact in dynamic environments characterized by strategic heterogeneity and asymmetric information, negotiating over multidimensional issues under time constraints. Through extensive simulation experiments, we compare E³-MAN against the Nash bargaining solution and equal-split baselines using key performance metrics: utilitarian efficiency, Nash social welfare, Jain fairness index, Gini coefficient, and institutional compliance. Results show that E³-MAN achieves near-optimal efficiency while significantly improving distributive equity and agreement stability. A legal application simulating multilateral labor arbitration demonstrates that institutional default rules foster more balanced outcomes and increase negotiation success rates from 58% to 98%. By combining computational intelligence with normative constraints, this work contributes to the growing field of socially aware autonomous agents. It offers a virtual laboratory for exploring how simple institutional interventions can enhance justice, cooperation, and robustness in complex socio-legal systems.

A language economics perspective on language spread: Simulating Language Dynamics in a Social Network

Marco Civico | Published Saturday, June 07, 2025This model examines language dynamics within a social network using simulation techniques to represent the interplay of language adoption, social influence, economic incentives, and language policies. The agent-based model (ABM) focuses on interactions between agents endowed with specific linguistic attributes, who engage in communication based on predefined rules. A key feature of our model is the incorporation of network analysis, structuring agent relationships as a dynamic network and leveraging network metrics to capture the evolving inter-agent connections over time. This integrative approach provides nuanced insights into emergent behaviors and system dynamics, offering an analytical framework that extends beyond traditional modeling approaches. By combining agent-based modeling with network analysis, the model sheds light on the underlying mechanisms governing complex language systems and can be effectively paired with sociolinguistic observational data.

We provide a theory-grounded, socio-geographic agent-based model to present a possible explanation for human movement in the Adriatic region within the Cetina phenomenon.

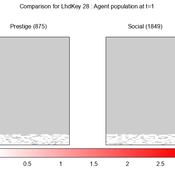

Focusing on ideas of social capital theory from Piere Bordieu (1986), we implement agent mobility in an abstract geography based on cultural capital (prestige) and social capital (social position). Agents hold myopic representations of social (Schaff, 2016) and geographical networks and decide in a heuristic way on moving (and where) or staying.

The model is implemented in a fork of the Laboratory for Simulation Development (LSD), appended with GIS capabilities (Pereira et. al. 2020).

Soy2Grow-ABM-V1

Siavash Farahbakhsh | Published Monday, January 20, 2025The Soy2Grow ABM aims to simulate the adoption of soybean production in Flanders, Belgium. The model primarily considers two types of agents as farmers: 1) arable and 2) dairy farmers. Each farmer, based on its type, assesses the feasibility of adopting soybean cultivation. The feasibility assessment depends on many interrelated factors, including price, production costs, yield, disease, drought (i.e., environmental stress), social pressure, group formations, learning and skills, risk-taking, subsidies, target profit margins, tolerance to bad experiences, etc. Moreover, after adopting soybean production, agents will reassess their performance. If their performance is unsatisfactory, an agent may opt out of soy production. Therefore, one of the main outcomes to look for in the model is the number of adopters over time.

The main agents are farmers. Generally, factors influencing farmers’ decision-making are divided into seven main areas: 1) external environmental factors, 2) cooperation and learning (with slight differences depending on whether they are arable or dairy farmers), 3) crop-specific factors, 4) economics, 5) support frameworks, 6) behavioral factors, and 7) the role of mobile toasters (applicable only to dairy farmers).

Moreover, factors not only influence decision-making but also interact with each other. Specifically, external environmental factors (i.e., stress) will result in lower yield and quality (protein content). The reducing effect, identified during participatory workshops, can reach 50 %. Skills can grow and improve yield; however, their growth has a limit and follows different learning curves depending on how individualistic a farmer is. During participatory workshops, it was identified that, contrary to cooperative farmers, individualistic farmers may learn faster and reach their limits more quickly. Furthermore, subsidies directly affect revenues and profit margins; however, their impact may disappear when they are removed. In the case of dairy farmers, mobile toasters play an important role, adding toasting and processing costs to those producing soy for their animal feed consumption.

Last but not least, behavioral factors directly influence the final adoption decision. For example, high risk-taking farmers may adopt faster, whereas more conservative farmers may wait for their neighbors to adopt first. Farmers may evaluate their success based on their own targets and may also consider other crops rather than soy.

A formalized implementation of Halstead and O’Shea’s Bad Year Economics. The agent population uses one of four resilience strategies in an attempt to cope with a dynamic environment of stresses and shocks.

Peer reviewed Agent-Based Ramsey growth model with Brown and Green capital (ABRam-BG)

Sarah Wolf Aida Sarai Figueroa Alvarez | Published Monday, December 09, 2024The purpose of the ABRam-BG model is to study belief dynamics as a potential driver of green (growth) transitions and illustrate their dynamics in a closed, decentralized economy populated by utility maximizing agents with an environmental attitude. The model is built using the ABRam-T model (for model visit: https://doi.org/10.25937/ep45-k084) and introduces two types of capital – green (low carbon intensity) and brown (high carbon intensity) – with their respective technological progress levels. ABRam-BG simulates a green transition as an emergent phenomenon resulting from well-known opinion dynamics along the economic process.

Team Structure and Task Performance

Davide Secchi Martin Neumann | Published Monday, August 05, 2024This model was designed to study resilience in organizations. Inspired by ethnographic work, it follows the simple goal to understand whether team structure affects the way in which tasks are performed. In so doing, it compares the ‘hybrid’ data-inspired structure with three more traditional structures (i.e. hierarchy, flexible/relaxed hierarchy, and anarchy/disorganization).

Peer reviewed A financial market with zero intelligence agents

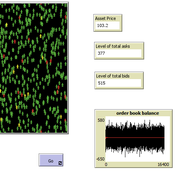

edgarkp | Published Wednesday, March 27, 2024The model’s aim is to represent the price dynamics under very simple market conditions, given the values adopted by the user for the model parameters. We suppose the market of a financial asset contains agents on the hypothesis they have zero-intelligence. In each period, a certain amount of agents are randomly selected to participate to the market. Each of these agents decides, in a equiprobable way, between proposing to make a transaction (talk = 1) or not (talk = 0). Again in an equiprobable way, each participating agent decides to speak on the supply (ask) or the demand side (bid) of the market, and proposes a volume of assets, where this number is drawn randomly from a uniform distribution. The granularity depends on various factors, including market conventions, the type of assets or goods being traded, and regulatory requirements. In some markets, high granularity is essential to capture small price movements accurately, while in others, coarser granularity is sufficient due to the nature of the assets or goods being traded

AgriAdopt

Sebastian Rasch | Published Tuesday, March 26, 2024The purpose of this model is to project the dynamics of technology adoption of autonomous weeding robots by sugar beet producing farmers in North Rhine-Westphalia (NRW). Moreover, the design of the model serves the purpose to investigate second-order effects of robot adoption on shifts in farm income and on production quantities of main crops produced in North Rhine-Westphalia. One aim is to analyse the impact of technology attributes and costs of pesticides on adoption patterns.

Opinion dynamics model for prediction markets

Valerio Restocchi | Published Monday, July 31, 2023We introduce a model of prediction markets that uses opinion dynamics as its underlying mechanism for price formation. We base the opinion dynamics on the Deffuant model of bounded rationality. We have used this model to show that price formation in prediction markets can be robustly explained by opinion dynamics, and that the model can also explain phase transitions depending on just two parameters.

Displaying 10 of 65 results economics clear search