About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 49 results demand clear search

The SAFIRe model : Simulation of Agents for Fertility, Integrated Energy, Food security, and Reforestation

Etienne DELAY Lucas Broutin | Published Thursday, June 12, 2025The SAFIRe model (Simulation of Agents for Fertility, Integrated Energy, Food Security, and Reforestation) is an agent-based model co-developed with rural communities in Senegal’s Groundnut Basin. Its purpose is to explore how local farming and pastoral practices affect the regeneration of Faidherbia albida trees, which are essential for maintaining soil fertility and supporting food security through improved millet production. The model supports collective reflection on how different social and ecological factors interact, particularly around firewood demand, livestock pressure, and agricultural intensification.

The model simulates a 100-hectare agricultural landscape where agents (farmers, shepherds, woodcutters, and supervisors) interact with trees, land parcels, and each other. It incorporates seasonality, crop rotation, tree growth and cutting, livestock feeding behaviors, and farmers’ engagement in sapling protection through Assisted Natural Regeneration (ANR). Two types of surveillance strategies are compared: community-led monitoring and delegated surveillance by forestry authorities. Farmer engagement evolves over time based on peer influence, meeting participation, and the success of visible tree regeneration efforts.

SAFIRe integrates participatory modeling (ComMod and ComExp) and a backcasting approach (ACARDI) to co-produce scenarios rooted in local aspirations. It was explored using the OpenMole platform, allowing stakeholders to test a wide range of future trajectories and analyze the sensitivity of key parameters (e.g., discussion frequency, time in fields). The model’s outcomes not only revealed unexpected insights—such as the hidden role of farmers in tree loss—but also led to real-world actions, including community nursery creation and behavioral shifts toward tree care. SAFIRe illustrates how agent-based modeling can become a tool for social learning and collective action in socio-ecological systems.

Peer reviewed WaDemEsT-Water Demand Estimation Tool for Residential Areas

Kamil Aybuğa | Published Tuesday, February 18, 2025This model simulates household water consumption patterns in an urban environment. Its current setup compares monthly water consumption data, and the results of a daily heuristic water demand model with the simulation results produced by household demographics that is fine tuned via some base demand model. It’s designed to estimate and analyze water demand based on various factors including household demographics, daily routines of residents (working, weekending, vacation patterns), weather conditions (temperature and precipitation), appliance usage patterns, seasonal variations, and special periods such as weekends and holidays. The model aims to help understand how different factors influence residential water consumption and can be used for water demand forecasting and management.

BarterNet is a platform for modeling early barter networks with the aim of learning how supply and demand for a good determine if traders will learn to use that good as a form of money. Traders use a good as money when they offer to trade for it even if they can’t consume it, but believe that they can subsequently trade it for a good they can consume in the near future.

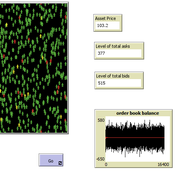

Peer reviewed A financial market with zero intelligence agents

edgarkp | Published Wednesday, March 27, 2024The model’s aim is to represent the price dynamics under very simple market conditions, given the values adopted by the user for the model parameters. We suppose the market of a financial asset contains agents on the hypothesis they have zero-intelligence. In each period, a certain amount of agents are randomly selected to participate to the market. Each of these agents decides, in a equiprobable way, between proposing to make a transaction (talk = 1) or not (talk = 0). Again in an equiprobable way, each participating agent decides to speak on the supply (ask) or the demand side (bid) of the market, and proposes a volume of assets, where this number is drawn randomly from a uniform distribution. The granularity depends on various factors, including market conventions, the type of assets or goods being traded, and regulatory requirements. In some markets, high granularity is essential to capture small price movements accurately, while in others, coarser granularity is sufficient due to the nature of the assets or goods being traded

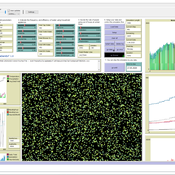

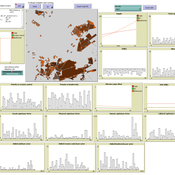

Peer reviewed The Viability of the Social-Ecological Agroecosystem (ViSA) Spatial Agent-based Model

Mostafa Shaaban | Published Monday, March 25, 2024ViSA 2.0.0 is an updated version of ViSA 1.0.0 aiming at integrating empirical data of a new use case that is much smaller than in the first version to include field scale analysis. Further, the code of the model is simplified to make the model easier and faster. Some features from the previous version have been removed.

It simulates decision behaviors of different stakeholders showing demands for ecosystem services (ESS) in agricultural landscape. It investigates conditions and scenarios that can increase the supply of ecosystem services while keeping the viability of the social system by suggesting different mixes of initial unit utilities and decision rules.

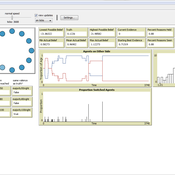

An Agent-Based Model of an Insurance Market driven by Supply and Demand with Imperfectly Estimated Strategies in C#

Rei England | Published Sunday, September 24, 2023This is a simulation of an insurance market where the premium moves according to the balance between supply and demand. In this model, insurers set their supply with the aim of maximising their expected utility gain while operating under imperfect information about both customer demand and underlying risk distributions.

There are seven types of insurer strategies. One type follows a rational strategy within the bounds of imperfect information. The other six types also seek to maximise their utility gain, but base their market expectations on a chartist strategy. Under this strategy, market premium is extrapolated from trends based on past insurance prices. This is subdivided according to whether the insurer is trend following or a contrarian (counter-trend), and further depending on whether the trend is estimated from short-term, medium-term, or long-term data.

Customers are modelled as a whole and allocated between insurers according to available supply. Customer demand is calculated according to a logit choice model based on the expected utility gain of purchasing insurance for an average customer versus the expected utility gain of non-purchase.

Peer reviewed Co-adoption of low-carbon household energy technologies

Mart van der Kam Maria Lagomarsino Elie Azar Ulf Hahnel David Parra | Published Tuesday, August 29, 2023 | Last modified Friday, February 23, 2024The model simulates the diffusion of four low-carbon energy technologies among households: photovoltaic (PV) solar panels, electric vehicles (EVs), heat pumps, and home batteries. We model household decision making as the decision marking of one person, the agent. The agent decides whether to adopt these technologies. Hereby, the model can be used to study co-adoption behaviour, thereby going beyond traditional diffusion models that focus on the adop-tion of single technologies. The combination of these technologies is of particular interest be-cause (1) using the energy generated by PV solar panels for EVs and heat pumps can reduce emissions associated with transport and heating, respectively, and (2) EVs, heat pumps, and home batteries can help to integrate PV solar panels in local electricity grids by offering flexible demand (EVs and heat pumps) and energy storage (home batteries and EVs), thereby reducing grid impacts and associated upgrading costs.

The purpose of the model is to represent realistic adoption and co-adoption behaviour. This is achieved by grounding the decision model on the risks-as-feelings model (Loewenstein et al., 2001), theory from environmental and social psychology, and empirically informing agent be-haviour by survey-data among 1469 people in the Swiss region Romandie.

The model can be used to construct scenarios for the diffusion of the four low-carbon energy technologies depending on different contexts, and as a virtual experimentation environment for ex ante evaluation of policy interventions to stimulate adoption and co-adoption.

The Epistemic Role of Diversity in Juries

Aaron Bramson Patrick Grim Daniel J Singer Jiin Jung William J. Berger Bennett Holman | Published Wednesday, August 16, 2023This model is linked to the paper “The Epistemic Role of Diversity in Juries: An Agent-Based Model”. There are many version of this model, but the current version focuses on the role of diversity in whether juries reach correct verdicts. Using this agent-based model, we argue that diversity can play at least four importantly different roles in affecting jury verdicts. (1) Where different subgroups have access to different information, equal representation can strengthen epistemic jury success. (2) If one subgroup has access to particularly strong evidence, epistemic success may demand participation by that group. (3) Diversity can also reduce the redundancy of the information on which a jury focuses, which can have a positive impact. (4) Finally, and most surprisingly, we show that limiting communication between diverse groups in juries can favor epistemic success as well.

Peer reviewed Reduced Mobility Transition Model (R-MoTMo)

Gesine A. Steudle Sarah Wolf Steffen Fürst | Published Tuesday, December 06, 2022The Mobility Transition Model (MoTMo) is a large scale agent-based model to simulate the private mobility demand in Germany until 2035. Here, we publish a very much reduced version of this model (R-MoTMo) which is designed to demonstrate the basic modelling ideas; the aim is by abstracting from the (empirical, technological, geographical, etc.) details to examine the feed-backs of individual decisions on the socio-technical system.

WATER REUSE ADOPTION BY FARMERS (WRAF)

Farshid Shoushtarian | Published Tuesday, September 27, 2022Agriculture is the largest water-consuming sector worldwide, responsible for almost 70% of the world’s total freshwater consumption. Agricultural water reuse is one of the most sustainable and reliable methods to alleviate water shortages worldwide. However, the dynamics of agricultural water reuse adoption by farmers and its impacts on local water resources are still unknown to the scientific community, according to the literature. Therefore, the primary purpose of the WRAF model is to investigate the micro-level dynamics of agricultural water reuse adoption by farmers and its impacts on local water resources. The WRAF was developed using agent-based modeling as an exploratory tool for scenario analysis. The model was specifically designed for researchers and water resources decision-makers, especially those interested in natural resources management and water reuse.

WRAF simulates a virtual agricultural area in which several autonomous farms operate. It also simulates these farms’ water consumption dynamics. The developed model includes two types of agents: farmers and wastewater treatment plants. In general, farmer agents are the main water-consuming agents, and wastewater treatment plant agents are recycled water providers in the WRAF model. Dynamic simulation of agricultural water supply and demand in the area allows the user to observe the results of various irrigation water management scenarios, including recycled water. The models also enable the user to apply multiple climate change scenarios, including normal, moderate drought, severe drought, and wet weather conditions.

Displaying 10 of 49 results demand clear search