About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 6 of 6 results innovation adoption clear search

The simulation on the study of the optimal business strategy with the interaction between technologies and consumers.

sej-yoo | Published Monday, June 27, 2022 | Last modified Monday, July 04, 2022HOW IT WORKS

This model consists of three agents, and each agent type operates per business theories as below.

a. New technologies(Tech): It evolves per sustaining or disruptive technology trajectory with the constraint of project management triangle (Scope, Time, Quality, and Cost).

b. Entrepreneurs(Entre): It builds up the solution by combining Tech components per its own strategy (Exploration, Exploitation, or Ambidex).

c. Consumer(Consumer): It selects the solution per its own preference due to Diffusion of innovation theory (Innovators, Early Adopters, Early Majority, Late Majority, Laggards)

…

Diffusion of Eco-Innovation through Inter-firm Network Targeting: An Agent-Based Model

apyka Flaminio Squazzoni Shyaam Ramkumar Matthias Mueller | Published Monday, January 10, 2022This model is developed as a theoretical agent-based model to study the general phenomena of network-based targeting strategies on eco-innovation adoption and diffusion through inter-firm networks.

9 Maturity levels in Empirical Validation - An innovation diffusion example

Martin Rixin | Published Wednesday, October 19, 2011 | Last modified Saturday, April 27, 2013Several taxonomies for empirical validation have been published. Our model integrates different methods to calibrate an innovation diffusion model, ranging from simple randomized input validation to complex calibration with the use of microdata.

(Policy induced) Diffusion of Innovations - An integrated demand-supply Model based on Cournot Competition

Martin Rixin | Published Monday, August 29, 2011 | Last modified Saturday, April 27, 2013Objective is to simulate policy interventions in an integrated demand-supply model. The underlying demand function links both sides. Diffusion proceeds if interactions distribute awareness (Epidemic effect) and rivalry reduces the market price (Probit effect). Endogeneity is given due to the fact that consumer awareness as well as their willingness-to-pay drives supply-side rivalry. Firm´s entry and exit decisions as well as quantity and price settings are driven by Cournot competition.

A consumer-demand simulation for Smart Metering tariffs (Innovation Diffusion)

Martin Rixin | Published Thursday, August 18, 2011 | Last modified Saturday, April 27, 2013An Agent-based model simulates consumer demand for Smart Metering tariffs. It utilizes the Bass Diffusion Model and Rogers´s adopter categories. Integration of empirical census microdata enables a validated socio-economic background for each consumer.

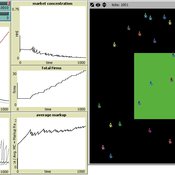

Toward Market Structure as a Complex System: A Web Based Simulation Assignment Implemented in Netlogo

Timothy Kochanski | Published Monday, February 14, 2011 | Last modified Saturday, April 27, 2013This is the model for a paper that is based on a simulation model, programmed in Netlogo, that demonstrates changes in market structure that occur as marginal costs, demand, and barriers to entry change. Students predict and observe market structure changes in terms of number of firms, market concentration, market price and quantity, and average marginal costs, profits, and markups across the market as firms innovate. By adjusting the demand growth and barriers to entry, students can […]