About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 241 results for "Armin Haas" clear search

Peer reviewed Price Evolution with Expectations

J M Applegate Gesine Steudel Armin Haas Carlo Jaeger | Published Friday, September 10, 2021The Price Evolution with Expectations model provides the opportunity to explore the question of non-equilibrium market dynamics, and how and under which conditions an economic system converges to the classically defined economic equilibrium. To accomplish this, we bring together two points of view of the economy; the classical perspective of general equilibrium theory and an evolutionary perspective, in which the current development of the economic system determines the possibilities for further evolution.

The Price Evolution with Expectations model consists of a representative firm producing no profit but producing a single good, which we call sugar, and a representative household which provides labour to the firm and purchases sugar.The model explores the evolutionary dynamics whereby the firm does not initially know the household demand but eventually this demand and thus the correct price for sugar given the household’s optimal labour.

The model can be run in one of two ways; the first does not include money and the second uses money such that the firm and/or the household have an endowment that can be spent or saved. In either case, the household has preferences for leisure and consumption and a demand function relating sugar and price, and the firm has a production function and learns the household demand over a set number of time steps using either an endogenous or exogenous learning algorithm. The resulting equilibria, or fixed points of the system, may or may not match the classical economic equilibrium.

Spatial model of the noisy Prisoner's Dilemma with reward shift

Matus Halas | Published Thursday, March 05, 2015 | Last modified Tuesday, May 29, 2018Interactions of players embedded in a closed square lattice are determined by distance and overall gains and they lead to shifts of reward payoff between temptation and punishment. A new winner balancing against threats is ultimately discovered.

The Effect of Individual and Collective Characteristics on Team Performance: A Model of Networked Agents Engaged in Collective Problem Solving

Amin Boroomand | Published Tuesday, March 16, 2021 | Last modified Monday, July 26, 2021This code is for an agent-based model of collective problem solving in which agents with different behavior strategies, explore the NK landscape while they communicate with their peers agents. This model is based on the famous work of Lazer, D., & Friedman, A. (2007), The network structure of exploration and exploitation.

Heterogeneity of preferences and the dynamics of voluntary contributions to public goods

Engi Amin Amal Soliman Mohamed Abouelela | Published Thursday, August 18, 2016 | Last modified Thursday, January 25, 2018This model simulates the heterogeneity of preferences in a PG game and how the interaction between them affects the dynamics of voluntary contributions. Model is based on the results of a human-based experiment.

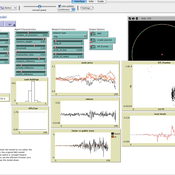

Superiority Bias and Communication Noise in a Model of Collective Problem Solving

Paul Smaldino Amin Boroomand | Published Sunday, May 01, 2022This model aims to examine how different levels of communication noise and superiority bias affect team performance when solving problems collectively. We used a networked agent-based model of collective problem solving in which agents explore the NK landscape for a better solution and communicate with each other regarding their current solutions. We compared the team performance in solving problems collectively at different levels of self-superiority bias when facing simple and complex problems. Additionally, we addressed the effect of different levels of communication noise on the team’s outcome

Enhancing recycling of construction materials; an agent based model with empirically based decision parameters

Igor Nikolic Claudia Binder Christof Knoeri Hans-Joerg Althaus | Published Sunday, October 21, 2012 | Last modified Monday, June 09, 2014This model allows for analyzing the most efficient levers for enhancing the use of recycled construction materials, and the role of empirically based decision parameters.

Cluster Analysis

Lars Spång | Published Sunday, January 14, 2018This model illustrates how to apply a simple cluster-analysis on points distributed around 5 centers. The result can be displayed in shades of a color or a spectacular colored pattern.

Multi Asset Variable Network Stock Market Model

Matthew Oldham | Published Monday, September 12, 2016 | Last modified Tuesday, October 10, 2017An artifcal stock market model that allows users to vary the number of risky assets as well as the network topology that investors forms in an attempt to understand the dynamics of the market.

SearchResource

Romulus-Catalin Damaceanu | Published Friday, May 04, 2012 | Last modified Saturday, April 27, 2013An algorithm implemented in NetLogo that can be used for searching resources.

Eco-Evolutionary Pathways Toward Industrial Cities

Handi Chandra Putra | Published Thursday, May 21, 2020Industrial location theory has not emphasized environmental concerns, and research on industrial symbiosis has not emphasized workforce housing concerns. This article brings jobs, housing, and environmental considerations together in an agent-based model of industrial

and household location. It shows that four classic outcomes emerge from the interplay of a relatively small number of explanatory factors: the isolated enterprise with commuters; the company town; the economic agglomeration; and the balanced city.

Displaying 10 of 241 results for "Armin Haas" clear search