About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 1191 results for "Lee-Ann Sutherland" clear search

Zero, Some, or Zero-Sum: Exploring Trade-Offs in Identifying Human Trafficking Among Migration Flows

Kyle Ballard | Published Saturday, September 23, 2017The model attempts to explore the trade-offs between immigration policies and successfully identifying human trafficking victims.

Sharing economy in the short-time accommodations market

Bruna Bruno Marisa Faggini | Published Wednesday, October 16, 2019We present an agent-based model for the sharing economy, in the short-time accommodations market, where peers participating as suppliers and demanders follow simple decision rules about sharing market participation, according to their heterogeneous characteristics. We consider the sharing economy mainly as a peer-to-peer market where the access is preferred to ownership, excluding professional agents using sharing platforms as Airbnb to promote their business.

Agent-Based Model of a Circular Food Packaging Ecosystem to assess Packaging Waste Dynamics

Annoek Reitsema | Published Friday, October 11, 2024Reducing packaging waste is a critical challenge that requires organizations to collaborate within circular ecosystems, considering social, economic, and technical variables like decision-making behavior, material prices, and available technologies. Agent-Based Modeling (ABM) offers a valuable methodology for understanding these complex dynamics. In our research, we have developed an ABM to explore circular ecosystems’ potential in reducing packaging waste, using a case study of the Dutch food packaging ecosystem. The model incorporates three types of agents—beverage producers, packaging producers, and waste treaters—who can form closed-loop recycling systems.

Beverage Producer Agents: These agents represent the beverage company divided into five types based on packaging formats: cans, PET bottles, glass bottles, cartons, and bag-in-boxes. Each producer has specific packaging demands based on product volume, type, weight, and reuse potential. They select packaging suppliers annually, guided by deterministic decision styles: bargaining (seeking the lowest price) or problem-solving (prioritizing high recycled content).

Packaging Producer Agents: These agents are responsible for creating packaging using either recycled or virgin materials. The model assumes a mix of monopolistic and competitive market situations, with agents calculating annual material needs. Decision styles influence their choices: bargaining agents compare recycled and virgin material costs, while problem-solving agents prioritize maximum recycled content. They calculate recycled content in packaging and set prices accordingly, ensuring all produced packaging is sold within or outside the model.

…

The Li-BIM model aims at simulating the behavior of occupants in a building. It is structured around the numerical modeling of the building (IFC format) and a BDI cognitive architecture. The model has been implemented under the GAMA platform.

This model investigates how anti-conformist intentions could be related to some biases on the perception of attitudes. It starts from two case studies, related to the adoption of organic farming, that show anti-conformist intentions. It proposes an agent-based model which computes an intention based on the Theory of Reasoned Action and assumes some biases in the perception of others’ attitudes according to the Social Judgement Theory.

It investigates the conditions on the model parameter values for which the simulations reproduce the features observed in the case studies. The results suggest that perception biases are indeed likely to contribute to anti-conformist intentions.

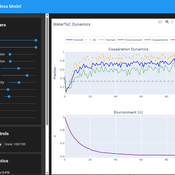

Tragedy of the Commons with Environmental Feedback: A Model of Human-AI Socio-Environmental Water Dilemma

Ivana Malcic Luka Waronig Andrew Crossley | Published Saturday, July 05, 2025 | Last modified Sunday, July 06, 2025This project is an interactive agent-based model simulating consumption of a shared, renewable resource using a game-theoretic framework with environmental feedback. The primary function of this model was to test how resource-use among AI and human agents degrades the environment, and to explore the socio-environmental feedback loops that lead to complex emergent system dynamics. We implemented a classic game theoretic matrix which decides agents´ strategies, and added a feedback loop which switches between strategies in pristine vs degraded environments. This leads to cooperation in bad environments, and defection in good ones.

Despite this use, it can be applicable for a variety of other scenarios including simulating climate disasters, environmental sensitivity to resource consumption, or influence of environmental degradation to agent behaviour.

The ABM was inspired by the Weitz et. al. (2016, https://pubmed.ncbi.nlm.nih.gov/27830651/) use of environmental feedback in their paper, as well as the Demographic Prisoner’s Dilemma on a Grid model (https://mesa.readthedocs.io/stable/examples/advanced/pd_grid.html#demographic-prisoner-s-dilemma-on-a-grid). The main innovation is the added environmental feedback with local resource replenishment.

Beyond its theoretical insights into coevolutionary dynamics, it serves as a versatile tool with several practical applications. For urban planners and policymakers, the model can function as a ”digital sandbox” for testing the impacts of locating high-consumption industrial agents, such as data centers, in proximity to residential communities. It allows for the exploration of different urban densities, and the evaluation of policy interventions—such as taxes on defection or subsidies for cooperation—by directly modifying the agents’ resource consumptions to observe effects on resource health. Furthermore, the model provides a framework for assessing the resilience of such socio-environmental systems to external shocks.

…

Informal City version 1.0

Nina Schwarz | Published Friday, July 25, 2014 | Last modified Thursday, July 30, 2015InformalCity, a spatially explicit agent-based model, simulates an artificial city and allows for testing configurations of urban upgrading schemes in informal settlements.

Evolutionary Prosocial Behavior Algorithm 1.1 (EPBA_1.1)

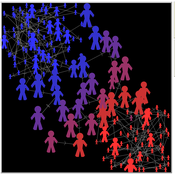

Andrea Ceschi | Published Tuesday, September 04, 2018In order to test how prosocial strategies (compassionate altruism vs. reciprocity) grow over time, we developed an evolutionary simulation model where artificial agents are equipped with different emotionally-based drivers that vary in strength. Evolutionary algorithms mimic the evolutionary selection process by letting the chances of agents conceiving offspring depend on their fitness. Equipping the agents with heritable prosocial strategies allows for a selection of those strategies that result in the highest fitness. Since some prosocial attributes may be more successful than others, an initially heterogeneous population can specialize towards altruism or reciprocity. The success of particular prosocial strategies is also expected to depend on the cultural norms and environmental conditions the agents live in.

Social Construction of Reality Agent-Based Model

Manuel Castañón-Puga E. Dante Suarez Loren Demerath | Published Saturday, June 29, 2024This model illustrates the processes underlying the social construction of reality through an agent-based genetic algorithm. By simulating the interactions of agents within a structured environment, we have demonstrated how shared information and popularity contribute to the formation of emergent social structures with diverse cultures. The model illustrates how agents balance environmentally valid information with socially reliable information. It also highlights how social interaction leads to the formation of stable, yet diverse, social groups.

Location Analysis Hybrid ABM

Lukasz Kowalski | Published Friday, February 08, 2019The purpose of this hybrid ABM is to answer the question: where is the best place for a new swimming pool in a region of Krakow (in Poland)?

The model is well described in ODD protocol, that can be found in the end of my article published in JASSS journal (available online: http://jasss.soc.surrey.ac.uk/22/1/1.html ). Comparison of this kind of models with spatial interaction ones, is presented in the article. Before developing the model for different purposes, area of interest or services, I recommend reading ODD protocol and the article.

I published two films on YouTube that present the model: https://www.youtube.com/watch?v=iFWG2Xv20Ss , https://www.youtube.com/watch?v=tDTtcscyTdI&t=1s

…

Displaying 10 of 1191 results for "Lee-Ann Sutherland" clear search