About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 927 results for "Am Vaes - Van De Hulsbeek" clear search

Scientific disagreements and the diagnosticity of evidence

Matteo Michelini | Published Wednesday, December 13, 2023The present model is an abstract ABM designed for theoretical exploration and hypotheses generation. Its main aim is to explore the relationship between disagreement over the diagnostic value of evidence and the formation of polarization in scientific communities.

The model represents a scientific community in which scientists aim to determine whether hypothesis H is true, and we assume that agents are in a world in which H is indeed true. To this end, scientists perform experiments, interpret data and exchange their views on how diagnostic of H the obtained evidence is. Based on how the scientists conduct the inquiry, the community may reach a correct consensus (i.e. a situation in which every scientist agrees that H is correct) or not.

Benchmark for RepastHPC Agent-based modeling and simulation (ABMS) platform

Andreu Moreno Vendrell Josep Jorba Eduardo César Anna Sikora | Published Friday, November 22, 2024Agent-based modeling and simulation (ABMS) is a class of computational models for simulating the actions and interactions of autonomous agents with the goal of assessing their effects on a system as a whole. Several frameworks for generating parallel ABMS applications have been developed taking advantage of their common characteristics, but there is a lack of a general benchmark for comparing the performance of generated applications. We propose and design a benchmark that takes into consideration the most common characteristics of this type of applications and includes parameters for influencing their relevant performance aspects. We provide an initial implementation of the benchmark for RepastHPC one of the most popular parallel ABMS platforms, and we use it for comparing the applications generated by these platforms.

Benchmark for FLAME Agent-based modeling and simulation (ABMS) platform

Andreu Moreno Vendrell Josep Jorba Eduardo César Anna Sikora | Published Friday, November 22, 2024Agent-based modeling and simulation (ABMS) is a class of computational models for simulating the actions and interactions of autonomous agents with the goal of assessing their effects on a system as a whole. Several frameworks for generating parallel ABMS applications have been developed taking advantage of their common characteristics, but there is a lack of a general benchmark for comparing the performance of generated applications. We propose and design a benchmark that takes into consideration the most common characteristics of this type of applications and includes parameters for influencing their relevant performance aspects. We provide an initial implementation of the benchmark for FLAME one of the most popular parallel ABMS platforms, and we use it for comparing the applications generated by these platforms.

Status hierarchies and the emergence of cooperation in task groups

Hsuan-Wei Lee | Published Thursday, January 02, 2025This repository contains an agent-based simulation model exploring how status hierarchies influence the emergence and sustainability of cooperation in task-oriented groups. The model builds on evolutionary game theory to examine the dynamics of cooperation under single-leader and multi-leader hierarchies, investigating factors such as group size, assortativity, and hierarchical clarity. Key findings highlight the trade-offs between different leadership structures in fostering group cooperation and reveal the conditions under which cooperation is most stable.

The repository includes code for simulations, numerical analysis scripts, and visualization tools to replicate the results presented in the manuscript titled “Status hierarchies and the emergence of cooperation in task groups.”

Feel free to explore, reproduce the findings, or adapt the model for further research!

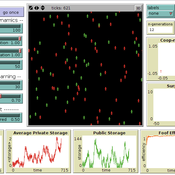

“Food for all” (FFD)

Andreas Angourakis José Manuel Galán Andrea L Balbo José Santos | Published Friday, April 25, 2014 | Last modified Monday, April 08, 2019“Food for all” (FFD) is an agent-based model designed to study the evolution of cooperation for food storage. Households face the social dilemma of whether to store food in a corporate stock or to keep it in a private stock.

Individual time preferences and adoption of destructive extraction methods

Marco Janssen Aneeque Javaid Hauke Reuter Achim Schlueter | Published Tuesday, December 06, 2016We model the relationship between natural resource user´s individual time preferences and their use of destructive extraction method in the context of small-scale fisheries.

The Coevolution of the Firm and the Product Attribute Space

César García-Díaz | Published Friday, May 22, 2020This model inspects the performance of firms as the product attribute space changes, which evolves as a consequence of firms’ actions. Firms may create new product variants by dragging demand from other existing variants. Firms decide whether to open new product variants, to invade existing ones, or to keep their variant portfolio. At each variant there is a Cournot competition each round. Competition is nested since many firms compete at many variants simultaneously, affecting firm composition at each location (variant).

After the Cournot outcomes, at each round firms decide whether to (i) keep their existing product variant niche, (ii) invade an existing variant, (iii) create a new variant, or (iv) abandon a variant. Firms’ profits across their niche take into consideration the niche-width cost and the cost of opening a new variant.

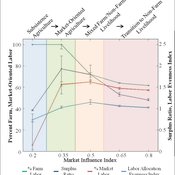

Land-Livelihood Transitions

Nicholas Magliocca Daniel G Brown Erle C Ellis | Published Monday, September 09, 2013 | Last modified Friday, September 13, 2013Implemented as a virtual laboratory, this model explores transitions in land-use and livelihood decisions that emerge from changing local and global conditions.

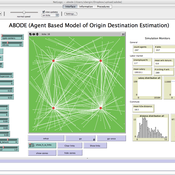

ABODE - Agent Based Model of Origin Destination Estimation

D Levinson | Published Monday, August 29, 2011 | Last modified Saturday, April 27, 2013The agent based model matches origins and destinations using employment search methods at the individual level.

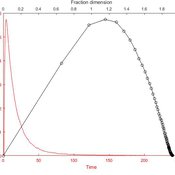

How does knowledge infrastructure mobilization influence the safe operating space of regulated exploited ecosystems?

Jean-Denis Mathias | Published Tuesday, July 17, 2018Decision-makers often have to act before critical times to avoid the collapse of ecosystems using knowledge \textcolor{red}{that can be incomplete or biased}. Adaptive management may help managers tackle such issues. However, because the knowledge infrastructure required for adaptive management may be mobilized in several ways, we study the quality and the quantity of knowledge provided by this knowledge infrastructure. In order to analyze the influence of mobilized knowledge, we study how the following typology of knowledge and its use may impact the safe operating space of exploited ecosystems: 1) knowledge of the past based on a time series distorted by measurement errors; 2) knowledge of the current systems’ dynamics based on the representativeness of the decision-makers’ mental models of the exploited ecosystem; 3) knowledge of future events based on decision-makers’ likelihood estimates of extreme events based on modeling infrastructure (models and experts to interpret them) they have at their disposal. We consider different adaptive management strategies of a general regulated exploited ecosystem model and we characterize the robustness of these strategies to biased knowledge. Our results show that even with significant mobilized knowledge and optimal strategies, imperfect knowledge may still shrink the safe operating space of the system leading to the collapse of the system. However, and perhaps more interestingly, we also show that in some cases imperfect knowledge may unexpectedly increase the safe operating space by suggesting cautious strategies.

The code enables to calculate the safe operating spaces of different managers in the case of biased and unbiased knowledge.

Displaying 10 of 927 results for "Am Vaes - Van De Hulsbeek" clear search