About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 251 results for "Yue Dou" clear search

Peer reviewed Agent-based model to simulate equilibria and regime shifts emerged in lake ecosystems

no contributors listed | Published Tuesday, January 25, 2022(An empty output folder named “NETLOGOexperiment” in the same location with the LAKEOBS_MIX.nlogo file is required before the model can be run properly)

The model is motivated by regime shifts (i.e. abrupt and persistent transition) revealed in the previous paleoecological study of Taibai Lake. The aim of this model is to improve a general understanding of the mechanism of emergent nonlinear shifts in complex systems. Prelimnary calibration and validation is done against survey data in MLYB lakes. Dynamic population changes of function groups can be simulated and observed on the Netlogo interface.

Main functional groups in lake ecosystems were modelled as super-individuals in a space where they interact with each other. They are phytoplankton, zooplankton, submerged macrophyte, planktivorous fish, herbivorous fish and piscivorous fish. The relationships between these functional groups include predation (e.g. zooplankton-phytoplankton), competition (phytoplankton-macrophyte) and protection (macrophyte-zooplankton). Each individual has properties in size, mass, energy, and age as physiological variables and reproduce or die according to predefined criteria. A system dynamic model was integrated to simulate external drivers.

Set biological and environmental parameters using the green sliders first. If the data of simulation are to be logged, set “Logdata” as true and input the name of the file you want the spreadsheet(.csv) to be called. You will need create an empty folder called “NETLOGOexperiment” in the same level and location with the LAKEOBS_MIX.nlogo file. Press “setup” to initialise the system and “go” to start life cycles.

Impacts of consensus protocols and trade network topologies on blockchain system performance

Zhou HE | Published Friday, March 20, 2020This model is programmed in Python 3.6. We model how different consensus protocols and trade network topologies affect the performance of a blockchain system. The model consists of multiple trader and miner agents (Trader.py and Tx.py), and one system agent (System.py). We investigated three consensus protocols, namely proof-of-work (PoW), proof-of-stake (PoS), and delegated proof-of-stake (DPoS). We also examined three common trade network topologies: random, small-world, and scale-free. To reproduce our results, you may need to create some databases using, e.g., MySQL; or read and write some CSV files as model configurations.

Simulating Social Interaction in Times of COVID Restrictions

Oscar de Vries | Published Friday, November 17, 2023Social distancing is a strategy to mitigate the spread of contagious disease, but it bears negative impacts on people’s social well-being, resulting in non-compliance. This paper uses an integrated behavioral simulation model, called HUMAT, to identify a sweet spot

that balances strictness of and obedience to social distancing rules.

A novel agent-based model was developed that aims to explore social interaction while it is constrained by visitor limitations (due to Dutch COVID measures). Specifically, the model aims to capture the interaction between the need for social contact and the support for the visitors measure. The model was developed using the HUMAT integrated framework, which offered a psychological and sociological foundation for the behavior of the agents.

Simulating the Transmission of Foot-And-Mouth Disease Among Mobile Herds in the Far North Region, Cameroon

Mark Moritz Hyeyoung Kim Ningchuan Xiao Rebecca Garabed Laura W Pomeroy | Published Wednesday, April 13, 2016This model simulates movements of mobile pastoralists and their impacts on the transmission of foot-and-mouth disease (FMD) in the Far North Region of Cameroon.

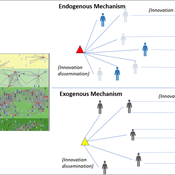

Peer reviewed Modelling Agricultural Innovations as a Social-Ecological Phenomenon

Maja Schlüter Udita Sanga | Published Thursday, November 17, 2022The goal of the AG-Innovation agent-based model is to explore and compare the effects of two alternative mechanisms of innovation development and diffusion (exogenous, linear and endogenous, non-linear) on emergent properties of food and income distribution and adoption rates of different innovations. The model also assesses the range of conditions under which these two alternative mechanisms would be effective in improving food security and income inequality outcomes. Our modelling questions were: i) How do cross-scalar social-ecological interactions within agricultural innovation systems affect system outcomes of food security and income inequality? ii) Do foreign aid-driven exogenous innovation perpetuate income inequality and food insecurity and if so, under which conditions? iii) Do community-driven endogenous innovations improve food security and income inequality and if so, under which conditions? The Ag-Innovation model is intended to serve as a thinking tool for for the development and testing of hypotheses, generating an understanding of the behavior of agricultural innovation systems, and identifying conditions under which alternated innovation mechanisms would improve food security and income inequality outcomes.

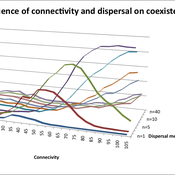

Varying effects of connectivity and dispersal on interacting species dynamics

Kehinde Salau | Published Monday, August 29, 2011 | Last modified Saturday, April 27, 2013An agent-based model of species interaction on fragmented landscape is developed to address the question, how do population levels of predators and prey react with respect to changes in the patch connectivity as well as changes in the sharpness of threshold dispersal?

Holy Mackerel! An Exploratory Agent-Based Model of Illicit Fishing and Forced Labor

Kyle Ballard | Published Saturday, October 21, 2017This agent-based model explores the existence of positive feedback loops related to illegal, unregulated, unreported (IUU) fishing; the use of forced labor; and the depletion of fish populations due to commercial fishing.

Metaphoria 2019 eternal mutation

Timothy Gooding | Published Sunday, February 24, 2019This model is a modification of Metaphoria 2019, where the monetary system can be run with agents that do not die, but their characteristics are mutated as they are in the mortal population.

Shared Norms and the Evolution of Ethnic Markers

Nathan Rollins | Published Friday, January 22, 2010 | Last modified Saturday, April 27, 2013The publication and mathematical model upon which this ABM is based shows one mechanism that can lead to stable behavioral and cultural traits between groups.

Vaccine adoption with outgroup aversion using Cleveland area data

bruce1809 | Published Monday, July 31, 2023 | Last modified Sunday, August 06, 2023This model takes concepts from a JASSS paper this is accepted for the October, 2023 edition and applies the concepts to empirical data from counties surrounding and including Cleveland Ohio. The agent-based model has a proportional number of agents in each of the counties to represent the correct proportions of adults in these counties. The adoption decision probability uses the equations from Bass (1969) as adapted by Rand & Rust (2011). It also includes the Outgroup aversion factor from Smaldino, who initially had used a different imitation model on line grid. This model uses preferential attachment network as a metaphor for social networks influencing adoption. The preferential network can be adjusted in the model to be created based on both nodes preferred due to higher rank as well as a mild preference for nodes of a like group.

Displaying 10 of 251 results for "Yue Dou" clear search