About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 113 results for "Dongwon Lim" clear search

SMILI-T: Small-scale fisheries institutions and local interactions for transformations

Emilie Lindkvist Maja Schlüter Xavier Basurto | Published Tuesday, January 09, 2018 | Last modified Friday, March 26, 2021This model examines how financial and social top-down interventions interplay with the internal self-organizing dynamics of a fishing community. The aim is to transform from hierarchical fishbuyer-fisher relationship into fishing cooperatives.

Hybrid agent-based methodology for testing response protocols

Fernando Sancho Caparrini | Published Wednesday, February 03, 2021In recent years we have seen multiple incidents with a large number of people injured and killed by one or more armed attackers. Since this type of violence is difficult to predict, detecting threats as early as possible allows to generate early warnings and reduce response time. In this context, any tool to check and compare different action protocols can be a further step in the direction of saving lives. Our proposal combines features from continuous and discrete models to obtain the best of both worlds in order to simulate large and crowded spaces where complex behavior individuals interact. With this proposal we aim to provide a tool for testing different security protocols under several emergency scenarios, where spaces, hazards, and population can be customized. Finally, we use a proof of concept implementation of this model to test specific security protocols under emergency situations for real spaces. Specifically, we test how providing some users of a university college with an app that informs about the type and characteristics of the ongoing hazard, affects in the safety performance.

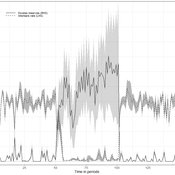

A basic macroeconomic agent-based model for analyzing monetary regime shifts

Oliver Reinhardt Florian Peters Doris Neuberger Adelinde Uhrmacher | Published Tuesday, May 03, 2022In macroeconomics, an emerging discussion of alternative monetary systems addresses the dimensions of systemic risk in advanced financial systems. Monetary regime changes with the aim of achieving a more sustainable financial system have already been discussed in several European parliaments and were the subject of a referendum in Switzerland. However, their effectiveness and efficacy concerning macro-financial stability are not well-known. This paper introduces a macroeconomic agent-based model (MABM) in a novel simulation environment to simulate the current monetary system, which may serve as a basis to implement and analyze monetary regime shifts. In this context, the monetary system affects the lending potential of banks and might impact the dynamics of financial crises. MABMs are predestined to replicate emergent financial crisis dynamics, analyze institutional changes within a financial system, and thus measure macro-financial stability. The used simulation environment makes the model more accessible and facilitates exploring the impact of different hypotheses and mechanisms in a less complex way. The model replicates a wide range of stylized economic facts, including simplifying assumptions to reduce model complexity.

BEEHAVE Extension: Varroa mite control within Good Beekeeping Practice in Germany

Volker Grimm Jürgen Groeneveld Isabel Schödl | Published Wednesday, May 25, 2022 | Last modified Monday, November 07, 2022The western honey bee Apis mellifera is the most important pollinator in the world. The biggest threat to managed honey bees is the ectoparasitic mite Varroa destructor and the viruses DWV (Deformed Wing Virus) and APV (Acute Paralysis Virus) it transmits. Untreated honey bee colonies are expected to die within one to three years. This led to the development of strategies for beekeepers to control the Varroa mite in honey bee colonies and ensure the health and survival of their bee colonies, so called Good Beekeeping Practice. The aim of the extension of BEEHAVE was to represent the Good Beekeeping Practice of Varroa control in Germany. The relevant measures within the Varroa control strategies are drone brood removal as a Varroa trap and the treatment of bee colonies with organic acaricides (formic and oxalic acid) to kill the mites. This extension improves BEEHAVE and builds a bridge between beekeepers in practice and in the modelling world. It vastly contributes to the future use of BEEHAVE in beekeeping education in Germany.

An Agent-Based Model of an Insurance Market driven by Supply and Demand with Imperfectly Estimated Strategies in C#

Rei England | Published Sunday, September 24, 2023This is a simulation of an insurance market where the premium moves according to the balance between supply and demand. In this model, insurers set their supply with the aim of maximising their expected utility gain while operating under imperfect information about both customer demand and underlying risk distributions.

There are seven types of insurer strategies. One type follows a rational strategy within the bounds of imperfect information. The other six types also seek to maximise their utility gain, but base their market expectations on a chartist strategy. Under this strategy, market premium is extrapolated from trends based on past insurance prices. This is subdivided according to whether the insurer is trend following or a contrarian (counter-trend), and further depending on whether the trend is estimated from short-term, medium-term, or long-term data.

Customers are modelled as a whole and allocated between insurers according to available supply. Customer demand is calculated according to a logit choice model based on the expected utility gain of purchasing insurance for an average customer versus the expected utility gain of non-purchase.

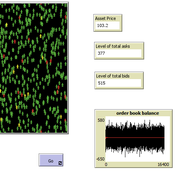

Peer reviewed A financial market with zero intelligence agents

edgarkp | Published Wednesday, March 27, 2024The model’s aim is to represent the price dynamics under very simple market conditions, given the values adopted by the user for the model parameters. We suppose the market of a financial asset contains agents on the hypothesis they have zero-intelligence. In each period, a certain amount of agents are randomly selected to participate to the market. Each of these agents decides, in a equiprobable way, between proposing to make a transaction (talk = 1) or not (talk = 0). Again in an equiprobable way, each participating agent decides to speak on the supply (ask) or the demand side (bid) of the market, and proposes a volume of assets, where this number is drawn randomly from a uniform distribution. The granularity depends on various factors, including market conventions, the type of assets or goods being traded, and regulatory requirements. In some markets, high granularity is essential to capture small price movements accurately, while in others, coarser granularity is sufficient due to the nature of the assets or goods being traded

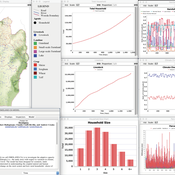

OMOLAND-CA: An Agent-Based Modeling of Rural Households’ Adaptation to Climate Change

Atesmachew Hailegiorgis Andrew Crooks Claudio Cioffi-Revilla | Published Tuesday, July 25, 2017 | Last modified Tuesday, July 10, 2018The purpose of the OMOLAND-CA is to investigate the adaptive capacity of rural households in the South Omo zone of Ethiopia with respect to variation in climate, socioeconomic factors, and land-use at the local level.

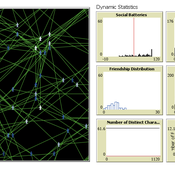

The Friendship Field

Eva Timmer Chrisja van de Kieft | Published Thursday, May 26, 2022 | Last modified Tuesday, August 30, 2022The Friendship Field model aims at modelling friendship formation based on three factors: Extraversion, Resemblance and Status, where social interaction is motivated by the Social Battery. Social Battery is one’s energy and motivation to engage in social contact. Since social contact is crucial for friendship formation, the model included Social Battery to affect social interactions. To our best knowledge, Social Battery is a yet unintroduced concept in research while it is a dynamic factor influencing the social interaction besides one’s characteristics. Extraverts’ Social Batteries charge while interacting and exhaust while being alone. Introverts’ Social Batteries charge while being alone and exhaust while interacting. The aim of the model is to illustrate the concept of Social Battery. Moreover, the Friendship Field shows patterns regarding Extraversion, Resemblance and Status including the mere-exposure effect and friendship by similarity. For the implementation of Status, Kemper’s status-power theory is used. The concept of Social Battery is also linked to Kemper’s theory on the organism as reference group. By running the model for a year (3 interactions moments per day), the friendship dynamics over time can be studied.

We presented the model at the Social Simulation Conference 2022.

Sorghum supply development in Meru County, Kenya

Tim Verwaart Coen Van Wagenberg | Published Wednesday, September 06, 2017 | Last modified Thursday, May 30, 2019Trust between farmers and processors is a key factor in developing stable supply chains including “bottom of the pyramid”, small-scale farmers. This simulation studies a case with 10000 farmers.

The tragedy of the park: an agent-based model on endogenous and exogenous institutions for the management of a forest.

Elena Vallino | Published Wednesday, March 27, 2013 | Last modified Thursday, April 26, 2018I model a forest and a community of loggers. Agents follow different kinds of rules in order to log. I compare the impact of endogenous and of exogenous institutions on the state of the forest and on the profit of the users, representing different scenarios of participatory conservation projects.

Displaying 10 of 113 results for "Dongwon Lim" clear search