About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 237 results for "Marcel Volosin" clear search

Cellular automata model of social networks

Rubens de Almeida Zimbres | Published Tuesday, August 02, 2022This project was developed during the Santa Fe course Introduction to Agent-Based Modeling 2022. The origin is a Cellular Automata (CA) model to simulate human interactions that happen in the real world, from Rubens and Oliveira (2009). These authors used a market research with real people in two different times: one at time zero and the second at time zero plus 4 months (longitudinal market research). They developed an agent-based model whose initial condition was inherited from the results of the first market research response values and evolve it to simulate human interactions with Agent-Based Modeling that led to the values of the second market research, without explicitly imposing rules. Then, compared results of the model with the second market research. The model reached 73.80% accuracy.

In the same way, this project is an Exploratory ABM project that models individuals in a closed society whose behavior depends upon the result of interaction with two neighbors within a radius of interaction, one on the relative “right” and other one on the relative “left”. According to the states (colors) of neighbors, a given cellular automata rule is applied, according to the value set in Chooser. Five states were used here and are defined as levels of quality perception, where red (states 0 and 1) means unhappy, state 3 is neutral and green (states 3 and 4) means happy.

There is also a message passing algorithm in the social network, to analyze the flow and spread of information among nodes. Both the cellular automaton and the message passing algorithms were developed using the Python extension. The model also uses extensions csv and arduino.

A Double-Auction Equity Market For a Single Firm with AR1 Earnings

Eric Weisbrod | Published Monday, December 13, 2010 | Last modified Saturday, April 27, 2013This is a final project for the class AML 591 at Arizona State University. I have done a small amount of bug-checking, but overall the project represents only a half of a semester’s work, so proceed w

This agent-based model (ABM), developed in NetLogo and available on the COMSES repository, simulates a stylized, competitive electricity market to explore the effects of carbon pricing policies under conditions of technological innovation. Unlike traditional models that treat innovation as exogenous, this ABM incorporates endogenous innovation dynamics, allowing clean technology costs to evolve based on cumulative deployment (Wright’s Law) or time (Moore’s Law). Electricity generation companies act as agents, making investment decisions across coal, gas, wind, and solar PV technologies based on expected returns and market conditions. The model evaluates three policy scenarios—No Policy, Emissions Trading System (ETS), and Carbon Tax—within a merit-order market framework. It is partially empirically grounded, using real-world data for technology costs and emissions caps. By capturing emergent system behavior, this model offers a flexible and transparent tool for analyzing the transition to low-carbon electricity systems.

LaMEStModel

Ruth Meyer | Published Friday, October 12, 2018The Labour Markets and Ethnic Segmentation (LaMESt) Model is a model of a simplified labour market, where only jobs of the lowest skill level are considered. Immigrants of two different ethnicities (“Latino”, “Asian”) compete with a majority (“White”) and minority (“Black”) native population for these jobs. The model’s purpose is to investigate the effect of ethnically homogeneous social networks on the emergence of ethnic segmentation in such a labour market. It is inspired by Waldinger & Lichter’s study of immigration and the social organisation of labour in 1990’s Los Angeles.

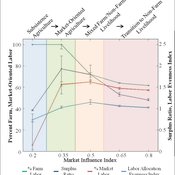

Land-Livelihood Transitions

Nicholas Magliocca Daniel G Brown Erle C Ellis | Published Monday, September 09, 2013 | Last modified Friday, September 13, 2013Implemented as a virtual laboratory, this model explores transitions in land-use and livelihood decisions that emerge from changing local and global conditions.

An Agent-Based Model of an Insurance Market driven by Supply and Demand with Imperfectly Estimated Strategies in C#

Rei England | Published Sunday, September 24, 2023This is a simulation of an insurance market where the premium moves according to the balance between supply and demand. In this model, insurers set their supply with the aim of maximising their expected utility gain while operating under imperfect information about both customer demand and underlying risk distributions.

There are seven types of insurer strategies. One type follows a rational strategy within the bounds of imperfect information. The other six types also seek to maximise their utility gain, but base their market expectations on a chartist strategy. Under this strategy, market premium is extrapolated from trends based on past insurance prices. This is subdivided according to whether the insurer is trend following or a contrarian (counter-trend), and further depending on whether the trend is estimated from short-term, medium-term, or long-term data.

Customers are modelled as a whole and allocated between insurers according to available supply. Customer demand is calculated according to a logit choice model based on the expected utility gain of purchasing insurance for an average customer versus the expected utility gain of non-purchase.

AMIRIS

Ulrich Frey Felix Nitsch Christoph Schimeczek Johannes Kochems Kristina Nienhaus Evelyn Sperber Aboubakr Achraf El Ghazi Seyedfarzad Sarfarazi | Published Thursday, February 03, 2022AMIRIS is the Agent-based Market model for the Investigation of Renewable and Integrated energy Systems.

It is an agent-based simulation of electricity markets and their actors.

AMIRIS enables researches to analyse and evaluate energy policy instruments and their impact on the actors involved in the simulation context.

Different prototypical agents on the electricity market interact with each other, each employing complex decision strategies.

AMIRIS allows to calculate the impact of policy instruments on economic performance of power plant operators and marketers.

…

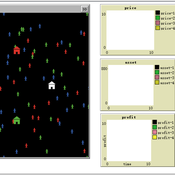

Dynamic pricing strategies for perishable products in a competitive multi-agent retailer market

Wenchong Chen Hongwei Liu | Published Monday, November 27, 2017 | Last modified Thursday, March 01, 2018This model explores a price Q-learning mechanism for perishable products that considers uncertain demand and customer preferences in a competitive multi-agent retailer market (a model-free environment).

An Agent-Based Model of Flood Risk and Insurance

J Dubbelboer I Nikolic K Jenkins J Hall | Published Monday, July 27, 2015 | Last modified Monday, October 03, 2016A model to show the effects of flood risk on a housing market; the role of flood protection for risk reduction; the working of the existing public-private flood insurance partnership in the UK, and the proposed scheme ‘Flood Re’.

Auctionsimulation

Deniz Kayar | Published Wednesday, August 12, 2020This repository the multi-agent simulation software for the paper “Comparison of Competing Market Mechanisms with Reinforcement Learning in a CarPooling Scenario”. It’s a mutlithreaded Javaapplication.

Displaying 10 of 237 results for "Marcel Volosin" clear search