About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 490 results for "Tim M Daw" clear search

Impact of Seasonal Forecast Use on Agricultural Income in a System with Varying Crop Costs and Returns

Thushara Gunda Josh T Bazuin John Nay Kam L Yeung | Published Tuesday, February 07, 2017The objective of the model is to evaluate the impact of seasonal forecasts on a farmer’s net agricultural income when their crop choices have different and variable costs and returns.

GRASP world

Gert Jan Hofstede | Published Tuesday, April 16, 2019This agent-based model investigates group longevity in a population in a foundational way, using theory on social relations and culture. It is the first application of the GRASP meta-model for social agents, containing elements of Groups, Rituals, Affiliation, Status, and Power. It can be considered an exercise in artificial sociality: a culture-general, content-free base-line trust model from which to engage in more specific studies. Depending on cultural settings for individualism and power distance, as well as settings for xenophobia and for the increase of trust over group life, the GRASP world model generates a variety of patters. Number of groups ranges from one to many, composition from random to segregated, and pattern genesis from rapid to many hundreds of time steps. This makes GRASP world an instrument that plausibly models some basic elements of social structure in different societies.

Peer reviewed OfficeMoves: Personalities and Performance in an Interdependent Environment

Alan Dugger | Published Thursday, June 11, 2020After a little work experience, we realize that different kinds of people prefer different work environments: some enjoy a fast-paced challenge; some want to get by; and, others want to show off.

From that experience, we also realize that different kinds of people affect their work environments differently: some increase the pace; some slow it down; and, others make it about themselves.

This model concerns how three different kinds of people affect their work environment and how that work environment affects them in return. The model explores how this circular relation between people’s preferences and their environment creates patterns of association and performance over time.

…

Peer reviewed Circular Business Model experimentation: local biodigestion network

Igor Nikolic Kasper Pieter Hendrik Lange Gijsbert Korevaar Paulien Herder | Published Thursday, December 17, 2020 | Last modified Tuesday, June 29, 2021The purpose of the model is to explore the influence of the design of circular business models (CBMs) on CBM viability. The model represents an Industrial Symbiosis Network (ISN) in which a processor uses the organic waste from suppliers to produce biogas and nutrient rich digestate for local reuse. CBM viability is expressed as value captured (e.g., cash flow/tonne waste/agent) and the survival of the network over time (shown in the interface).

In the model, the value captured is calculated relative to the initial state, using incineration costs as a benchmark. Moderating variables are interactions with the waste incinerator and actor behaviour factors. Actors may leave the network when the waste supply for local production is too low, or when personal economic benefits are too low. When the processor decides to leave, the network fails. Theory of planned behaviour can be used to include agent behaviour in the simulations.

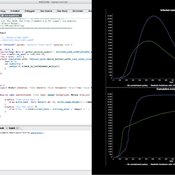

A replication and extension of the Taylor's Simulation Model of Insurance Market Dynamics in C#

Rei England | Published Sunday, September 24, 2023A simple model is constructed using C# in order to to capture key features of market dynamics, while also producing reasonable results for the individual insurers. A replication of Taylor’s model is also constructed in order to compare results with the new premium setting mechanism. To enable the comparison of the two premium mechanisms, the rest of the model set-up is maintained as in the Taylor model. As in the Taylor example, homogeneous customers represented as a total market exposure which is allocated amongst the insurers.

In each time period, the model undergoes the following steps:

1. Insurers set competitive premiums per exposure unit

2. Losses are generated based on each insurer’s share of the market exposure

3. Accounting results are calculated for each insurer

…

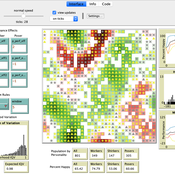

An agent-based model exploring the biodiversity-agriculture-nutrition dynamics in Eastern Madagascar resulting from alternative land uses

Romain Clercq-Roques Jessica Williams Katja Perez Guzman Marta Kozicka Kristine Belesova Zaid Chalabi | Published Wednesday, July 23, 2025This agent-based model simulates the interactions between smallholder farming households, land-use dynamics, and ecosystem services in a rural landscape of Eastern Madagascar. It explores how alternative agricultural practices —shifting agriculture, rice cultivation, and agroforestry—combined with varying levels of forest protection, influence food production, food security, dietary diversity, and forest biodiversity over time. The landscape is represented as a grid of spatially explicit patches characterized by land use, ecological attributes, and regeneration dynamics. Agents make yearly decisions on land management based on demographic pressures, agricultural returns, and institutional constraints. Crop yields are affected by stochastic biotic and abiotic disruptions, modulated by local ecosystem regulation functions. The model additionally represents foraging as a secondary food source and pressure on biodiversity. The model supports the analysis of long-term trade-offs between agricultural productivity, human nutrition, and conservation under different policy and land-use scenarios.

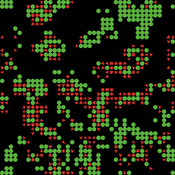

Peer reviewed COMOKIT

Patrick Taillandier Alexis Drogoul Benoit Gaudou Kevin Chapuis Nghi Huyng Quang Doanh Nguyen Ngoc Arthur Brugière Pierre Larmande Marc Choisy Damien Philippon | Published Tuesday, May 26, 2020 | Last modified Wednesday, July 01, 2020In the face of the COVID-19 pandemic, public health authorities around the world have experimented, in a short period of time, with various combinations of interventions at different scales. However, as the pandemic continues to progress, there is a growing need for tools and methodologies to quickly analyze the impact of these interventions and answer concrete questions regarding their effectiveness, range and temporality.

COMOKIT, the COVID-19 modeling kit, is such a tool. It is a computer model that allows intervention strategies to be explored in silico before their possible implementation phase. It can take into account important dimensions of policy actions, such as the heterogeneity of individual responses or the spatial aspect of containment strategies.

In COMOKIT, built using the agent-based modeling and simulation platform GAMA, the profiles, activities and interactions of people, person-to-person and environmental transmissions, individual clinical statuses, public health policies and interventions are explicitly represented and they all serve as a basis for describing the dynamics of the epidemic in a detailed and realistic representation of space.

…

Agent-based Simulation of Innovation Diffusion

Theresa Elbracht | Published Monday, May 19, 2025The agent-based simulation of innovation diffusion is based on the idea of the Bass model (1969).

The adoption of an agent is driven two parameters: its innovativess p and its prospensity to conform with others. The model is designed for a computational experiment building up on the following four model variations:

(i) the agent population it fully connected and all agents share the same parameter values for p and q

(ii) the agent population it fully connected and agents are heterogeneous, i.e. individual parameter values are drawn from a normal distribution

(iii) the agents population is embeded in a social network and all agents share the same parameter values for p and q

…

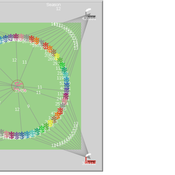

Spatiotemporal Visualization of Emotional and Emotional-related Mental States

Luis Macedo | Published Monday, November 07, 2011 | Last modified Saturday, April 27, 2013A system that receives from an agent-based social simulation the agent’s emotional data, their emotional-related data such as motivations and beliefs, as well as their location, and visualizes of all this information in a two dimensional map of the geographic region the agents inhabit as well as on graphs along the time dimension.

Mast seeding model

Giangiacomo Bravo Lucia Tamburino | Published Saturday, September 08, 2012 | Last modified Saturday, April 27, 2013Purpose of the model is to perform a “virtual experiment” to test the predator satiation hypothesis, advanced in literature to explain the mast seeding phenomenon.

Displaying 10 of 490 results for "Tim M Daw" clear search