About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 251 results for "Yue Dou" clear search

Evolution of cooperation via indirect reciprocity by image scoring

Marco Janssen | Published Friday, October 22, 2010 | Last modified Saturday, April 27, 2013The model explores the possibility of the evolution of cooperation due to indirect reciprocity when agents derive information about the past behavior of the opponent in one-shot dilemma games.

A double-layer network and the contagion mechanism of China’s financial systemic risk

zou | Published Tuesday, August 13, 2019We establish a double-layer network for China’s financial system, consisting of an interbank lending network and a cross-shareholding network. The loss of diffusion in an interbank lending channel independently, a cross-shareholding channel independently and a double-layer contagion channel after one of the financial institutions goes bankrupt with an initial shock are simulated to explore the nonlinear evolution mechanism of financial risk and impact factors of financial systemic risk in China.

Non-attentional visual information transmission in groups under predation

J. Fransje Weerden, van | Published Wednesday, March 25, 2020Our aim is to show effects of group living when only low-level cognition is assumed, such as pattern recognition needed for normal functioning, without assuming individuals have knowledge about others around them or warn them actively.

The model is of a group of vigilant foragers staying within a patch, under attack by a predator. The foragers use attentional scanning for predator detection, and flee after detection. This fleeing action constitutes a visual cue to danger, and can be received non-attentionally by others if it occurs within their limited visual field. The focus of this model is on the effectiveness of this non-attentional visual information reception.

A blind angle obstructing cue reception caused by behaviour can exist in front, morphology causes a blind angle in the back. These limitations are represented by two visual field shapes. The scan for predators is all-around, with distance-dependent detection; reception of flight cues is limited by visual field shape.

Initial parameters for instance: group sizes, movement, vision characteristics for predator detection and for cue reception. Captures (failure), number of times the information reached all individuals at the same time (All-fled, success), and several other effects of the visual settings are recorded.

University Connectivity

Rachel Wozniak Nick Glover Chris English Juan Cisneros | Published Tuesday, November 30, 2021This model is designed to show the effects of personality types and student organizations have on ones chance to making friendships in a university setting. As known from psychology studies, those that are extroverted have an easier chance making friendships in comparison to those that are introverted.

Once every tick a pair of students (nodes) will be randomly selected they will then have the chance to either be come friends or not (create an edge or not) based on their personality type (you are able to change what the effect of each personality is) and whether or not they are in the same club (you can change this value) then the model triggers the next tick cycle to begin.

RiskNetABM

Birgit Müller Jürgen Groeneveld Karin Frank Meike Will Friederike Lenel | Published Monday, July 20, 2020 | Last modified Monday, May 03, 2021The fight against poverty is an urgent global challenge. Microinsurance is promoted as a valuable instrument for buffering income losses due to health or climate-related risks of low-income households in developing countries. However, apart from direct positive effects they can have unintended side effects when insured households lower their contribution to traditional arrangements where risk is shared through private monetary support.

RiskNetABM is an agent-based model that captures dynamics between income losses, insurance payments and informal risk-sharing. The model explicitly includes decisions about informal transfers. It can be used to assess the impact of insurance products and informal risk-sharing arrangements on the resilience of smallholders. Specifically, it allows to analyze whether and how economic needs (i.e. level of living costs) and characteristics of extreme events (i.e. frequency, intensity and type of shock) influence the ability of insurance and informal risk-sharing to buffer income shocks. Two types of behavior with regard to private monetary transfers are explicitly distinguished: (1) all households provide transfers whenever they can afford it and (2) insured households do not show solidarity with their uninsured peers.

The model is stylized and is not used to analyze a particular case study, but represents conditions from several regions with different risk contexts where informal risk-sharing networks between smallholder farmers are prevalent.

…

How to not get stuck – an ant model showing how negative feedback due to crowding maintains flexibility in ant foraging

Tomer Czaczkes | Published Thursday, December 17, 2015Positive feedback can lead to “trapping” in local optima. Adding a simple negative feedback effect, based on ant behaviour, prevents this trapping

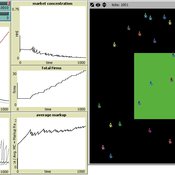

Toward Market Structure as a Complex System: A Web Based Simulation Assignment Implemented in Netlogo

Timothy Kochanski | Published Monday, February 14, 2011 | Last modified Saturday, April 27, 2013This is the model for a paper that is based on a simulation model, programmed in Netlogo, that demonstrates changes in market structure that occur as marginal costs, demand, and barriers to entry change. Students predict and observe market structure changes in terms of number of firms, market concentration, market price and quantity, and average marginal costs, profits, and markups across the market as firms innovate. By adjusting the demand growth and barriers to entry, students can […]

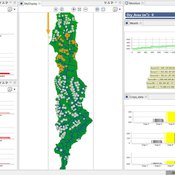

Vacunación-Covid Ecuador

Adrian Lara | Published Tuesday, March 22, 2022El modelo a continuación, fue desarrollado para el DATA CHALLENGE 2022. Es un análisis de la información descargada del Portal de datos abiertos de Ecuador. Dentro del modelo podemos realizar una breve exploración de la información así como una simulación respecto al proceso de vacunación en Ecuador.

Samambaia Basin - Hydro-ABM

Pedro Phelipe Gonçalves Porto | Published Sunday, April 07, 2019 | Last modified Monday, May 06, 2019This model is a tool to support water management on Samambaia Basin. On it you can explore different scenarios of policy, management and externalities that could influence the water uses. (Scenarios already tested include less rain and payment on water use)

Multi-agent model of the spread of climate change denial

Kalina Maria Piskorska Martin Takáč | Published Monday, March 03, 2025This NetLogo model simulates the spread of climate change beliefs within a population of individuals. Each believer has an initial belief level, which changes over time due to interactions with other individuals and exposure to media. The aim of the model is to identify possible methods for reducing climate change denial.

Displaying 10 of 251 results for "Yue Dou" clear search