About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 63 results for "Merlin Radbruch" clear search

Implementation of 'satisficing’ as a model for farmers’ decision-making in an agent-based model of groundwater over-exploitation

Marvin Nebel | Published Monday, May 20, 2013This model uses ’satisficing’ as a model for farmers’ decision making to learn about influences of alternative decision-making models on simulation results and to exemplify a way to transform a rather theoretical concept into a feasible decision-making model for agent-based farming models.

Peer reviewed Umwelten Ants

Kit Martin | Published Thursday, January 15, 2015 | Last modified Thursday, August 27, 2015Simulates impacts of ants killing colony mates when in conflict with another nest. The murder rate is adjustable, and the environmental change is variable. The colonies employ social learning so knowledge diffusion proceeds if interactions occur.

ABSAM model

Marcin Wozniak | Published Monday, August 29, 2016 | Last modified Tuesday, November 08, 2016ABSAM model is an agent-based search and matching model of the local labor market. There are four types of agents in the economy, which cooperate in the artificial world, where behavioral rules were extracted from the labor market search theory.

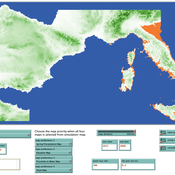

The Cardial Spread Model

Sean Bergin | Published Friday, September 29, 2017 | Last modified Monday, February 04, 2019The purpose of this model is to provide a platform to test and compare four conceptual models have been proposed to explain the spread of the Impresso-Cardial Neolithic in the west Mediterranean.

LimnoSES - social-ecological lake management undergoing regime shifts

Romina Martin | Published Thursday, November 24, 2016 | Last modified Friday, January 18, 2019LimnoSES is a coupled system dynamics, agent-based model to simulate social-ecological feedbacks in shallow lake use and management.

Agent Based Integrated Assessment Model

Marcin Czupryna | Published Saturday, June 27, 2020Agent based approach to the class of the Integrated Assessment Models. An agent-based model (ABM) that focuses on the energy sector and climate relevant facts in a detailed way while being complemented with consumer goods, labour and capital markets to a minimal necessary extent.

Parallel trading systems

Marcin Czupryna | Published Friday, June 26, 2020The model simulates agents behaviour in wine market parallel trading systems: auctions, OTC and Liv-ex. Models are written in JAVA and use MASON framework. To run a simulation download source files with additional src folder with sobol.csv file. In WineSimulation.java set RESULTS_FOLDER parameter. Uses following external libraries mason19..jar, opencsv.jar, commons-lang3-3.5.jar and commons-math3-3.6.1.jar.

Behavioural parallel trading systems

Marcin Czupryna | Published Friday, June 26, 2020This model simulates the behaviour of the agents in 3 wine markets parallel trading systems: Liv-ex, Auctions and additionally OTC market (finally not used). Behavioural aspects (impatience) is additionally modeled. This is an extention of parallel trading systems model with technical trading (momentum and contrarian) and noise trading.

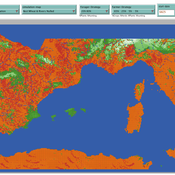

Geographic Expansion Model (GEM)

Sean Bergin | Published Friday, February 28, 2020The purpose of this model is to explore the importance of geographic factors to the settlement choices of early Neolithic agriculturalists. In the model, each agriculturalist spreads to one of the best locations within a modeler specified radius. The best location is determined by choosing either one factor such as elevation or slope; or by ranking geographic factors in order of importance.

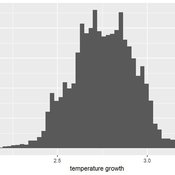

A Matter of Values: On The Link between Economic Performance and Schwartz Human Values

Marcin Czupryna | Published Sunday, June 23, 2024The goal of the paper is to propose an abstract but formalised model of how Schwartz higher order values may influence individual decisions on sharing an individual effort among alternative economic activities. Subsequently, individual decisions are aggregated into the total (collective) economic output, taking into account interactions between the agents. In particular, we explore the relationship between individual higher order values: Self–Enhancement, Self–Transcendence, Openness to Change, and Conservation – measured according to Schwartz’s universal human values theory – and individual and collective economic performance, by means of a theoretical agent based model. Furthermore, based on empirical observations, Openness to Change (measured by the population average in the case of collective output) is positively associated with individual and collective output. These relations are negative for Conservation. Self-Enhancement is positively associated with individual output but negatively with collective output. In case of Self–Transcendence, this effect is opposite. The model provides the potential explanations, in terms of individual and population differences in: propensity for management, willingness to change, and skills (measured by an educational level) for the empirically observed relations between Schwartz higher order values and individual and collective output. We directly calibrate the micro–level of the model using data from the ninth round of the European Social Survey (ESS9) and present the results of numerical simulations.

Displaying 10 of 63 results for "Merlin Radbruch" clear search