About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 128 results for "Charles Macal" clear search

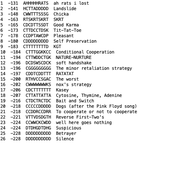

Prisoner's Tournament

Kristin Crouse | Published Wednesday, November 06, 2019 | Last modified Wednesday, December 15, 2021This model replicates the Axelrod prisoner’s dilemma tournaments. The model takes as input a file of strategies and pits them against each other to see who achieves the best payoff in the end. Change the payoff structure to see how it changes the tournament outcome!

An Agent Based Model of International Capital Flows

Harvey Baldovino | Published Thursday, April 06, 2023This is a preliminary attempt in creating an Agent-Based Model of capital flows. This is based on the theory of capital flows based on interest-rate differentials. Foreign capital flows to a country with higher interest rates relative to another. The model shows how capital volatilty and wealth concentration are affected by the speed of capital flow, number of investors, magnitude of changes in interest rate due to capital flows and the interest differential threshold that investors set in deciding whether to move capital or not. Investors in the model are either “regional” investors (only investing in neighboring countries) and “global” investors (those who invest anywhere in the world).

In the future, the author hopes to extend this model to incorporate capital flow based on changes in macroeconomic fundamentals, exchange rate volatility, behavioral finance (for instance, herding behavior) and the presence of capital controls.

cluster analysis

Lars Spång | Published Tuesday, November 07, 2017This model demonstrates how to illustrate a cluster pattern by counting turtles within i moving circle with a specified radius. The procedure is common in archaeological spatial analysis.

This model presents an autonomous, two-lane driving environment with a single lane-closure that can be toggled. The four driving scenarios - two baseline cases (based on the real-world) and two experimental setups - are as follows:

- Baseline-1 is where cars are not informed of the lane closure.

- Baseline-2 is where a Red Zone is marked wherein cars are informed of the lane closure ahead.

- Strategy-1 is where cars use a co-operative driving strategy - FAS. <sup>[1]</sup>

- Strategy-2 is a variant of Strategy-1 and uses comfortable deceleration values instead of the vehicle’s limit.

…

Multi-agent model of the spread of climate change denial

Kalina Maria Piskorska Martin Takáč | Published Monday, March 03, 2025This NetLogo model simulates the spread of climate change beliefs within a population of individuals. Each believer has an initial belief level, which changes over time due to interactions with other individuals and exposure to media. The aim of the model is to identify possible methods for reducing climate change denial.

Tuberculosis and helminthes

Marco Janssen Nathan Rollins Alhaji Cherif Marcel Hurtado | Published Saturday, June 05, 2010 | Last modified Saturday, April 27, 2013The purpose of this model is to investigate the consequences of helminthes in public health policy to eradicate tuberculosis. Helminthes surprise immune system responses and without changes in hygiene

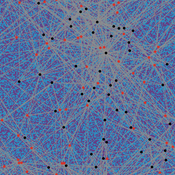

Peer reviewed The Effect of Spatial Clustering on Stone Raw Material Procurement

Marco Janssen Simen Oestmo Curtis W Marean | Published Friday, April 21, 2017This model allows for the investigation of the effect spatial clustering of raw material sources has on the outcome of the neutral model of stone raw material procurement by Brantingham (2003).

Cultural Evolution of Sustainable Behaviours: Landscape of Affordances Model

Nikita Strelkovskii Roope Oskari Kaaronen | Published Wednesday, December 04, 2019 | Last modified Wednesday, December 04, 2019This NetLogo model illustrates the cultural evolution of pro-environmental behaviour patterns. It illustrates how collective behaviour patterns evolve from interactions between agents and agents (in a social network) as well as agents and the affordances (action opportunities provided by the environment) within a niche. More specifically, the cultural evolution of behaviour patterns is understood in this model as a product of:

- The landscape of affordances provided by the material environment,

- Individual learning and habituation,

- Social learning and network structure,

- Personal states (such as habits and attitudes), and

…

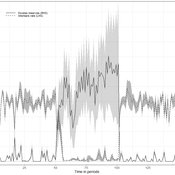

A basic macroeconomic agent-based model for analyzing monetary regime shifts

Oliver Reinhardt Florian Peters Doris Neuberger Adelinde Uhrmacher | Published Tuesday, May 03, 2022In macroeconomics, an emerging discussion of alternative monetary systems addresses the dimensions of systemic risk in advanced financial systems. Monetary regime changes with the aim of achieving a more sustainable financial system have already been discussed in several European parliaments and were the subject of a referendum in Switzerland. However, their effectiveness and efficacy concerning macro-financial stability are not well-known. This paper introduces a macroeconomic agent-based model (MABM) in a novel simulation environment to simulate the current monetary system, which may serve as a basis to implement and analyze monetary regime shifts. In this context, the monetary system affects the lending potential of banks and might impact the dynamics of financial crises. MABMs are predestined to replicate emergent financial crisis dynamics, analyze institutional changes within a financial system, and thus measure macro-financial stability. The used simulation environment makes the model more accessible and facilitates exploring the impact of different hypotheses and mechanisms in a less complex way. The model replicates a wide range of stylized economic facts, including simplifying assumptions to reduce model complexity.

Relational integration in schools through seating assignments

Károly Takács Marta Rado | Published Thursday, July 18, 2019We model interpersonal dynamics and study behavior in the classroom in the hypothetical case of a single teacher who defines students’ seating arrangements. The model incorporates the mechanisms of peer influence on study behavior, on attitude formation, and homophilous selection in order to depict the interrelated dynamics of networks, behavior, and attitudes. We compare various seating arrangement scenarios and observe how GPA distribution and level of prejudice changes over time.

Displaying 10 of 128 results for "Charles Macal" clear search