About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 1104 results for "J A Cuesta" clear search

A model to explore the link between the gender-gap reversal in education and relative divorce risks

Jan Van Bavel Christine Schnor André Grow | Published Thursday, June 30, 2016 | Last modified Wednesday, September 13, 2017This model explores a social mechanism that links the reversal of the gender gap in education with changing patterns in relative divorce risks in 12 European countries.

A model of opinion dynamics based on formal argumentation: application to the diffusion of the vegetarian diet

Patrick Taillandier Nicolas Salliou Rallou Thomopoulos | Published Monday, March 15, 2021This generic agent-based model simulates the evolution of agent’s opinions through their exchange of arguments.

The idea behind this model is to explicitly represent the process of mental deliberation of agents from arguments to an opinion, through the use of Dung’s argumentation framework complemented by a structured description of arguments. An application of the model on the diffusion of vegetarian diets is proposed.

Simulation model replicating the five different games that were run during a workshop of the TISSS Lab

tissslab | Published Friday, April 30, 2021The three-day participatory workshop organized by the TISSS Lab had 20 participants who were academics in different career stages ranging from university student to professor. For each of the five games, the participants had to move between tables according to some pre-specified rules. After the workshop both the participant’s perception of the games’ complexities and the participants’ satisfaction with the games were recorded.

In order to obtain additional objective measures for the games’ complexities, these games were also simulated using this simulation model here. Therefore, the simulation model is an as-accurate-as-possible reproduction of the workshop games: it has 20 participants moving between 5 different tables. The rules that specify who moves when vary from game to game. Just to get an idea, Game 3 has the rule: “move if you’re sitting next to someone who is waring white or no socks”.

An exact description of the workshop games and the associated simulation models can be found in the paper “The relation between perceived complexity and happiness with decision situations: searching for objective measures in social simulation games”.

Using a simple ABM to help undergraduates understand impacts of an invasive species: fish, lionfish, and zooplankton

Samantha Farquhar | Published Friday, February 24, 2023This model is an implementation of a predator-prey simulation using NetLogo programming language. It simulates the interaction between fish, lionfish, and zooplankton. Fish and lionfish are both represented as turtles, and they have their own energy level. In this simulation, lionfish eat fish, and fish eat zooplankton. Zooplankton are represented as green patches on the NetLogo world. Lionfish and fish can reproduce and gain energy by eating other turtles or zooplankton.

This model was created to help undergraduate students understand how simulation models might be helpful in addressing complex environmental problems. In this case, students were asked to use this model to make predictions about how the introduction of lionfish (considered an invasive species in some places) might alter the ecosystem.

Peer reviewed SIM-VOLATILE: Adoption of emerging circular technologies in the waste-treatment sector

Siavash Farahbakhsh | Published Wednesday, December 14, 2022The SIM-VOLATILE model is a technology adoption model at the population level. The technology, in this model, is called Volatile Fatty Acid Platform (VFAP) and it is in the frame of the circular economy. The technology is considered an emerging technology and it is in the optimization phase. Through the adoption of VFAP, waste-treatment plants will be able to convert organic waste into high-end products rather than focusing on the production of biogas. Moreover, there are three adoption/investment scenarios as the technology enables the production of polyhydroxyalkanoates (PHA), single-cell oils (SCO), and polyunsaturated fatty acids (PUFA). However, due to differences in the processing related to the products, waste-treatment plants need to choose one adoption scenario.

In this simulation, there are several parameters and variables. Agents are heterogeneous waste-treatment plants that face the problem of circular economy technology adoption. Since the technology is emerging, the adoption decision is associated with high risks. In this regard, first, agents evaluate the economic feasibility of the emerging technology for each product (investment scenarios). Second, they will check on the trend of adoption in their social environment (i.e. local pressure for each scenario). Third, they combine these two economic and social assessments with an environmental assessment which is their environmental decision-value (i.e. their status on green technology). This combination gives the agent an overall adaptability fitness value (detailed for each scenario). If this value is above a certain threshold, agents may decide to adopt the emerging technology, which is ultimately depending on their predominant adoption probabilities and market gaps.

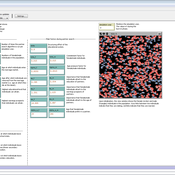

CINCH1 (Covid-19 INfection Control in Hospitals)

Nick Gotts | Published Sunday, August 29, 2021CINCH1 (Covid-19 INfection Control in Hospitals), is a prototype model of physical distancing for infection control among staff in University College London Hospital during the Covid-19 pandemic, developed at the University of Leeds, School of Geography. It models the movement of collections of agents in simple spaces under conflicting motivations of reaching their destination, maintaining physical distance from each other, and walking together with a companion. The model incorporates aspects of the Capability, Opportunity and Motivation of Behaviour (COM-B) Behaviour Change Framework developed at University College London Centre for Behaviour Change, and is aimed at informing decisions about behavioural interventions in hospital and other workplace settings during this and possible future outbreaks of highly contagious diseases. CINCH1 was developed as part of the SAFER (SARS-CoV-2 Acquisition in Frontline Health Care Workers – Evaluation to Inform Response) project

(https://www.ucl.ac.uk/behaviour-change/research/safer-sars-cov-2-acquisition-frontline-health-care-workers-evaluation-inform-response), funded by the UK Medical Research Council. It is written in Python 3.8, and built upon Mesa version 0.8.7 (copyright 2020 Project Mesa Team).

Optimal Trading Strategies of Agents in a Population of Firms: An Agent-Based Approach to Soccer Transfer Markets

Kehinde Salau | Published Tuesday, December 16, 2008 | Last modified Saturday, April 27, 2013Default Initial skill, read ODD for more info. The purpose of the model presented by Salau is to study the ’player profit vs. club benefit’ dilemma present in professional soccer organizations.

Peer reviewed The dynamical relationship between individual needs and group performance: A simulation of the self-organising task allocation process

Shaoni Wang | Published Tuesday, October 05, 2021The purpose of the model is to study the dynamical relationship between individual needs and group performance when focusing on self-organizing task allocation. For this, we develop a model that formalizes Deci & Ryan’s self-determination theory (SDT) theory into an ABM creating a framework to study the social dynamics that pertain to the mutual relations between the individual and group level of team performance. Specifically, it aims to answer how the three individual motivations of autonomy, competence, and belonging affect team performance.

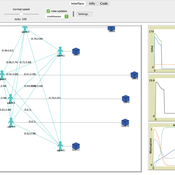

A Data-Driven Approach of Layout Evaluation for Electric Vehicle Charging Infrastructure Using Agent-Based Simulation and GIS

yue zhang | Published Thursday, September 21, 2023The development and popularisation of new energy vehicles have become a global consensus. The shortage and unreasonable layout of electric vehicle charging infrastructure (EVCI) have severely restricted the development of electric vehicles. In the literature, many methods can be used to optimise the layout of charging stations (CSs) for producing good layout designs. However, more realistic evaluation and validation should be used to assess and validate these layout options. This study suggested an agent-based simulation (ABS) model to evaluate the layout designs of EVCI and simulate the driving and charging behaviours of electric taxis (ETs). In the case study of Shenzhen, China, GPS trajectory data were used to extract the temporal and spatial patterns of ETs, which were then used to calibrate and validate the actions of ETs in the simulation. The ABS model was developed in a GIS context of an urban road network with travelling speeds of 24 h to account for the effects of traffic conditions. After the high-resolution simulation, evaluation results of the performance of EVCI and the behaviours of ETs can be provided in detail and in summary. Sensitivity analysis demonstrates the accuracy of simulation implementation and aids in understanding the effect of model parameters on system performance. Maximising the time satisfaction of ET users and reducing the workload variance of EVCI were the two goals of a multiobjective layout optimisation technique based on the Pareto frontier. The location plans for the new CS based on Pareto analysis can significantly enhance both metrics through simulation evaluation.

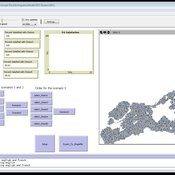

Mobility, Ethnicity, and Language-Based Immigrant Settlement Model - MELBIS

Liliana Perez Jonathan Gaudreau Suzana Dragicevic Taylor Anderson Aaron Leung | Published Monday, June 14, 2021 | Last modified Monday, June 14, 2021MELBIS-V1 is a spatially explicit agent-based model that allows the geospatial simulation of the decision-making process of newcomers arriving in the bilingual cities and boroughs of the island of Montreal, Quebec in CANADA, and the resulting urban segregation spatial patterns. The model was implemented in NetLogo, using geospatial raster datasets of 120m spatial resolution.

MELBIS-V2 enhances MELBIS-V1 to implement and simulate the decision-making processes of incoming immigrants, and to analyze the resulting spatial patterns of segregation as immigrants arrive and settle in various cities in Canada. The arrival and segregation of immigrants is modeled with MELBIS-V2 and compared for three major Canadian immigration gateways, including the City of Toronto, Metro Vancouver, and the City of Calgary.

Displaying 10 of 1104 results for "J A Cuesta" clear search