About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 359 results for "John C Moore" clear search

Heterogeneity of preferences and the dynamics of voluntary contributions to public goods

Engi Amin Amal Soliman Mohamed Abouelela | Published Thursday, August 18, 2016 | Last modified Thursday, January 25, 2018This model simulates the heterogeneity of preferences in a PG game and how the interaction between them affects the dynamics of voluntary contributions. Model is based on the results of a human-based experiment.

DiDIY Factory

Ruth Meyer | Published Tuesday, February 20, 2018The DiDIY-Factory model is a model of an abstract factory. Its purpose is to investigate the impact Digital Do-It-Yourself (DiDIY) could have on the domain of work and organisation.

DiDIY can be defined as the set of all manufacturing activities (and mindsets) that are made possible by digital technologies. The availability and ease of use of digital technologies together with easily accessible shared knowledge may allow anyone to carry out activities that were previously only performed by experts and professionals. In the context of work and organisations, the DiDIY effect shakes organisational roles by such disintermediation of experts. It allows workers to overcome the traditionally strict organisational hierarchies by having direct access to relevant information, e.g. the status of machines via real-time information systems implemented in the factory.

A simulation model of this general scenario needs to represent a more or less abstract manufacturing firm with supervisors, workers, machines and tasks to be performed. Experiments with such a model can then be run to investigate the organisational structure –- changing from a strict hierarchy to a self-organised, seemingly anarchic organisation.

Peer reviewed Minding Norms in an Epidemic Does Matter

Klaus G. Troitzsch | Published Saturday, February 27, 2021 | Last modified Monday, September 13, 2021This paper tries to shed some light on the mutual influence of citizen behaviour and the spread of a virus in an epidemic. While the spread of a virus from infectious to susceptible persons and the outbreak of an infection leading to more or less severe illness and, finally, to recovery and immunity or death has been modelled with different kinds of models in the past, the influence of certain behaviours to keep the epidemic low and to follow recommendations of others to apply these behaviours has rarely been modelled. The model introduced here uses a theory of the effect of norm invocations among persons to find out the effect of spreading norms interacts with the progress of an epidemic. Results show that norm invocations matter. The model replicates the histories of the COVID-19 epidemic in various region, including “second waves” (but only until the end of 2021 as afterwards the official statistics ceased to be reliable as many infected persons did not report their positive test results after countermeasures were relieved), and shows that the calculation of the reproduction numbers from current reported infections usually overestimates the “real” but in practice unobservable reproduction number.

How information propagation in hybrid spaces affects decision-making: using ABM to simulate Covid-19 vaccine uptake

Fuzhen Yin | Published Wednesday, March 13, 2024Abstract: The notion of physical space has long been central in geographical theories. However, the widespread adoption of information and communication technologies (ICTs) has freed human dynamics from purely physical to also relational and cyber spaces. While researchers increasingly recognize such shifts, rarely have studies examined how the information propagates in these hybrid spaces (i.e., physical, relational, and cyber). By exploring the vaccine opinion dynamics through agent-based modeling, this study is the first that combines all hybrid spaces and explores their distinct impacts on human dynamics from an individual’s perspective. Our model captures the temporal dynamics of vaccination progress with small errors (MAE=2.45). Our results suggest that all hybrid spaces are indispensable in vaccination decision making. However, in our model, most of the agents tend to give more emphasis to the information that is spread in the physical instead of other hybrid spaces. Our study not only sheds light on human dynamics research but also offers a new lens to identifying vaccinated individuals which has long been challenging in disease-spread models. Furthermore, our study also provides responses for practitioners to develop vaccination outreach policies and plan for future outbreaks.

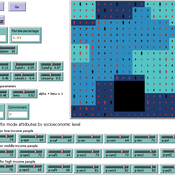

Peer reviewed Urban Transport Mode Choices

Kathleen Salazar -Serna Lorena Cadavid Carlos Franco | Published Thursday, May 22, 2025The model represents urban commuters’ transport mode choices among cars, public transit, and motorcycles—a mode highly prevalent in developing countries. Using an agent-based modeling approach, it simulates transport dynamics and serves as a testbed for evaluating policies aimed at improving mobility.

The model simulates an ecosystem of human agents who decide, at each time step, which mode of transportation to use for commuting to work. Their decision is based on a combination of personal satisfaction with their most recent journey—evaluated across a vector of individual needs—the information they crowdsource from their social network, and their personal uncertainty regarding trying new transport options.

Agents are assigned demographic attributes such as sex, age, and income level, and are distributed across city neighborhoods according to their socioeconomic status. To represent social influence in decision-making, agents are connected via a scale-free social network topology, where connections are more likely among agents within the same socioeconomic group, reflecting the tendency of individuals to form social ties with similar others.

…

Impact of topography and climate change on Magdalenian social networks

Claudine Gravel-Miguel | Published Monday, September 11, 2017The model presented here was created as part of my dissertation. It aims to study the impacts of topography and climate change on prehistoric networks, with a focus on the Magdalenian, which is dated to between 20 and 14,000 years ago.

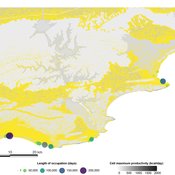

PaleoscapeABM: coastal occupation and shellfish discard

Claudine Gravel-Miguel | Published Tuesday, February 08, 2022This model builds on the Armature distribution within the PaleoscapeABM model, which is itself a variant of the PaleoscapeABM available here written by Wren and Janssen, and.

This model aims to explore where and how much shellfish is discarded at coastal and non-coastal locations by daily coastal foraging. We use this model’s output to test the idea that we can confidently use the archaeological record to evaluate the importance of shellfish in prehistoric people’s diets.

The recognition that aquatic adaptations likely had significant impacts on human evolution triggered an explosion of research on that topic. Recognizing coastal foraging in the past relies on the archaeological signature of that behavior. We use this model to explore why some coastal sites are very intensely occupied and see if it is due to the shellfish productivity of the coast.

RETURN MIGRATION AFTER BRAIN DRAIN: A SIMULATION APPROACH

Alessandro Pluchino Alessio Emanuele Biondo Andrea Rapisarda | Published Friday, June 21, 2013This model, realized on the NetLogo platform, compares utility levels at home and abroad to simulate agents’ migration and their eventual return. Our model is based on two fundamental individual features, i.e. risk aversion and initial expectation, which characterize the dynamics of different agents according to the evolution of their social contacts.

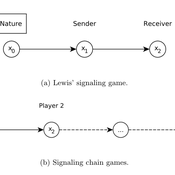

Lewis' Signaling Chains

Giorgio Gosti | Published Wednesday, January 14, 2015 | Last modified Friday, April 03, 2015Signaling chains are a special case of Lewis’ signaling games on networks. In a signaling chain, a sender tries to send a single unit of information to a receiver through a chain of players that do not share a common signaling system.

Simulating Sustainability of Collective Awareness Platform for Sustainability and Social Innovation (CAPS)

Peter Gerbrands | Published Friday, May 08, 2020In an associated paper which focuses on analyzing the structure of several egocentric networks of collective awareness platforms for sustainable innovation (CAPS), this model is developed. It answers the question whether the network structure is determinative for the sustainability of the created awareness. Based on a thorough literature review a model is developed to explain and operationalize the concept of sustainability of a social network in terms of importance, effectiveness and robustness. By developing this agent-based model, the expected outcomes after the dissolution of the CAPS are predicted and compared with the results of a network with the same participants but with different ties. Twitter data from different CAPS is collected and used to feed the simulation. The results show that the structure of the network is of key importance for its sustainability. With this knowledge and the ability to simulate the results after network changes have taken place, CAPS can assess the sustainability of their legacy and actively steer towards a longer lasting potential for social innovation. The retrieved knowledge urges organizations like the European Commission to adopt a more blended approach focusing not only on solving societal issues but on building a community to sustain the initiated development.

Displaying 10 of 359 results for "John C Moore" clear search