About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 349 results for "Miriam C. Kopels" clear search

The uFUNK Model

Davide Secchi | Published Monday, August 31, 2020The agent-based simulation is set to work on information that is either (a) functional, (b) pseudo-functional, (c) dysfunctional, or (d) irrelevant. The idea is that a judgment on whether information falls into one of the four categories is based on the agent and its network. In other words, it is the agents who interprets a particular information as being (a), (b), (c), or (d). It is a decision based on an exchange with co-workers. This makes the judgment a socially-grounded cognitive exercise. The uFUNK 1.0.2 Model is set on an organization where agent-employee work on agent-tasks.

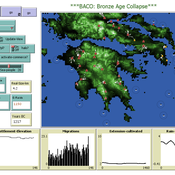

The Bronze Age Collapse model (BACO model)

Marco Vidal-Cordasco | Published Friday, October 09, 2020The Bronze Age Collapse model (BACO model) is written using free NetLogo software v.6.0.3. The purpose of using the BACO model is to develop a tool to identify and analyse the main factors that made the Late Bronze Age and Early Iron Age socio-ecological system resilient or vulnerable in the face of the environmental aridity recorded in the Aegean. The model explores the relationship between dependent and independent variables. Independent variables are: a) inter-annual rainfall variability for the Late Bronze Age and Early Iron Age in the eastern Mediterranean, b) intensity of raiding, c) percentage of marine, agricultural and other calorie sources included in the diet, d) soil erosion processes, e) farming assets, and d) storage capacity. Dependent variables are: a) human pressure for land, b) settlement patterns, c) number of commercial exchanges, d) demographic behaviour, and e) number of migrations.

In-group favoritism due to friend selection strategies based on fixed tag and within-group reputation

Yutaka Nakai | Published Friday, March 28, 2014 | Last modified Friday, March 28, 2014An agent-based model simulates emergence of in-group favoritism. Agents adopt friend selection strategies using an invariable tag and reputations meaning how cooperative others are to a group. The reputation can be seen as a kind of public opinion.

A simple model that aims to demonstrate the influence of agri-environmental payments on land-use patterns in a virtual landscape. The landscape consists of grassland (which can be managed extensively or intensively) and a river. Agri-environmental payments are provided for extensive management of grassland. Additionally, there are boni for (a) extensive grassland in proximity of the river; and (b) clusters (“agglomerations”) of extensive grassland. The farmers, who own randomly distributed grassland patches, make decisions either on the basis of simple income maximization or they maximize only up to an income threshold beyond which they seize making changes in management. The resulting landscape pattern is evaluated by means of three simple models for (a) agricultural yield, (b) habitat/biodiversity and (c) water quality. The latter two correspond to the two boni. The model has been developed within a small project called Aligning Agent-Based Modelling with Multi-Objective Land-Use Allocation (ALABAMA).

AIforGoodSimulator - Modeling Covid-19 Spread and Potential Interventions in Refugee Camps

Shyaam Ramkumar Woi Sok Oh | Published Thursday, March 18, 2021The Netlogo model is a conceptualization of the Moria refugee camp, capturing the household demographics of refugees in the camp, a theoretical friendship network based on values, and an abstraction of their daily activities. The model then simulates how Covid-19 could spread through the camp if one refugee is exposed to the virus, utilizing transmission probabilities and the stages of disease progression of Covid-19 from susceptible to exposed to asymptomatic / symptomatic to mild / severe to recovered from literature. The model also incorporates various interventions - PPE, lockdown, isolation of symptomatic refugees - to analyze how they could mitigate the spread of the virus through the camp.

FEARLUS-SPOMM

Dawn Parker Gary Polhill Nick Gotts Alistair Law Luis Izquierdio Alessandro Gimona Lee-Ann Sutherland | Published Friday, March 25, 2016This is a coupled conceptual model of agricultural land decision-making and incentivisation and species metacommunities.

06b EiLab_Model_I_V5.00 NL

Garvin Boyle | Published Saturday, October 05, 2019EiLab - Model I - is a capital exchange model. That is a type of economic model used to study the dynamics of modern money which, strangely, is very similar to the dynamics of energetic systems. It is a variation on the BDY models first described in the paper by Dragulescu and Yakovenko, published in 2000, entitled “Statistical Mechanics of Money”. This model demonstrates the ability of capital exchange models to produce a distribution of wealth that does not have a preponderance of poor agents and a small number of exceedingly wealthy agents.

This is a re-implementation of a model first built in the C++ application called Entropic Index Laboratory, or EiLab. The first eight models in that application were labeled A through H, and are the BDY models. The BDY models all have a single constraint - a limit on how poor agents can be. That is to say that the wealth distribution is bounded on the left. This ninth model is a variation on the BDY models that has an added constraint that limits how wealthy an agent can be? It is bounded on both the left and right.

EiLab demonstrates the inevitable role of entropy in such capital exchange models, and can be used to examine the connections between changing entropy and changes in wealth distributions at a very minute level.

…

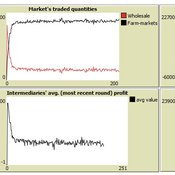

Market-level effects of firm-level adaptation and intermediation in networked markets of fresh foods: a case study in Colombia.

César García-Díaz | Published Sunday, April 12, 2020 | Last modified Sunday, April 12, 2020This a model developed as a part of the paper Mejía, G. & García-Díaz, C. (2018). Market-level effects of firm-level adaptation and intermediation in networked markets of fresh foods: a case study in Colombia. Agricultural Systems 160: 132-142.

It simulates the competition dynamics of the potato market in Bogotá, Colombia. The model explores the economic impact of intermediary actors on the potato supply chain.

An Agent-Based Model of Insurance Customer Behaviour with Word of Mouth Network in C#

Rei England Iqbal Owadally Douglas Wright | Published Friday, March 04, 2022This is an agent-based model with two types of agents: customers and insurers. Insurers are price-takers who choose how much to spend on their service quality, and customers evaluate insurers based on premium, brand preference, and their perceived service quality. Customers are also connected in a small-world network and may share their opinions with their network.

The ABM contains two types of agents: insurers and customers. These act within the environment of a motor insurance market. At each simulation, the model undergoes the following steps:

- Network generation: At the start of the simulation, the model generates a small world network of social links between the customers, and randomly assigns each customer to an initial insurer ...

A replication and extension of the Taylor's Simulation Model of Insurance Market Dynamics in C#

Rei England | Published Sunday, September 24, 2023A simple model is constructed using C# in order to to capture key features of market dynamics, while also producing reasonable results for the individual insurers. A replication of Taylor’s model is also constructed in order to compare results with the new premium setting mechanism. To enable the comparison of the two premium mechanisms, the rest of the model set-up is maintained as in the Taylor model. As in the Taylor example, homogeneous customers represented as a total market exposure which is allocated amongst the insurers.

In each time period, the model undergoes the following steps:

1. Insurers set competitive premiums per exposure unit

2. Losses are generated based on each insurer’s share of the market exposure

3. Accounting results are calculated for each insurer

…

Displaying 10 of 349 results for "Miriam C. Kopels" clear search