About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 515 results for "Mark Orr" clear search

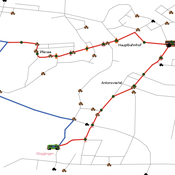

Simulating changing traffic flow caused by new bus route in Augsburg

Eduard | Published Wednesday, August 04, 2021This is a Netlogo model which simulates car and bus/tram traffic in Augsburg, specifically between the districts Stadtbergen, Göggingen and the Königsplatz. People either use their cars or public transport to travel to one of their random destinations (Stadtbergen or Göggingen), performing some activity and then returning to their home. Attributes such as travel and waiting time as well as their happiness upon arriving are stored and have an impact on individuals on whether they would consider changing their mode of transport or not.

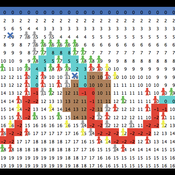

Income and Expenditure

Tony Lawson | Published Thursday, October 06, 2011 | Last modified Saturday, April 27, 2013How do households alter their spending patterns when they experience changes in income? This model answers this question using a random assignment scheme where spending patterns are copied from a household in the new income bracket.

Simulation of Self-enforcing Agreement in Cooperative Teams

Hang Xiong | Published Friday, April 01, 2016This is an agent-based model of the implementation of the self-enforcing agreement in cooperative teams.

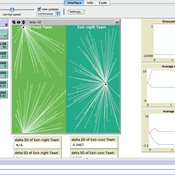

An Agent-Based DSS for Word-of-Mouth Programs in Freemium Apps

Manuel Chica | Published Monday, September 05, 2016An agent-based framework that aggregates social network-level individual interactions to run targeting and rewarding programs for a freemium social app. Git source code in https://bitbucket.org/mchserrano/socialdynamicsfreemiumapps

FlowLogo: An agent-based platform for simulating complex human-aquifer interactions in managed groundwater systems

Juan Castilla-Rho | Published Sunday, August 30, 2015FlowLogo integrates agent-based and groundwater flow simulation. It aims to simplify the process of developing participatory ABMs in the groundwater space and begin the exploration of novel, bottom-up solutions to conflicts in shared aquifers.

Lakeland 2 is a simple version of the original Lakeland of Jager et al. (2000) Ecological Economics 35(3): 357-380. The model can be used to explore the consequences of different behavioral assumptions on resource and social dynamics.

Open Peer Review Model

Federico Bianchi | Published Monday, May 24, 2021This is an agent-based model of a population of scientists alternatively authoring or reviewing manuscripts submitted to a scholarly journal for peer review. Peer-review evaluation can be either ‘confidential’, i.e. the identity of authors and reviewers is not disclosed, or ‘open’, i.e. authors’ identity is disclosed to reviewers. The quality of the submitted manuscripts vary according to their authors’ resources, which vary according to the number of publications. Reviewers can assess the assigned manuscript’s quality either reliably of unreliably according to varying behavioural assumptions, i.e. direct/indirect reciprocation of past outcome as authors, or deference towards higher-status authors.

Gender Disparity in COVID-19’s Impact on Academic Careers: An Agent-Based Model

S.R. Aurora (a.k.a. Mai P. Trinh) Chantal van Esch | Published Tuesday, September 26, 2023Prior to COVID-19, female academics accounted for 45% of assistant professors, 37% of associate professors, and 21% of full professors in business schools (Morgan et al., 2021). The pandemic arguably widened this gender gap, but little systemic data exists to quantify it. Our study set out to answer two questions: (1) How much will the COVID-19 pandemic have impacted the gender gap in U.S. business school tenured and tenure-track faculty? and (2) How much will institutional policies designed to help faculty members during the pandemic have affected this gender gap? We used agent-based modeling coupled with archival data to develop a simulation of the tenure process in business schools in the U.S. and tested how institutional interventions would affect this gender gap. Our simulations demonstrated that the gender gap in U.S. business schools was on track to close but would need further interventions to reach equality (50% females). In the long-term picture, COVID-19 had a small impact on the gender gap, as did dependent care assistance and tenure extensions (unless only women received tenure extensions). Changing performance evaluation methods to better value teaching and service activities and increasing the proportion of female new hires would help close the gender gap faster.

On the liquidity of the illiquid (hard-to-trade) assets

Marcin Czupryna | Published Monday, January 13, 2025This paper investigates the impact of agents' trading decisions on market liquidity and transactional efficiency in markets for illiquid (hard-to-trade) assets. Drawing on a unique order book dataset from the fine wine exchange Liv-ex, we offer novel insights into liquidity dynamics in illiquid markets. Using an agent-based framework, we assess the adequacy of conventional liquidity measures in capturing market liquidity and transactional efficiency. Our main findings reveal that conventional liquidity measures, such as the number of bids, asks, new bids and new asks, may not accurately represent overall transactional efficiency. Instead, volume (measured by the number of trades) and relative spread measures may be more appropriate indicators of liquidity within the context of illiquid markets. Furthermore, our simulations demonstrate that a greater number of traders participating in the market correlates with an increased efficiency in trade execution, while wider trader-set margins may decrease the transactional efficiency. Interestingly, the trading period of the agents appears to have a significant impact on trade execution. This suggests that granting market participants additional time for trading (for example, through the support of automated trading systems) can enhance transactional efficiency within illiquid markets. These insights offer practical implications for market participants and policymakers aiming to optimise market functioning and liquidity.

Peer reviewed Are Countertrade credits as flexible and efficient as cash? A novel approach to reducing income inequality using countertrade methodology.

Peter Malliaros | Published Monday, May 03, 2021 | Last modified Tuesday, May 11, 2021The impacts of income inequality can be seen everywhere, regardless of the country or the level of economic development. According to the literature review, income inequality has negative impacts in economic, social, and political variables. Notwithstanding of how well or not countries have done in reducing income inequality, none have been able to reduce it to a Gini Coefficient level of 0.2 or less.

This is the promise that a novel approach called Counterbalance Economics (CBE) provides without the need of increased taxes.

Based on the simulation, introducing the CBE into the Australian, UK, US, Swiss or German economies would result in an overall GDP increase of under 1% however, the level of inequality would be reduced from an average of 0.33 down to an average of 0.08. A detailed explanation of how to use the model, software, and data dependencies along with all other requirements have been included as part of the info tab in the model.

Displaying 10 of 515 results for "Mark Orr" clear search