About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 1104 results for "J A Cuesta" clear search

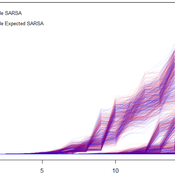

Reflexivity in a diffusion of innovations model

César García-Díaz Carlos Cordoba | Published Thursday, May 07, 2020In this agent-based model, agents decide to adopt a new product according to a utility function that depends on two kinds of social influences. First, there is a local influence exerted on an agent by her closest neighbors that have already adopted, and also by herself if she feels the product suits her personal needs. Second, there is a global influence which leads agents to adopt when they become aware of emerging trends happening in the system. For this, we endow agents with a reflexive capacity that allows them to recognize a trend, even if they can not perceive a significant change in their neighborhood.

Results reveal the appearance of slowdown periods along the adoption rate curve, in contrast with the classic stylized bell-shaped behavior. Results also show that network structure plays an important role in the effect of reflexivity: while some structures (e.g., scale-free networks) may amplify it, others (e.g., small-world structure) weaken such an effect.

Peer reviewed Vigilant sharing in a small-scale society

Marcos Pinheiro | Published Wednesday, July 22, 2020 | Last modified Wednesday, July 29, 2020The model explores food distribution patterns that emerge in a small-scale non-agricultural group when sharing individuals engage in intentional consumption leveling with a given probability.

Venues and Segregation: A Revised Schelling Model

Ultan Byrne | Published Thursday, August 06, 2020This model examines an important but underappreciated mechanism affecting urban segregation and integration: urban venues. The venue- an area where urbanites interact- is an essential aspect of city life that tends to influence how satisfactory any location is. We study the venue/segregation relationship by installing venues into Schelling’s classic agent-based segregation model.

ICARUS - a multi-agent compliance inspection model

Slaven Smojver | Published Monday, May 09, 2022ICARUS is a multi-agent compliance inspection model (ICARUS - Inspecting Compliance to mAny RUleS). The model is applicable to environments where an inspection agency, via centrally coordinated inspections, examines compliance in organizations which must comply with multiple provisions (rules). The model (ICARUS) contains 3 types of agents: entities, inspection agency and inspectors / inspections. ICARUS describes a repeated, simultaneous, non-cooperative game of pure competition. Agents have imperfect, incomplete, asymmetric information. Entities in each move (tick) choose a pure strategy (comply/violate) for each rule, depending on their own subjective assessment of the probability of the inspection. The Inspection Agency carries out the given inspection strategy.

A more detailed description of the model is available in the .nlogo file.

Full description of the model (in line with the ODD+D protocol) and the analysis of the model (including verification, validation and sensitivity analysis) can be found in the attached documentation.

Peer reviewed A financial market with zero intelligence agents

edgarkp | Published Wednesday, March 27, 2024The model’s aim is to represent the price dynamics under very simple market conditions, given the values adopted by the user for the model parameters. We suppose the market of a financial asset contains agents on the hypothesis they have zero-intelligence. In each period, a certain amount of agents are randomly selected to participate to the market. Each of these agents decides, in a equiprobable way, between proposing to make a transaction (talk = 1) or not (talk = 0). Again in an equiprobable way, each participating agent decides to speak on the supply (ask) or the demand side (bid) of the market, and proposes a volume of assets, where this number is drawn randomly from a uniform distribution. The granularity depends on various factors, including market conventions, the type of assets or goods being traded, and regulatory requirements. In some markets, high granularity is essential to capture small price movements accurately, while in others, coarser granularity is sufficient due to the nature of the assets or goods being traded

A model on feeding and social interaction behaviour of pigs

Iris J.M.M. Boumans | Published Thursday, May 04, 2017 | Last modified Tuesday, February 27, 2018The model simulates interaction between internal physiological factors (e.g. energy balance) and external social factors (e.g. competition level) underlying feeding and social interaction behaviour of commercially group-housed pigs.

FlipFlop1-ProMEERB: A coupled social-ecological model with a promotional mechanism for emergence of environmentally responsible behavior

Liliana Perez Saeed Harati Roberto Molowny-Horas | Published Friday, December 17, 2021At the heart of a study of Social-Ecological Systems, this model is built by coupling together two independently developed models of social and ecological phenomena. The social component of the model is an abstract model of interactions of a governing agent and several user agents, where the governing agent aims to promote a particular behavior among the user agents. The ecological model is a spatial model of spread of the Mountain Pine Beetle in the forests of British Columbia, Canada. The coupled model allowed us to simulate various hypothetical management scenarios in a context of forest insect infestations. The social and ecological components of this model are developed in two different environments. In order to establish the connection between those components, this model is equipped with a ‘FlipFlop’ - a structure of storage directories and communication protocols which allows each of the models to process its inputs, send an output message to the other, and/or wait for an input message from the other, when necessary. To see the publications associated with the social and ecological components of this coupled model please see the References section.

Peer reviewed An agent-based simulation model of pedestrian evacuation based on Bayesian Nash Equilibrium

Jiaqi Ge Yiyu Wang Alexis Comber | Published Wednesday, July 06, 2022This ABM aims to introduce a new individual decision-making model, BNE into the ABM of pedestrian evacuation to properly model individual behaviours and motions in emergency situations. Three types of behavioural models has been developed, which are Shortest Route (SR) model, Random Follow (RF) model, and BNE model, to better reproduce evacuation dynamics in a tunnel space. A series of simulation experiments were conducted to evaluate the simulating performance of the proposed ABM.

Peer reviewed SequiaBasalto model

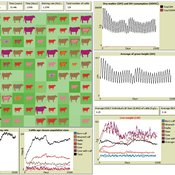

Marco Janssen Irene Perez Ibarra Pierre Bommel Diego J. Soler-Navarro Alicia Tenza Peral Francisco Dieguez Cameroni | Published Friday, May 26, 2023This is a replication of the SequiaBasalto model, originally built in Cormas by Dieguez Cameroni et al. (2012, 2014, Bommel et al. 2014 and Morales et al. 2015). The model aimed to test various adaptations of livestock producers to the drought phenomenon provoked by climate change. For that purpose, it simulates the behavior of one livestock farm in the Basaltic Region of Uruguay. The model incorporates the price of livestock, fodder and paddocks, as well as the growth of grass as a function of climate and seasons (environmental submodel), the life cycle of animals feeding on the pasture (livestock submodel), and the different strategies used by farmers to manage their livestock (management submodel). The purpose of the model is to analyze to what degree the common management practices used by farmers (i.e., proactive and reactive) to cope with seasonal and interannual climate variations allow to maintain a sustainable livestock production without depleting the natural resources (i.e., pasture). Here, we replicate the environmental and livestock submodel using NetLogo.

One year is 368 days. Seasons change every 92 days. Each day begins with the growth of grass as a function of climate and season. This is followed by updating the live weight of cows according to the grass height of their patch, and grass consumption, which is determined based on the updated live weight. After consumption, cows grow and reproduce, and a new grass height is calculated. Cows then move to the patch with less cows and with the highest grass height. This updated grass height value will be the initial grass height for the next day.

The Effects of Fiscal Targets in a Currency Union: a Multi-Country Agent Based-Stock Flow Consistent Model

Ermanno Catullo Alessandro Caiani Mauro Gallegati | Published Saturday, March 11, 2017We present an Agent-Based Stock Flow Consistent Multi-Country model of a Currency Union to analyze the impact of changes in the fiscal regimes that is permanent changes in the deficit-to-GDP targets that governments commit to comply.

Displaying 10 of 1104 results for "J A Cuesta" clear search