About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 10 of 110 results for "François Vallée" clear search

Peer reviewed A Simple Agent-Based Spatial Model of the Economy: Tools for Policy

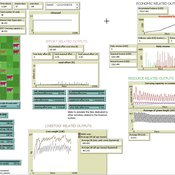

Bernardo Furtado Isaque Daniel Rocha Eberhardt | Published Tuesday, July 05, 2022This study simulates the evolution of artificial economies in order to understand the tax relevance of administrative boundaries in the quality of life of its citizens. The modeling involves the construction of a computational algorithm, which includes citizens, bounded into families; firms and governments; all of them interacting in markets for goods, labor and real estate. The real estate market allows families to move to dwellings with higher quality or lower price when the families capitalize property values. The goods market allows consumers to search on a flexible number of firms choosing by price and proximity. The labor market entails a matching process between firms (given its location) and candidates, according to their qualification. The government may be configured into one, four or seven distinct sub-national governments, which are all economically conurbated. The role of government is to collect taxes on the value added of firms in its territory and invest the taxes into higher levels of quality of life for residents. The results suggest that the configuration of administrative boundaries is relevant to the levels of quality of life arising from the reversal of taxes. The model with seven regions is more dynamic, but more unequal and heterogeneous across regions. The simulation with only one region is more homogeneously poor. The study seeks to contribute to a theoretical and methodological framework as well as to describe, operationalize and test computer models of public finance analysis, with explicitly spatial and dynamic emphasis. Several alternatives of expansion of the model for future research are described. Moreover, this study adds to the existing literature in the realm of simple microeconomic computational models, specifying structural relationships between local governments and firms, consumers and dwellings mediated by distance.

02 OamLab V1.10 - Open Atwood Machine Laboratory

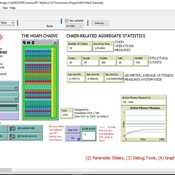

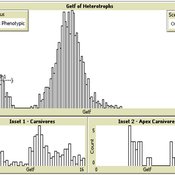

Garvin Boyle | Published Saturday, January 31, 2015 | Last modified Thursday, April 13, 2017Using chains of replicas of Atwood’s Machine, this model explores implications of the Maximum Power Principle. It is one of a series of models exploring the dynamics of sustainable economics – PSoup, ModEco, EiLab, OamLab, MppLab, TpLab, EiLab.

03 MppLab V1.09 – Maximum Power Principle Laboratory

Garvin Boyle | Published Saturday, April 15, 2017Using webs of replicas of Atwood’s Machine, we explore implications of the Maximum Power Principle. This is one of a series of models exploring the dynamics of sustainable economics – PSoup, ModEco, EiLab, OamLab, MppLab, TpLab, CmLab.

05 CmLab V1.17 – Conservation of Money Laboratory

Garvin Boyle | Published Saturday, April 15, 2017In CmLab we explore the implications of the phenomenon of Conservation of Money in a modern economy. This is one of a series of models exploring the dynamics of sustainable economics – PSoup, ModEco, EiLab, OamLab, MppLab, TpLab, CmLab.

Peer reviewed soslivestock model

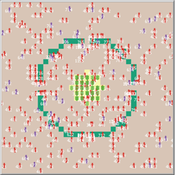

Marco Janssen Irene Perez Ibarra Diego J. Soler-Navarro Alicia Tenza Peral | Published Wednesday, May 28, 2025 | Last modified Tuesday, June 10, 2025The purpose of this model is to analyze how different management strategies affect the wellbeing, sustainability and resilience of an extensive livestock system under scenarios of climate change and landscape configurations. For this purpose, it simulates one cattle farming system, in which agents (cattle) move through the space using resources (grass). Three farmer profiles are considered: 1) a subsistence farmer that emphasizes self-sufficiency and low costs with limited attention to herd management practices, 2) a commercial farmer focused on profit maximization through efficient production methods, and 3) an environmental farmer that prioritizes conservation of natural resources and animal welfare over profit maximization. These three farmer profiles share the same management strategies to adapt to climate and resource conditions, but differ in their goals and decision-making criteria for when, how, and whether to implement those strategies. This model is based on the SequiaBasalto model (Dieguez Cameroni et al. 2012, 2014, Bommel et al. 2014 and Morales et al. 2015), replicated in NetLogo by Soler-Navarro et al. (2023).

One year is 368 days. Seasons change every 92 days. Each step begins with the growth of grass as a function of climate and season. This is followed by updating the live weight of animals according to the grass height of their patch, and grass consumption, which is determined based on the updated live weight. Animals can be supplemented by the farmer in case of severe drought. After consumption, cows grow and reproduce, and a new grass height is calculated. This updated grass height value becomes the starting grass height for the next day. Cows then move to the next area with the highest grass height. After that, cattle prices are updated and cattle sales are held on the first day of fall. In the event of a severe drought, special sales are held. Finally, at the end of the day, the farm balance and the farmer’s effort are calculated.

Peer reviewed BAM: The Bottom-up Adaptive Macroeconomics Model

Alejandro Platas López Alejandro Guerra-Hernández | Published Tuesday, January 14, 2020 | Last modified Sunday, July 26, 2020Overview

Purpose

Modeling an economy with stable macro signals, that works as a benchmark for studying the effects of the agent activities, e.g. extortion, at the service of the elaboration of public policies..

…

Rebel Group Protection Rackets

Gerd Wagner Luis Gustavo Nardin Kamil C. Klosek Frances Duffy | Published Wednesday, December 04, 2019System Narrative

How do rebel groups control territory and engage with the local economy during civil war? Charles Tilly’s seminal War and State Making as Organized Crime (1985) posits that the process of waging war and providing governance resembles that of a protection racket, in which aspiring governing groups will extort local populations in order to gain power, and civilians or businesses will pay in order to ensure their own protection. As civil war research increasingly probes the mechanisms that fuel local disputes and the origination of violence, we develop an agent-based simulation model to explore the economic relationship of rebel groups with local populations, using extortion racket interactions to explain the dynamics of rebel fighting, their impact on the economy, and the importance of their economic base of support. This analysis provides insights for understanding the causes and byproducts of rebel competition in present-day conflicts, such as the cases of South Sudan, Afghanistan, and Somalia.

Model Description

The model defines two object types: RebelGroup and Enterprise. A RebelGroup is a group that competes for power in a system of anarchy, in which there is effectively no government control. An Enterprise is a local civilian-level actor that conducts business in this environment, whose objective is to make a profit. In this system, a RebelGroup may choose to extort money from Enterprises in order to support its fighting efforts. It can extract payments from an Enterprise, which fears for its safety if it does not pay. This adds some amount of money to the RebelGroup’s resources, and they can return to extort the same Enterprise again. The RebelGroup can also choose to loot the Enterprise instead. This results in gaining all of the Enterprise wealth, but prompts the individual Enterprise to flee, or leave the model. This reduces the available pool of Enterprises available to the RebelGroup for extortion. Following these interactions the RebelGroup can choose to AllocateWealth, or pay its rebel fighters. Depending on the value of its available resources, it can add more rebels or expel some of those which it already has, changing its size. It can also choose to expand over new territory, or effectively increase its number of potential extorting Enterprises. As a response to these dynamics, an Enterprise can choose to Report expansion to another RebelGroup, which results in fighting between the two groups. This system shows how, faced with economic choices, RebelGroups and Enterprises make decisions in war that impact conflict and violence outcomes.

Socio-hydrologicalModel_version_SESMO

Marco Janssen Andres Baeza-Castro Paola Gomez Luis Bojorquez Fidel Serrano-Candela Hallie Eakin Yosune Miquelajauregui Rodrigo Garcia-Herrera | Published Tuesday, February 05, 2019We present here MEGADAPT_SESMO model. A hybrid, dynamic, spatially explicit, integrated model to simulate the vulnerability of urban coupled socio-ecological systems – in our case, the vulnerability of Mexico City to socio-hydrological risk.

Design principles for a redistributive collective action institution in times of crisis

Aashis Joshi | Published Friday, September 15, 2023What policy measures are effective in redistributing essential resources during crisis situations such as climate change impacts? We model a collective action institution with different rules for designing and organizing it, and make our analysis specific to various societal contexts.

Our model captures a generic societal context of unequal vulnerability and climate change impact in a stylized form. We represent a community of people who harvest and consume an essential resource to maintain their well-being. However, their ability to harvest the resource is not equal; people are characterized by a ‘resource access’ attribute whose values are uniformly distributed from 0 to 1 in the population. A person’s resource access value determines the amount of resource units they are able to harvest, and therefore the welfare levels they are able to attain. People travel to the centralized resource region and derive well-being or welfare, represented as an energy gain, by harvesting and consuming resource units.

The community is subject to a climate change impact event that occurs with a certain periodicity and over a certain duration. The capacity of resource units to regenerate diminishes during the impact events. Unequal capacities to access the essential resource results in unequal vulnerability among people with regards to their ability to maintain a sufficient welfare level, especially during impact events.

…

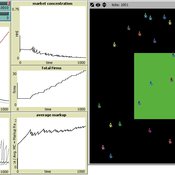

Toward Market Structure as a Complex System: A Web Based Simulation Assignment Implemented in Netlogo

Timothy Kochanski | Published Monday, February 14, 2011 | Last modified Saturday, April 27, 2013This is the model for a paper that is based on a simulation model, programmed in Netlogo, that demonstrates changes in market structure that occur as marginal costs, demand, and barriers to entry change. Students predict and observe market structure changes in terms of number of firms, market concentration, market price and quantity, and average marginal costs, profits, and markups across the market as firms innovate. By adjusting the demand growth and barriers to entry, students can […]

Displaying 10 of 110 results for "François Vallée" clear search