About the CoMSES Model Library more info

Our mission is to help computational modelers develop, document, and share their computational models in accordance with community standards and good open science and software engineering practices. Model authors can publish their model source code in the Computational Model Library with narrative documentation as well as metadata that supports open science and emerging norms that facilitate software citation, computational reproducibility / frictionless reuse, and interoperability. Model authors can also request private peer review of their computational models. Models that pass peer review receive a DOI once published.

All users of models published in the library must cite model authors when they use and benefit from their code.

Please check out our model publishing tutorial and feel free to contact us if you have any questions or concerns about publishing your model(s) in the Computational Model Library.

We also maintain a curated database of over 7500 publications of agent-based and individual based models with detailed metadata on availability of code and bibliometric information on the landscape of ABM/IBM publications that we welcome you to explore.

Displaying 4 of 4 results loan clear search

Peer reviewed Credit and debt market of low-income families

Márton Gosztonyi | Published Tuesday, December 12, 2023 | Last modified Friday, January 19, 2024The purpose of the Credit and debt market of low-income families model is to help the user examine how the financial market of low-income families works.

The model is calibrated based on real-time data which was collected in a small disadvantaged village in Hungary it contains 159 households’ social network and attributes data.

The simulation models the households’ money liquidity, expenses and revenue structures as well as the formal and informal loan institutions based on their network connections. The model forms an intertwined system integrated in the families’ local socioeconomic context through which families handle financial crises and overcome their livelihood challenges from one month to another.

The simulation-based on the abstract model of low-income families’ financial survival system at the bottom of the pyramid, which was described in following the papers:

…

RecovUS: An Agent-Based Model of Post-Disaster Household Recovery

Saeed Moradi | Published Thursday, July 30, 2020The purpose of this model is to explain the post-disaster recovery of households residing in their own single-family homes and to predict households’ recovery decisions from drivers of recovery. Herein, a household’s recovery decision is repair/reconstruction of its damaged house to the pre-disaster condition, waiting without repair/reconstruction, or selling the house (and relocating). Recovery drivers include financial conditions and functionality of the community that is most important to a household. Financial conditions are evaluated by two categories of variables: costs and resources. Costs include repair/reconstruction costs and rent of another property when the primary house is uninhabitable. Resources comprise the money required to cover the costs of repair/reconstruction and to pay the rent (if required). The repair/reconstruction resources include settlement from the National Flood Insurance (NFI), Housing Assistance provided by the Federal Emergency Management Agency (FEMA-HA), disaster loan offered by the Small Business Administration (SBA loan), a share of household liquid assets, and Community Development Block Grant Disaster Recovery (CDBG-DR) fund provided by the Department of Housing and Urban Development (HUD). Further, household income determines the amount of rent that it can afford. Community conditions are assessed for each household based on the restoration of specific anchors. ASNA indexes (Nejat, Moradi, & Ghosh 2019) are used to identify the category of community anchors that is important to a recovery decision of each household. Accordingly, households are indexed into three classes for each of which recovery of infrastructure, neighbors, or community assets matters most. Further, among similar anchors, those anchors are important to a household that are located in its perceived neighborhood area (Moradi, Nejat, Hu, & Ghosh 2020).

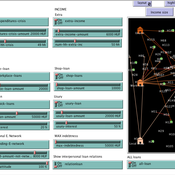

Peer reviewed BAM: The Bottom-up Adaptive Macroeconomics Model

Alejandro Platas López Alejandro Guerra-Hernández | Published Tuesday, January 14, 2020 | Last modified Sunday, July 26, 2020Overview

Purpose

Modeling an economy with stable macro signals, that works as a benchmark for studying the effects of the agent activities, e.g. extortion, at the service of the elaboration of public policies..

…

A Pastoral Stoking Strategy Model with Fodder Import and Loan Scenarios

Yanbo Li | Published Tuesday, December 24, 2019This model was built to estimate the impacts of exogenous fodder input and credit loans services on livelihood, rangeland health and profits of pastoral production in a small holder pastoral household in the arid steppe rangeland of Inner Mongolia, China. The model simulated the long-term dynamic of herd size and structure, the forage demand and supply, the cash flow, and the situation of loan debt under three different stocking strategies: (1) No external fodder input, (2) fodders were only imported when natural disaster occurred, and (3) frequent import of external fodder, with different amount of available credit loans. Monte-Carlo method was used to address the influence of climate variability.